Instituting a venture within Turkey present a lucrative opportunity, regardless your intentions encompass the inception of a fledgling corporation or ambition to extend matured enterprise. The Republic of Turkey has, throughout recent decades, exhibited remarkable advancements in its ability to entice funding and entrepreneurial ventures. The prevailing monetary approaches of nation are purposefully geared towards the stimulation of transnational capitalist engagement. The diligent execution of economic and judicial alterations has yielded a streamlined trajectory for the process of effecting venture enrollment, concurrently widening the spectrum of mercantile pursuits accessible to alien stakeholders.

What benefits does the process of company incorporation offer?

Presented here is overarching data concerning nation, which might pique curiosity of investors aspiring to inaugurate their personal enterprise or amplify their influence within Turkish commercial sphere.

Enrolling a logistics enterprise

might unveil prospects for expansion, given the nation's advantageous maritime access to both the Mediterranean and Black Seas. This intrinsic connectivity forms a natural transport conduit, seamlessly linking European, Asian, and Middle Eastern territories. Turkey's historical role as a pivotal node in countless significant trade routes has not only fostered the evolution of diverse cultural, international, and trade affiliations but has also propelled its progress.

In addition to its geographical allure, Turkey has strategically crafted an array of incentives designed to magnetize foreign direct investment. The regime demonstrates unwavering encouragement for augmentation through the establishment of an amiable investment framework, dismantling of bureaucratic hurdles, and granting of diverse financial incentives. These concerted endeavors have been instrumental in nurturing worldwide business liaisons, fostering infrastructural furtherance, nurturing fiscal expansion, catalyzing foreign trade activities.Moreover, Turkey's geographic fortuity facilitates prompt access to a populace of 1.5 billion individuals, encompassing residents of Europe, the Middle East, North Africa, and Central Asia. Notably, Istanbul and Ankara stand as formidable giants on global stage concerning GDP magnitude. Pivotal roles resonate significantly, bolstering nation's economic prosperity and yielding a profound imprint on its aggregate GDP. Istanbul, a bustling epicenter for commerce and finance, exerts a gravitational pull on enterprises spanning diverse industries. Interestingly, Istanbul uniquely straddles two continents, rendering it the sole city in the world to claim such distinction. Meanwhile, Turkey's capital, Ankara, exercises a pivotal function in both political and administrative spheres, actively steering the nation's developmental trajectory.

Another distinguishing trait that lends allure to the act of company registration in Turkey during 2024 is the presence of a youthful and immensely proficient labor pool. Seasoned experts equipped with a varied array of knowledge and competencies infuse a novel outlook and inventive concepts into the commercial realm, thereby catalyzing advancement within nascent sectors and bolstering nation's competitive edge. Turkey stands poised with latent potential across domains such as information technology, tourism, and international trade, among others. Youthful and finely honed populace holds the capacity to invigorate the growth trajectory across myriad spheres, serving as a catalyst for technological breakthroughs and heightened operational efficacy.

Embarking on a startup venture ushers in access to a dynamic and thriving entrepreneurial collective. Startups, spanning diverse phases of maturation, can actively partake in entrepreneurship-centric gatherings, accelerator initiatives, sector-specific convocations, and collaborative workspace hubs.A tax framework that favors economic growth and governmental incentives actively foster the expansion of the private sector, a pivotal determinant in the nation's global stature. The state's endorsement of 76 DTA pacts with nations across Europe, Asia, and Africa stands as a testament to its global engagement. Property rights, comprehensively defined and fortified by jurisprudence, enjoy steadfast protection. European Commission's recognition of RT elevated level of legal safeguarding for intellectual property rights, encompassing copyrights and related entitlements, underscores its commitment to this realm.

Moreover, it mentions that a substantial 78% of all foreign assets directed towards emanate from the European Union. Nation evolved into a bastion for European enterprises, which are progressively knitting themselves into the intricate fabric of the EU's supply chain. Turkey's financial sector stands out as a cornerstone of reliability within the European landscape. Furthermore, the process of commencing a business in Turkey requires a mere average of 7 days, a remarkable juxtaposition against the global mean of 30 days and the Middle East and North Africa (MENA) average of 23 days.

