Introduction

Establishing a company in Malaysia presents a convincing open door for trade people trying to begin a trade in this energetic district. It gives numerous advantages to new businesses due to its stable economy and favorable investment climate. Setting up a business in Malaysia gives an essential establishment to fruitful development across Southeast Asia, upheld by a clear enrollment process and engaging charge motivators. This article will frame the bit by bit system for firm enrollment in the region, alongside the vital stages and contemplations that should be addressed while beginning a venture in the territory.

It is a territory in Southeast Asia with a mainland portion on the Malacca Peninsula and an island in the east called Borneo. The country's capital is Kuala Lumpur, while its regulatory center point is situated in Putrajaya. Malaysia's economy is distinct, comprising areas, like, hardware, oil and gas, palm oil, and the travel industry. The Malay, Chinese, and Indian communities make up the country's cultural diversity, which is reflected in its cuisine, festivals, and customs.

What is SSM?

The Companies Commission of Malaysia, known as SSM, is a legislative agency laid out in 2002 through the consolidation of the ROC and the ROB. SSM is liable for supervising the enrollment and directives of organisations in the region.

Merits of Enrolling with SSM in Malaysia

- Schemes in a Trade that Are Legislative: When you enrol your trade with SSM, you give it a legislative moniker and make it feasible for it to participate in endeavour schemes like signing undertakings, initiating pecuniary accounts for endeavours, and doing other things.

- Admittance to Monetary Help: Banks and other financial institutions can only provide monetary aid to trades that are enrolled with SSM. Additionally, these trades can take leverage of a variety of sponsorships and rewards.

- Administration Entry: Remittance portals are among the many solutions that registered businesses in Malaysia can use to streamline their operations.

- Security of Organization Name: Enrolling with SSM guarantees your organization's name is legitimately shielded from being utilized by different enterprises inside Malaysia.

- Integrity and Observance: Your company's enrollment can help build trust with partners and customers by demonstrating adherence with Malaysian business statutes.

- Structured Procedures: Enrolled organizations benefit from plainly characterized designs and cycles, presenting reviews and investigations more directly.

- Ease of Entry to Resources: Ventures can gain access to useful data and resources through SSM application, which is necessary for tactical advancement and choice-making.

Photo credit: SSM official website .

Sequence for Organisation enrollment in Malaysia

The method comprised with enrolling an organisation can vary contingent upon explicit conditions, however the center advances by and large continue as before. The typical registration process for a company with SSM consists of the list of phases:

The initial phase is to present a trade moniker and get endorsement from the Registrar of Businesses. You must appoint a moniker that satisfies legal requirements, is distinctive, and does not mislead, offend, or conflict with any existing trademarks.

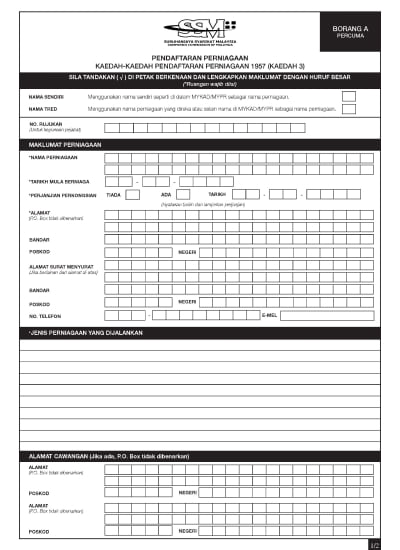

The subsequent phase is to fulfill the enrollment form with accurate subtleties about the business's name, beginning date, addresses, proprietor and associate details, and industry. It is vital to finish this structure precisely and completely to hinder from any defers in the enrollment phase.

Photo credit: SSM (Companies Commission of Malaysia) Trade enrollment form in the territory

- When enrolling, the list of indentures must be attached:

- Enrollment form for reserving a trade moniker.

- Copies of each financiers and manager's passport details.

- Statement of share rate held by each financier.

- The workplace location in the territory.

