This document furnishes detailed insights regarding the prerequisites for founding an account with RAKBANK.

RAKBANK overview

In 2023, prominent international rating entities, Fitch and S&P, issued assessments of the UAE’s banking sector. Their analyses underscore the ongoing robust growth and evolution within the sector. This robustness is particularly relevant for entities considering a transition of their business operations to the UAE, signaling the stability of the nation’s financial infrastructure. Notably, RakBank distinguishes itself as a reliable financial institution within the UAE.

Opting to transfer funds to RAKBANK is a prudent choice for those seeking to safeguard their financial assets. Since its inception in 1976, RAKBANK has been recognized as a leading provider of comprehensive banking services across the Emirates.

The government of Ras Al Khaimah holds a controlling interest in RakBank, with shares publicly listed on the Abu Dhabi Stock Exchange, one of the largest exchanges in the UAE. Established in 2000, the ADX is integral to the financial market of the country and operates under the regulatory oversight of the SCA.

Initially, the bank’s focus was predominantly on corporate clients; however, over the years, it has broadened its scope considerably to include an array of products and services for individual customers. This expansion into personal banking has enabled RakBank to attract new clients and diversify its revenue streams.

Presently, RakBank offers account services to both individual and corporate clients, including offshore and commercial entities, through a network of 21 branches and various digital platforms.

Additionally, RakBank endeavors to cater to the specific needs of its clientele by offering services that adhere to Shariah principles, available through its specialized Islamic banking division, RAKislamic. RakBank’s affiliation with the UAE UBF further solidifies its position within the Emirati financial community and its commitment to adhering to UBF standards and guidelines.

- Opening an account with the National Bank of Ras Al-Khaimah is tailored to fulfill the financial requisites of both business sectors and individual clients, accommodating both residents and non-residents.

- Entrepreneurs can leverage a business account with RAKBANK to access Business Loans (loans up to AED 3 million with extended financing options), facilitating the realization of expansive business objectives and development.

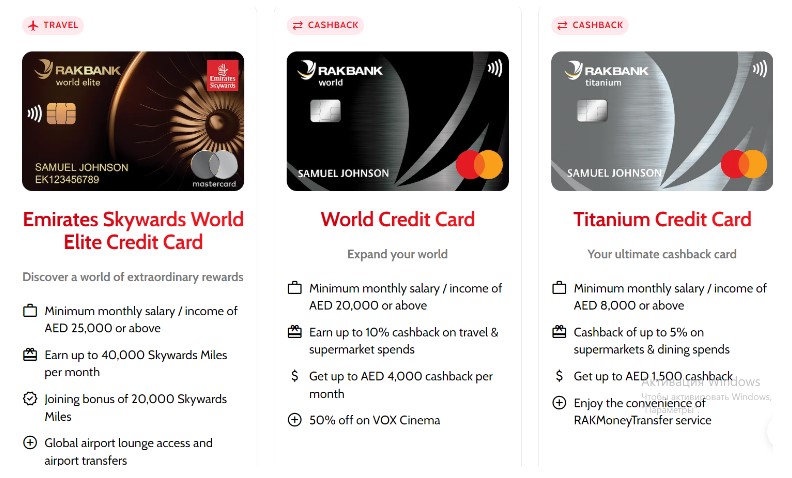

- For individual clients, an account with RAKBANK provides access to Credit Cards (offering competitive rates from 2.95% to 3.19% and requiring a monthly income of 3 to 35K AED), enhancing financial management and expenditure tracking.

- The bank also provides special terms for the acquisition of business equipment, aiding companies in upgrading their technological infrastructure and boosting operational efficiency.

- The RAKmoney transfer service ensures convenient and secure financial transfers to several Asian countries, including India.

- Online banking services are available in English.

- RakBank plans to allocate $163.5 million towards the digitalization of its services and the creation of new business lines by 2026. This investment will enhance critical areas such as cash management, foreign exchange, trade support, invoice discounting, and supply chain finance. Additionally, the bank aims to expand its wealth management services to better serve the evolving financial planning and investment needs of its clientele.

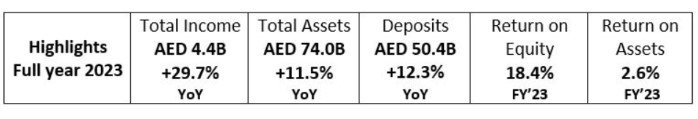

Key financial indicators for 2023.

-

Corporate account

- Initiating a corporate account with RAKBANK entails several mandatory procedures and the submission of specific documents. The standard protocol involves:

-

Documentation preparation.

- Engaging with RAKBANK representatives to ascertain account registration requirements.

-

Completion of the application form.

- Submission of necessary documents to the bank.

Upon receipt of all requisite documentation and the application form, the bank will conduct an assessment of your company to determine eligibility for opening a corporate bank account with the National Bank of Ras Al-Khaimah. Should the application be approved, the subsequent phase involves executing a corporate banking agreement. Following all procedural formalities, bank officials will provide the account details.

Concerning procedural requirements, the documents necessary for establishing a business account with RakBank in the United Arab Emirates include copies of foundational documents, a curriculum vitae of the director, a business model description, and a statement from the current bank account.

Depending on specific circumstances, RakBank managers might request additional documentation. For instance, offshore companies established over a year ago are required to furnish a certificate of good financial standing.