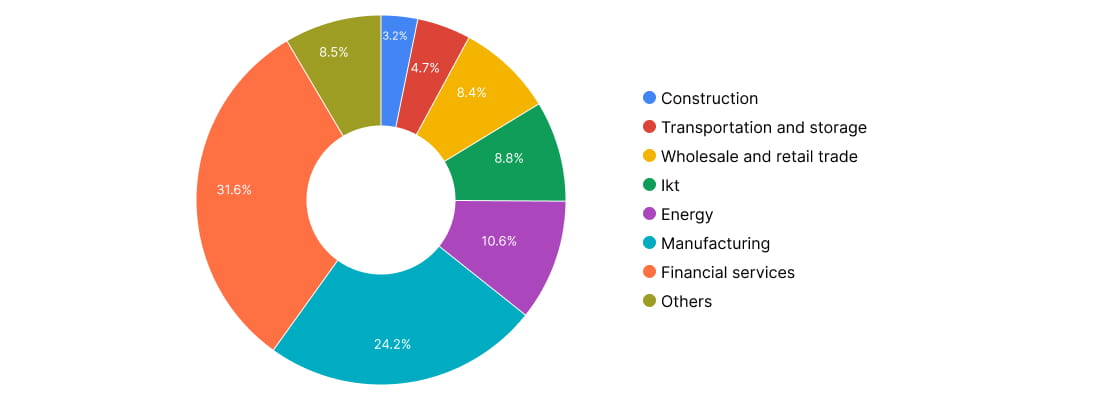

Inaugurating an monetary undertaking: admired areas

The startup system has made the Republic of Turkey one of the regional leaders in innovation (10th position regionally and 46th in the world). Legislative changes and the country's rapid economic growth encourage investors to make foreign direct investments. The choice of the most profitable type of infusion ought to rely on the goals and expectations, to maximize returns at minimal cost.

Alongside the contemporary legislative amendments, incubators have been given more uphold and levy inducements bestowed to contributors. The country is an alternative option for launching startups in e-commerce and retail, logistics, energy and environment. The energy realm has huge potential, especially in renewable energy, and perceived a promising growth market. Launching a fintech project could equally be a successful remedy for endeavor.

These industries accounting for the majority of all investments. Nevertheless, thanks to affordable and ambitious talent pool, novel global opportunities for ICT enterprises are projected to emerge, especially in biotechnology, nanotechnology. Simultaneously the software skills pool in the country ranks among the finest globally, the territory grants significant cost savings compared to global centers. If you are planning to arrange a startup in Turkey, knowing the peculiarities of the domestic startup system will put you one step ahead in the competition.

RT enterprise incorporation realizable with aid of YB Case's specialized experts. We provide comprehensive backing for funding activities in Turkey and will help you choose personalized business solutions.

Enterprise entering in Turkey: utmost domains

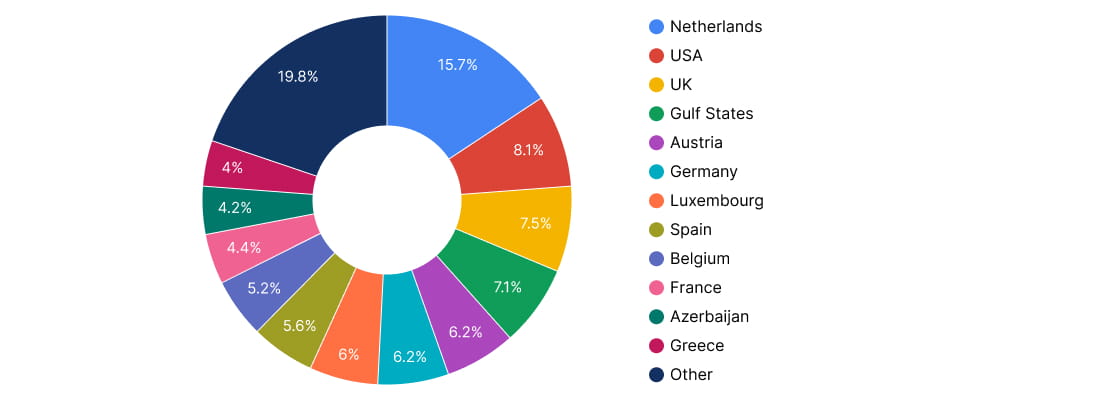

The dissemination of outlandish monetary allocation was amended during 18 years timeframe. The bulk of FDI inflows derive from European, North American and Gulf regions, concurrently the mission of Asia has decreased. The transitions depict the dynamic advancement of this state's economic structure, geopolitical engagements and altering funding patterns.Turkey persists one of the foremost magnets for overseas backers, revealing its significance and prospect for commercial growth and scaling.