- Subtleties about the paid-for fund.

In the event that any reports are in a language other than Malay or English, a confirmed interpretation should be given.

After all of the needed indentures have been submitted and the appropriate government fees have been paid, your application will be reviewed. The enrolment specialists will look at the records to guarantee they meet every laid out model and contain the expected data. Lawful expected level of investment includes checking that the structures and reports are accurately finished, the organization's sanction consents to legitimate prerequisites, and that the originators and chiefs meet the fundamental circumstances.

The enrollment specialists commonly survey the application inside a legitimately determined period (ordinarily around five working days). They might confirm the personalities of the originators and executives, affirm the organization's lawful location, and make sure that the expected approved capital is accessible in the organization's record. Endless supply of the survey and confirmation, the enlistment specialists will settle on the firm's enrollment. The company's information is entered into the state register, a unique registration number is assigned, and the registration indentures are prepared and certified if the application is approved.

Upon fruitful enrollment, the organization will get the accompanying archives: an endorsement of organization enrollment, a concentrate from the state register, ensured duplicates of the contract and fuse reports, an organization enrollment number, and a taxpayer identification number (TIN). These records act as true verification of the organization's enrollment and empower it to start lawful business tasks. The pioneers might gather the enrollment records face to face at the enrollment office, by means of postal conveyance (assuming that chosen during the application cycle), or on the web.

Contact our specialists

Post-Enrollment: Levy Enrollment with LHDN

In the wake of creating an organization in the polity, it is necessary to enrol with the Inland Revenue Board of Malaysia (LHDN) as a taxpayer. Companies that are mandated to give to PAYE and pay revenue levy must do this. Furthermore, organizations expecting yearly income surpassing RM365,000 should register for a GST number, given by the Royal Malaysian Customs.

It is essential to consider that violating the Business Registration Act of 1956 means operating an endeavour without being registered. This offense could result in a fine of up to RM50,000, incarceration for up to two years, or both, for individuals or businesses found guilty.

The region presents different corporate designs, each with distinct degrees of prerogatives, roles, and commitments for organizations. Underneath, we investigate the essential kinds of affiliations accessible to business people in this country.

Malaysian sole proprietorship:

A Sole Ownership is the most straightforward trade framework for the occupants wishing to begin their own endeavor. The business is claimed and controlled completely by one individual, with no lawful division between the proprietor and the trade enterprise. Notwithstanding, this also intends that assuming the trade experiences monetary challenges, the proprietor's very own resources might be in danger.

Registering a sole ownership in Malaysia is clear and savvy through the SSM, with negligible costs included. While a yearly re establishment expense is expected, absence of need for an organization secretary or yearly reviews. Thus, sole ownership gives a clear and reasonable method for starting a business in Malaysia, but it requests full monetary obligation from the proprietor.

Regardless of its clear straightforwardness, the dangers related with entrepreneurship are frequently underrated. The key dangers include:

- All of the company's loans fall on the holder's shoulders.

- Acquiring a trade credit from a bank can be challenging, as banks are frequently reluctant to loan to sole ownerships.

- Due to the lack of stakeholding options, this form of endeavor cannot attract expat financiers.

- To enroll as a sole proprietorship in Malaysia, only inhabitants or permanent inhabitants of Malaysia are qualified.

Tip:

Many are ignorant that even single owners should plan fundamental budget summaries, comprising a monetary record and a pay explanation for the monetary year. This record is fundamental while enrolling for a credit and fills in as supporting proof for monetary firms.

A partnership in Malaysia is a legitimate plan between 2 to 20 people who by and large own, make due, and split the gains of a trading. Under a partnership agreement that clearly outlines the distribution of profits and responsibilities, this structure enables multiple partners to co-own the business. In case of the business becoming ruined, the associates share joint responsibility, which could bring about their own resources being utilized to settle the organization's obligations.