Account types

|

Type |

Specifics |

|

RAKstarter Account |

Interest rates: 0.10% to 0.25% annually Account charges: none for zero account balance Benefits: offers exclusive business financing solutions like loans and real estate financing for startups Checkbooks: one free service checkbook annually; additional checkbooks available Eligibility: enterprises with a valid UAE trade license, operational for less than one year Minimum balance: None |

|

Current Account |

Minimum monthly balance: AED 25K; 10K USD/EUR/GBP for other currencies Interest rates: 0.10% to 0.25% annually Fees: monthly fee of 52.5 AED if minimum balance is not maintained; 210 AED for account closure within 6 months Eligibility: any company with a valid UAE trade license |

|

Business Elite Account |

Personal account manager Elite services: free cash transactions at select branches Currency exchange rates: preferential rates for multiple currencies Withdrawal limit: up to 100K AED daily Checkbooks: complimentary, unlimited electronic funds transfers Overdraft interest: 18% annually Eligibility: any company with a valid UAE trade license |

|

Business Call Account |

Minimum monthly balance: AED 25K if opened in dirhams Eligibility: companies with a valid UAE trade license or offshore companies Income verification: required Balance maintenance: specified average monthly balance required |

Further details on other bank tariffs and commissions can be obtained via the bank's home page.

Main page of business banking services on the RAKBANK website.

Additionally, RAKBANK offers exclusive packages like RAKvalue Plus and RAKvalue Max, which provide benefits such as free international money transfers, business insurance, and cloud-based accounting software, among others.

Corporate clients are provided with a debit card featuring Contactless Tap & GoTM technology, with a daily cash withdrawal limit of up to 75K AED. Also available are business loans of up to AED 3 million with a repayment period of 60 months, Islamic business finance, and a term deposit plus account (accessible to both individuals and businesses).

Credit cards presented at the official RAKBANK website.

Commercial banking services

Corporate entities frequently select RAKBANK for essential services like merchant acquiring. RAKBANKpay stands as a prominent provider of merchant payment solutions in the UAE. Principal offerings include:

- Acceptance of all leading card brands.

- Comprehensive transaction processing across all major payment gateways.

- Complimentary electronic funds transfers via digital platforms (exemption applies to RAKBANK charges only).

- Enhanced transaction limits for fund transfers through digital banking.

- Execution of staff remunerations through the WPS.

Personal account at RAKBANK for non-residents

Non-residents can open both a personal current account and a savings account at RAKBANK. The document requirements for opening a personal account include the applicant's passport, copies of the Emirates ID, UAE residence visa, and a financial standing verification document.

The personal current account at RAKBANK offers numerous advantages over a savings account, with notable features such as:

- Debit card provided free of charge (currency selection available).

- Monthly account statements to facilitate easy monitoring of financial transactions.

- Complimentary checkbook issued in dirhams.

- No-cost digital and SMS banking services.

- Account management via online banking, enhancing service convenience and efficiency.

Moreover, premium services are available, enhancing financial management security. The Fast Saver account is a notable option for smaller sums, offering substantial returns in AED and USD. Interest rates are up to 1.75% annually for balances up to 200K AED (approximately 54,460 USD), with a gradual decrease to 0.5% for balances exceeding 25 million AED (approximately 6,807,260 USD). Deposit rates in USD reach up to 0.75% annually.

RAKBANK Elite membership affords customers preferential exchange rates for USD, EUR, and GBP transactions. This elite status includes access to a dedicated account manager, providing expert financial guidance and personalized support.

For clients lacking an Emirates ID, a Saving Account is an optimal choice, especially suitable for those temporarily residing in the country or not intending to acquire residency. This account type is available in four currencies, each with specific minimum deposit requirements upon registration.

While there are distinct advantages, some limitations exist, such as the reduced feature set compared to a current account. For instance, the use of a debit card is restricted to dirhams, potentially complicating currency conversions. The absence of a checkbook may also be seen as a drawback for those who prefer this method of payment. Nonetheless, opening a savings account at RAKBANK offers extensive online and SMS banking capabilities, unrestricted access to funds, and regular account statements (monthly or quarterly as preferred by the customer).

It is also important to note that a monthly maintenance fee of 25 AED (approximately 6.85 USD) is charged if the deposit balance falls below the required threshold. Importantly, RAKBANK imposes no minimum balance requirements and offers a service fee waiver for the first three months, which may appeal to new clients.

Conclusion

RAKBANK, a compact private banking entity with governmental participation, is distinguished in the marketplace by its competitive rates and operational ease. Its offerings not only appeal to customers but also set it apart from numerous competitors. The National Bank of Ras Al Khaimah delivers both retail and commercial banking services, with operational segments including retail banking, wholesale banking, business banking, treasury, and insurance.

Overall, banks in the Emirates are celebrated for their high-quality service, dependability, and the simplicity of conducting international transactions. Nevertheless, non-residents may encounter challenges in accessing these services due to more rigorous account opening requirements.

Should you be interested in establishing an account with RakBANK, we invite you to contact us for assistance. Our seasoned professionals are equipped to provide thorough support and guidance throughout the process of setting up an account with RAKBANK.

A business registration in the UAE

A business registration in the UAE  Registering a company in the UAE: opportunities and prospects

Registering a company in the UAE: opportunities and prospects  Opening a Bank Account in the UAE in 2026: Unlocking Financial Control in Motion

Opening a Bank Account in the UAE in 2026: Unlocking Financial Control in Motion  Comparative table of UAE Free zones

Comparative table of UAE Free zones  Registering a business for trade in oil products in the UAE

Registering a business for trade in oil products in the UAE  Open an account for a company from the UAE

Open an account for a company from the UAE  Opening an investment facility in the UAE jurisdiction: simple or too complicated?

Opening an investment facility in the UAE jurisdiction: simple or too complicated?