Investment growth

Among the achievements of the Turkish economy is the increase in the number of companies with international capital. As of mid-2022, the number of such companies has reached an impressive 78,257, well above the 5,600 such companies that were registered in this jurisdiction in 2002. The number of these companies continues to grow, reflecting the attractiveness of the Turkish market to investors from around the world. Turkey continues to strengthen its integration into the global economy, and international capital companies play an important role in this process.

Number of companies with international capital

Stages of company registration in Turkey

The registration procedure is quite labour intensive and has some differences depending on the type of company. However, the basic steps may include the following:

- Choosing a corporate form.

- Submission of an application for approval of the name.

- Preparation of a package of incorporation documents.

- Filing an application for registration and all related documents.

- Obtaining special licenses and permits (if the industry in which you plan to operate is subject to licensing requirements).

- Opening a bank account in Turkey.

Now let us explain the main steps in more detail. Following key aspects and recommendations ought to be considered when selecting an OFP for the registration. First step - clearly define the objectives that the firm plans to realize in forthcoming. Second - familiarize yourself with the rules governing registration requirements, authorized capital, taxation, liability of participants and other aspects.After studying the legislation, it is necessary to make a comparative analysis of different legal forms and compare them with your business goals. It is also important to analyse the financial aspects of choosing a particular legal form, including financial clearance procedures. It is important to note that the choice of the legal form can have a significant impact on the company's future activities, its legal structure and tax liabilities. Therefore, it is recommended to consult with specialists before making a final decision.

Let's move on to explain the next registration step. The documentation required to open a company in Turkey usually includes the following:

- Application for registration.

- Articles of Association: contains information on the organizational structure of the company. It must necessarily contain the name of the company, its objectives and management powers.

- Decision on establishment: confirms the will of the founders to establish the company, the company's PFA, the distribution of the authorized capital, etc.

- Documents identifying the director(s) and confirming their place of residence.

- Substantiation of the destination.

If the instigator is a legitimate presencer, it`ll be imperative to apply for a review:

- Standard package of registration records.

- File confirming parent organization decision to record a Turkish enterprise.

- Personal papers (passport scans) of the beneficiaries.

Bear, this is ubiquitous information and specific requirements may vary depending on the sort of business.

Аiming to commencement a business account in Turkey, the approach may vary. Nonetheless, some common steps comprise:

- Submission of entire credentials package, paperworks confirming the enlistment of the enterprise, such as registration certificate, AA, etc., confirming the distinctiveness and addresses of all directors and inaugurators (pass, driving licence, utility bills, etc.), files confirming the business profile, such as a business plan.

- Bank visit. It is usually compulsory to visit the bank. During comparable encounter, the applicant may be asked additional questions and discuss the stipulations of commencement an account

- Making a minimum deposit, Depending on which bank you choose, you may be required to make a minimum deposit into the account. The amount of this deposit may vary depending not only on the bank you choose, but also on the type of account.

- Account Activation. When each file and deposit lodged, the bank will issue account details such as account number, International Bank Identification Number (IBAN), SWIFT code and other information required for banking transactions.

Kickstarting venturing in Turkey: available for external entrepreneurs?

Bulk commonly exploited entail:

These represent merely a selection of the primary modes of business ownership. It's imperative to engage legal advisors for a comprehensive grasp of the regulations and constraints tied to selecting a specific structure for your enterprise.

Registration of LLC

Above we have already briefly described the key characteristics of this OFF. Nevertheless, several other pivotal factors and aspects associated with this mode of business establishment warrant attention. An essential criterion for LLC registration in Turkey is the requisite deposit of a minimum authorized capital of 10,000 TL. The transfer of shares is governed as per the stipulations of the Articles of Association. Comparable to a JSC, this company form must adhere to accounting principles and submit annual financial reports. A Turkish LLC has the flexibility to appoint one or more directors. Physical presence at meetings is not obligatory for board members, as they can participate via electronic communication methods and decisions can be ratified through e-signatures.

If you plan to open a company in Turkey under the LLC type, you will need to:

- Approve the name, which must include "Limited şirket".

- Appoint a secretary (can be non-resident).

- Have a local registered address - a mandatory requirement.

- Pay an initial capital contribution (25% of the total amount).