Although registering a partnership in Malaysia is simple, it is essential to draft a comprehensive affiliation undertaking prior to doing so. The association should pay a yearly recharging expense for its enrollment, however it doesn't need the arrangement of an organization secretary or the accommodation of yearly reviews. The benefits apportioned to each associate are burdened as private pay, as per the relevant expense rates. While an organization offers the advantage of joining possession with shared mastery, it likewise opens each accomplice to individual responsibility threats.

Private limited company in Malaysia (Sdn. Bhd.).

In Malaysia, the favored decision for organisations looking for an organised and legitimately enrolled firm is the private limited company, also referred as a Sdn. Bhd.The list is a diagram of its fundamental attributes:

- Ownership: Financiers possess the trade by contributing finances and keeping resources, which signify their ownership rights.

- Legislative Individual: A Sdn. Bhd. is viewed as a different lawful firm, meaning it is liable for its own resources and liabilities, free of its investors.

- Enrollment Phase: Registering a Sdn. Bhd. in Malaysia is more unpredictable contrasted with less difficult business structures, needing the obligatory arrangement of a certified organisation secretary.

- Adherence: Each calendar year, an annual report must be conveyed to the SSM. Audits are not obligatory, but the SSM, the company's internal policies, or particular circumstances may make them necessary.

In conclusion, a Sdn. Bhd. provides its owners with a clear distinction between personal and business finances. In any case, it likewise involves a more perplexing hierarchical design and stricter adherence commitments.

Representative office in Malaysia

Multinational organisations wishing to explore the Malaysian market can open a RO It does not have a sole legislative status, so the parent firm is accountable for all loans and duties. The functions of a RO are constrained and do not include commercial schemes like generating profit by signing agreements or conducting trade. Its functions are constrained to collecting and analyzing information, market research, planning and coordination.

Foreign Branch in Malaysia

The division is an expansion of the transnational parent organisation and it is not an autonomous legislative firm. The parent enterprise is solely accountable for all loans and duties of the foreign branch in Malaysia. The tasks of the division should be consistent with the schemes of the parent establishment, which is proper for short-term venture expansion.

Company Limited by Guarantee/Berhad

Establishing a company limited by guarantee (Berhad) in Malaysia is notably more complex compared to other trade structures in the region. Here is an overview of its key features:

- Framework and Responsibility: A Berhad is a distinct legislative enterprise that provides shareholders with limited liability protection. This implies that investors are just at risk for the organisation's obligations up to how much their assurance, and their own resources remain defended.

- Enrollment and Adherence: The sequence to register a Berhad in Malaysia is thorough, including stricter roadmaps and higher beginning expenses contrasted with other business structures. It is fundamental to have a talented organisation secretary to successfully explore these necessities.

In summary, while a Berhad gives a strong legitimate system and possible admittance to government financing, it likewise includes a perplexing arrangement sequence, rigid conformance commitments, and required reviews.

Limited Liability Partnership in Malaysia

A trade structure known as an LLP (Limited Liability Partnership) in Malaysia provides its partners with both flexibility and limited liability protection. A summary of its main features is as follows:

- Associates hold partakes in the LLP's capital and gains, and the affiliation undertaking ought to frame the circulation of revenues, obligations, and the administration structure.

- Unlike traditional partnerships, a LLP is a particular legitimate enterprise, partial from its associates. The associates' individual holdings are shielded from business liabilities as an outcome of this separation, providing substantial security.

- An annual declaration and a solvency record are requested of LLPs. While reviews are by and large not needed, they might be commanded by the SSM or in unambiguous conditions illustrated in the LLP arrangement.

Generally speaking, LLPs offer a helpful harmony between functional adaptability and restricted responsibility. In any case, they accompany more thorough legitimate adherence prerequisites than sole ownerships and general associations.

Reasons for opening a company in Malaysia

Starting a business in Malaysia offers numerous advantages that make the country an appealing destination for entrepreneurs. With its favorable environment and affordable costs, Malaysia is an excellent choice for those looking to grow their business successfully. Below are key reasons why many entrepreneurs opt to establish their business in this country:

- Malaysia's expansion rate is 3.5%, which is extensively lower than in Europe (9%) and the U.S. (8%). This low expansion keeps up with the populace's buying power and keeps the costs of labor and products stable.

- The nation’s cost of living is significantly lower than that of Europe and the United States. This is apparent in costs like food, lodging, transportation, and diversion. Rent and dining out are significantly less expensive in major cities like Kuala Lumpur than in comparable Western cities.

- The region is an important member of the ASEAN, which is based in the Asia-Pacific region. Its essential position gives admittance to the huge ASEAN market of 667.3 million individuals. Malaysia is likewise an optimal area for oceanic exchange, flaunting four significant ports — Port Klang, Port Johor, Tanjung Pelepas Port, and Kuantan Port — as well as other significant ports like Penang Port, Bintulu Port, and Kemaman Port, making it an essential center for worldwide delivery.

- Positioned twelfth in the Doing Business 2020 report, Malaysia has secured itself as a unique economy with an open speculation strategy, ceaselessly making it simpler for the two occupants and non-inhabitants to begin a business. The nation additionally positions 24th in The Heritage Foundation's Economic Freedom Index and 27th in the World Economic Forum's 2019 Global Competitiveness Report.

- Malaysia has additionally gone into various international alliances, right now holding seven respective and seven local international alliances.

Company name in Malaysia

A company's identity and legal standing are both determined by its name. In Malaysia, the standards administering organization names are framed by regulation and directed by the SSM. Choosing a fitting name is the first and fundamental stage in the organization enrollment phase. An insightfully picked name catches the endeavour’s embodiment as well as guarantees adherence to legitimate norms, aiding with forestalling future lawful issues. The list are the regular rules and limitations for appointing business names in Malaysia.

- The company's structure must be indicated by an abbreviation at the end of the name. Blending English and Bahasa Malaysia is permitted, given that appropriate sentence structure is maintained and the trade is precisely addressed.

- A translation into the local language must be supplied if the moniker is written in a language other than English or Bahasa Malaysia.

- The moniker must not be disrespectful or offensive.

- The moniker should exclude strict references.

- The utilization of extraordinary characters is restricted to five: and ( counting "dan", "and," and "N"), . ( dot), - (dash), () (brackets), and ' (punctuation).

Limitations on organization names incorporate disallowances against utilizing names that propose a relationship with:

- Individuals from the imperial family (e.g., "Royal," "King," "Princess");

- Government divisions, administrative offices, legal bodies, or regions (e.g., "Bureaucratic," "Public");

- Commonwealth, ASEAN, foreign governments, the United Nations, or international organizations (such as ASEAN, UNESCO, and NATO);

- Ideological groups, social orders, worker's guilds, helpful social orders, or building social orders;

- Interpretations of names from existing organizations or transnational organizations enrolled under the Companies Act, or monikers that are indistinguishable or like other enlisted organizations.

English or Malay can be utilised for the enterprise moniker, as long as proper grammar is used.

Opening a bank account in Malaysia

After establishing a legal entity in Malaysia, the list of fundamental phases is to open a particular corporate account. This pecuniary account guarantees the solid administration of assets, works with exchanges, and gives admittance to credit items. Foreigners are permitted to open bank accounts as long as they possess the required documentation.

Owners of businesses, particularly those who frequently travel or are foreign nationals, benefit especially from having a corporate bank account. Such accounts are customized to upgrade trade and monetary administration, providing features like transnational trade and global exchanges at ideal terms. Furthermore, they enable check writing in the company's name for official debt payments and allow withdrawals beyond the account balance up to a specified limit, reducing the risk of bounced cheques and supplying admittance to extra funds.

The organisation solution, the laws, identification papers, and evidence of a commercial location should all be compiled. Having these documents on hand will create the enrollment phases go more smoothly.

Records regularly required include:

- completed paperworks from the selected bank for the enrollment.

- Identification indentures as photocopies for authorized signatories and overseers of the organisation.

- a list of permitted signatories and a committee resolution authorising the account's initiation.