Establishment of a joint stock company in Turkey

JSC has a larger minimum capital, unlike LLC - 50,000 TL. This type of company has different rules regarding management. A JSC must have a mandatory board of directors (at least 3 members). As already mentioned, the liability of shareholders is limited to the amount of invested capital. Below you will find a table explaining some of the differences between the two FLOs, namely AS and LS.

|

АО |

ООО |

|

|

Min. capital: |

50 000 TL. |

10 000 TL. |

|

Amount of founders: |

Min. number is 1 and max. - unlimited. |

The min. number is 1, max. - 50. |

|

Right to manage: |

Management is carried out by the Board of Directors (at least 3 persons). |

It is managed by at least one director. |

|

Accounting records: |

Statutory books: journal, general ledger, inventory, stock book, meeting book. |

|

|

+ Book of board resolutions. |

Decisions of the board of directors may be recorded in the book of the general meeting, or in a separate book of the board of directors. |

|

Businesses in Turkey: other OFPs for doing business

Election to institute a partnership is commonly employed for smaller enterprises, granting all partners the authority to jointly determine and oversee business operations. Within a general partnership, unlimited liability is shared by all partners. Consequently, each partner bears personal responsibility for the company's commitments, irrespective of their individual capital contribution's magnitude.

A co-operative

is a framework owned and overseen by its members, who concurrently avail its services. Gains are apportioned among members in proportion to their extent of involvement. Co-operatives find frequent application in retail and various sectors where co-operation is essential.

Selecting an organizational and lawful framework for engaging in commerce within Turkey, it's imperative to contemplate the distinct traits of every framework, along with their merits and drawbacks within the setting of your unique trade. If you harbor an intention to inaugurate a business venture in Turkey, our cadre of proficient specialists stands prepared to assist you in electing the fitting organizational structure and providing guidance throughout the stages of registering a business entity in Turkey.

Registration of a branch office of a foreign company in Turkey

According to the Law on Foreign Direct Investment in Turkey, national and foreign investors are given equal treatment, except where international conventions and special laws stipulate otherwise. In addition, investors and companies from abroad can open representative offices in this country to explore their industries without conducting commercial activities.

Company registration in a free zone in Turkey

As we mentioned earlier, local authorities have a high interest in attracting investors from abroad in order to strengthen the economic position of the state. One of the tools to stimulate the inflow of foreign investment in Turkey is the creation of special economic zones.

Some of the best known FTAs are:

- Gaziantep Free Economic Region. It is located in Gaziantep, a region in the south-east of Turkey. The zone specialises in textiles, clothing and footwear.

- Ankara-Esenboga Airport Free Economic Zone. This zone is located near the

- Esenboga Airport in Turkey's capital, Ankara. The zone focuses on the development and production of high-tech goods, including electronics, telecommunications and medical equipment.

- Antalya Free Trade Zone. This zone specializes in trade in jewelry, textiles and tourist goods.

- Mersin Free Trade Zone. This is another important trade zone in Turkey that specializes in automobiles, electronics and chemicals.

- Çorlu Free Trade Zone. This zone specializes in trade in agricultural products and manufacturing industries.

Preeminent perks of signing up in Turkey:

- Exemption from VAT, customs duties, CIT and income tax.

- 100% foreign ownership.

- Profits and income earned in FEZ can be freely transferred to any country.

- Exemption from land and property taxes.

It should be noted that in the last few years, among the most popular solutions were such as registering a company in Mersin Free Zone (the country's first FEZ) or registering a business in Istanbul Thrace Free Zone.

Technological development zones include the following features:

- Infrastructure. Technoparks have modern and high quality infrastructure including office space, laboratories, research centres, production spaces, high-speed internet and other technical facilities.

- Financial support. Zones provide favourable conditions for financial support such as grants, venture capital or investor partnerships. This helps startup projects in Turkey to attract investment and access resources.

- Tax incentives. The government usually provides tax incentives for companies operating in technology development zones. This may include income tax exemption, reduced tax rates or other tax advantages.

- Research and development facilities. Registering a company in a technological development zone in Turkey will provide access to scientific and research centres, universities and polytechnics. This facilitates co-operation between companies and the academic field.

- Clustering. Technology development zones often host several companies operating in the same industry. This promotes an efficient system where companies can share knowledge, resources and ideas.

- Visa support. The government endeavours to facilitate and expedite visa procedures for foreign professionals wishing to work in technology development zones. This helps to attract highly qualified specialists from other countries.

- Development of the startup system. Technoparks are actively developing the startup system, providing incubation and acceleration programmes, mentoring, training, access to markets and other resources to help young companies grow and develop.

Before opening a company in a free zone in Turkey, an investor must choose one of the activities, after which it can be determined which FTZ or FTZ is best suited to achieve business goals. The most popular areas are:

- R&D.

- Software development.

- Trade.

- Banking.

- Warehouse logistics.