- To adhere with AML directives, all supervisors and authorized individuals must visit the bank physically. Additionally, a visit to the company's physical location may be needed by some banks.

Appoint a bank that meets your business's requirements. Assess factors like the range of administrations, expenses, and client assistance. It might very well be helpful to visit a few banks to examine your necessities physically.

Present your enrollment alongside the expected archives to the bank. Online enrollments may be found from some banks, while physical enrollments may be needed from others.

The fiscal establishment will look over your enrollment and make sure the records you've sent in are genuine. According to the fiscal institution and the range of subtleties of your enrollment, this procedure may take anywhere from a few days to several weeks.

Upon approval of your enrollment, you will be mandated to make a first remittance to activate the corporate account. The needed payment amount differs by bank, so be sure to confirm this requirement in advance.

Here are some banks commonly used for opening a business bank account in Malaysia:

- Maybank: Among the reputable pecuniary establishments in the territory, with over 2,500 branches across 10 countries, Maybank provides a wide scope of solutions to non-occupants, comprising corporate account opening.

- CIMB Bank: The second-largest bank in Malaysia, CIMB Bank gives millions of customers through thousands of branches nationwide. It provides competitive interest rates and a variety of services for corporate clients.

- RHB Bank: A prominent new-generation bank, RHB Bank gives an array of solutions, attractive interest values, and a convenient trade account option called RHB Smart Account-i.

- Public Bank Berhad: One of Malaysia's grand banks, Public Bank Berhad has a substantial branch network and gives a broad scope of trade banking solutions, including corporate accounts.

- HSBC: A worldwide bank with an effective impact in Malaysia, HSBC gives an expansive variety of transnational fiscal solutions designed for firms.

- Standard Chartered: Another major global bank with a significant presence in Malaysia, Standard Chartered provides comprehensive corporate banking solutions, including cash flow management, trade finance, and treasury services.

- AmBank: Although primarily focused on the retail sector, AmBank also presents a scope of trading monetary solutions, comprise establishing an account and funding. management.

Closing a company in Malaysia

Terminating a business in Malaysia is as huge a choice as beginning one, requiring a cautious route through a complex legitimate system. Legal, financial, and strategic considerations all mandated to be carefully considered during this sequence. For chiefs and financiers, grasping the accessible choices and the ramifications of closing down an endeavour is critical.

In the region, a director, member, or liquidator's request to dissolve the trade is typically the first step in the phase. In addition, upon reviewing a company's records, the Registrar of Companies in Malaysia has the authority to dissolve it.

- A conventional goal from the pioneers, without which liquidation can't continue.

- The organization should give documentation demonstrating it has no resources or liabilities, upheld by budget reports conveyed to the Registrar.

- Before filing for dissolution, the venture is needed to settle any outstanding penalties or merger proposals under the Companies Act 2016.

- All charges and commitments to government entities should be settled, and a duty review finished prior to enrolling for expulsion from the directory.

- The organization should not be associated with any judicial actions, either inside Malaysia or abroad.

- The organization shouldn't work as an "underwriter organisation."

The final step is to submit a notice of termination to officially dissolve the registered company in Malaysia once these conditions are met.

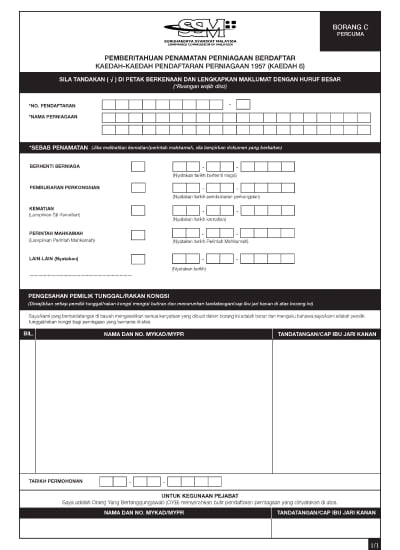

Image credit: Notice of dissolution of a registered company in Malaysia on the official link of the SSM (Companies Commission of Malaysia) .

When the vital archives are presented, the Registrar will tell the organization of its purpose to deregister the business in Malaysia except if protests are raised in 30 days or less. Assuming that no protests are gotten during this time, the Enlistment center will continue to eliminate the organization's moniker from the Federal Gazette, formally affirming its deregistration.

The firm is dissolved and ceases to exist as an outcome of this deregistration, preventing it from partaking in any legal or commercial activities. However, the company's members, officers may still be held accountable for any previous misconduct or illegal.

The list of foundations can be used to file an objection against a company's deregistration in Malaysia with the Registrar:

- It is as yet dynamic or has a legitimate justification behind its presence;

- It is engaged with continuous prosecution;

- It is presently insolvency or liquidation;

- The objector is a stakeholder, creditor, or has a claim against the organisation that has not been settled;

- The dissident accepts they have a legitimate case in the interest of the organization and expects to seek after it;

- Whatever other explanation that makes the deregistration of the organization low or nonsensical.

Taxation in Malaysia

Personal Income Tax

Rates and brackets for taxes

The individual income tax in Malaysia is progressive, meaning that the tax rate goes up as a taxpayer's income goes up. The rates range from 0% for the least workers to 30% for those in the most elevated levels of income.

Charge Reliefs and Allowances

Malaysian citizens can bring down their available pay by using different expense reliefs and derivations. Normal reliefs incorporate those for instruction costs, clinical expenses, and extra security charges.

Corporate Annual Expense

Charge Rates for Inhabitant and Non-Occupant Organizations

Occupant enterprises in Malaysia are dependent upon a corporate duty rate of 15-24% on their worldwide income. Interestingly, non-occupant organisations are just burdened on charges acquired inside Malaysia.

Charge Rewards for Organizations

Malaysia gives a few duty motivators to advance business extension and draw in transnational ventures. These motivating forces incorporate expense occasions, speculation recompenses, and advantages custom fitted to explicit areas like innovation and manufacturing.

Capital Gains Tax

Capital Gains Tax

Malaysia generally does not impose a broad capital gains tax. However, the Real Property Gains Tax (RPGT) applies to profits from the sale of real estate, with rates typically set at 10% of the gains or 2% of the gross sale value.

Indirect Taxes

Sales and Services Tax (SST)

The 5-10% sales tax is levied on taxable and imported taxable goods. The service tax rate increased by 6% to 8% on most taxable services, including imported taxable services and digital services provided by foreign registered persons.

Excise Duty

Certain domestically produced goods in the territory, like alcohol, tobacco, and automobiles, are contingent on an excise duty tax.

Import Duty

Goods brought in are subject to import duty, whose rates vary contingent on the type of goods and the nation of origin.

Tax Identification Number (TIN)

A Tax Identification Number (TIN) is obligatory for all businesses operating in Malaysia. This number is admitted by the Inland Revenue Board (IRB) and is essential for tax purposes.

Acquiring a TIN from the Inland Revenue Board (IRB)

To get a TIN, you are mandated to enrol your trade with the IRB. This process typically involves submitting your trade enrollment documents, details of your directors, and details about your business activities.

Conclusion

Setting up a business in Malaysia prepares for progress in Southeast Asia. This procedure necessitates strict adherence to local directives, which can be challenging without professional guidance. Fortunately, the professionalism and expertise of our firm will ensure a smooth enrollment process.

We provide complete assistance with company registration in Malaysia. Our group of specialists will give all fundamental counsel, help with documentation, and guarantee adherence to every lawful necessity. By joining forces with us, you gain a reliable partner focused on making your trade fruitful and serious on the worldwide stage.

Audit and Accounting support

Audit and Accounting support How to open a bank account in Malaysia in 2026

How to open a bank account in Malaysia in 2026  Buying property in Malaysia

Buying property in Malaysia  Liquidation of a company in Malaysia

Liquidation of a company in Malaysia