- Financial services.

Opening a corporate bank account in Turkey

Over the past decade, the country's banking system has advanced to meet the growing needs of foreigners. The Turkish banking system is organised according to global standards, with functional supervision, reasonable capital requirements. Turkish banks provide an extensive range of services, many of which are tailored to the needs of corporate clients.

Subsist popular banks that are willing to work with foreign companies and open accounts for them. Some of the options available include:

- Opening an account with Türkiye Finans Katılım Bankası. This is one of the largest banks in the country offering modern services for both individuals and corporate clients.

- Opening an account with Ziraat Bankası. This is a prestigious institution offering a wide range of services, including the option to open a partnership account.

- Opening a corporate account with Albaraka Türk Katılım Bankası. This is a large commercial bank that opens multi-currency accounts.

Banks in Turkey

- Elmak Bank Türkiye

- Finans Katılım Bankası

- Ziraat Bank

- Albaraka Türk Katılım Bankası

Taxation of Turkish companies

It is important for those interested in registering a business in Turkey to familiarise themselves with the taxation conditions for legal entities. Companies pay different types of taxes.

|

Kinds of taxes |

Tax% |

|

Corporation CIT): |

20% . |

|

VAT: |

18% (reduced rates of 8% and 1% are available). |

|

PIT: |

20-40%. |

|

Dividend: |

0-20%. |

|

Interest and royalty: |

10-20%. |

Programmes and incentives for foreign investors in Turkey

The Turkish government offers various programmes and incentives for foreign investors. Some of them are:

- Investment Residence Permit Programme. Foreign investors who have invested a certain amount of money in the Turkish economy can apply for a residence permit in Turkey.

- Facilitation of property ownership rules. Simplified rules and procedures for foreign investors to buy and own property in Turkey.

- Zoned industrial parks and free economic zones. The country has special zones for investors, including zoned industrial parks and free economic zones, where tax incentives and other benefits are provided.

- Financial incentives. Foreign investors can take advantage of government support, financial incentives and subsidies when investing in various sectors of the economy.

- Government procurement. Foreign investors can participate in public procurement in various sectors, gaining the opportunity to enter into contracts with the Turkish government.

Let's focus on Turkey's Residence Permit for Investment programme. It was introduced in 2017. This programme offers foreign investors the opportunity to obtain a residence permit in Turkey when making certain investments in the country. Several investment options under the programme:

- A property investment of at least USD 250,000. This can be the purchase of residential property (flats, villas, houses) or commercial property (hotels, shops, offices).

- Investment in government securities in the amount of at least 500,000 USD. In this case, you can purchase government bonds, shares or stock securities issued by the Turkish government.

- Investment in a bank deposit of at least USD 500,000. In this case, it is required to place the said amount in a Turkish bank account for a period of at least three years.

- Creation of at least 50 jobs for Turkish citizens and regular business operations. In this case, proof of job creation and active business activities is required.

In general, investor incentive programmes can be classified as follows:

- General Practices.

- All investment projects in Turkey that meet the established qualification conditions and minimum capital investment amount are supported under the General Practices for investment incentives, regardless of the region in which they will be implemented.

- Regional Practices.

- While the sectors to be supported in each region are determined according to the potential of the region and the size of the local economic scale, the intensity of the support provided varies according to the level of development of the regions.

- Large-scale practices.

- The government has developed investment incentives to increase R&D capacity and competitiveness. According to these incentives, each practice has different types of incentives such as VAT exemption, customs tax exemption, tax rebates, insurance premium support, income tax withholding rebate, etc.

Conclusion

Turkey offers significant prospects for business growth, development and scaling. This country has a strategic location between Europe and Asia, making it an attractive market for international entrepreneurs. Registering a company in Turkey will provide access to a dynamic economy and a large domestic consumer market. This creates business potential in many sectors including tourism, manufacturing, information technology and more. Among comparable European emerging market countries, the Republic of Turkey ranked first in attracting FDI.

In addition, the government is actively developing infrastructure, which provides a favourable environment for doing business. The country offers various tax incentives and support programmes to encourage foreign investment. However, as in any country, there are risks and difficulties. Some entrepreneurs may encounter bureaucratic procedures or cultural differences that can affect business. Therefore, it is important to do thorough research and seek business counselling.

- Joint Stock Company.

- Limited Liability Company.

- Free Zone Company.

- Branch office.

Establishing a holding company in Turkey

Establishing a holding company in Turkey  Registration of LLC in free regions of Turkey

Registration of LLC in free regions of Turkey