Choosing the best country to open a business abroad is a strategically prime decision for any firm and needs a comprehensive survey. Additionally to traditional criteria for opting for the best polity for trading, such as a statutory sphere characterized by stable legislation and effective statute enforcement, macroeconomic and political criteria, availability of qualified personnel, impost legislation and facility enhancement, in the context of a dynamically generating market situation and continuous tech transformations, there is a growing need for systematic monitoring of market trends, also proactive execution of innovative oversight solutions.

The choice of the best polity for forming startups can be influenced by a whole host of elements, including, but not limited to:

- flexibility of corporate legislation, allowing for the optimization of mercantile setup, also the level of safeguarding of financiers’ prerogatives;

- the range of licit safeguarding of intellectual property objects and the effectiveness of the sequences for getting it;

- the sequence for undertaking transnational exchange transactions, the existence of constraints on the movement of capital;

- the existence of valid transnational treaties targeted at eliminating double levy and hindering impost evasion;

- mentality of the local population, peculiarities of trading, language hurdles.

In the transnational pecuniary sphere, quite a few places that supply transnational financiers with commendable criteria for undertaking trade schemes. Numerous trade firms at the initial phase of enhancement have already benefited primely from the preferences supplied by such regions.

And although at the initial phase of entrepreneurship, SMEs often limit themselves to performing trade schemes within the national polity, from the point of view of the prolonged perspective and profit maximization, entering the transnational trading field seems to be a much more rational strategy. In today's modernised world, enrolling a firm overseas is a strategically advantageous solution for aspiring financiers.

The question arises as to how to choose a polity contingent on the specifics of the firm and other elements. The top jurisdictions for setting up a business in 2026 comprise both regions due to their enhanced economies and alluring impost regimes. They are traditionally known to be among the popular destinations for transnational speculation. However, each of these territories has its own unique parts.

This publication supplies a comparative survey of the regions’ trade spheres to help financiers make an informed choice of HK vs UAE for generating a mercantile. The survey covers a broad scope of parts that influence the efficiency of trade schemes, including impost rewards, admittance to pecuniary resources, level of facility enhancement, and degree of statutory burden.

Why register a company abroad?

The enrollment is a complex licit sequence, conditioned by many elements, including fiscal. This step allows financiers to optimize their trade model, expand the geography of their schemes and get leverages that are unavailable in the polity.

The main aims for enrolling a firm in a transnational polity are as stated:

- A value of transnational territories have commendable impost regimes, which allows for a prime reduction in the impost burden on the corporate sector. In some territories, complete exclusion from levy is possible if strict statutory criteria are met.

- In transnational venture capital practice, a highly enhanced facility for luring money is supplied, which supplies young firms with additional chances for financing their enhancement.

- In a number of territories, the bills of initial money speculation and overseeing a trade in the early phases of its operation are primely lower, which represents an fiscally advantageous sphere for start-ups and small endeavours.

- Forming a transnational licit entity is a strategic step that allows you to optimize trade sequences, reduce operational perils and propel the speculation alluring of the firm in the transnational arena.

- Generating a mercantile from scratch in a recognised and reputable polity helps to strengthen its reputation, increasing the level of trust from suppliers, financiers, trade associates and prospective users.

Another strong argument in favor of enrolling a firm abroad is the chance for its founders to leverage preferential migration programs. Many regions supply transnational financiers with a simplified sequence for getting prolonged visas, also other permits for licit residence and mercantile schemes on their territory. Consequently, enrolling a mercantile abroad can be the initial phase to getting the status of an occupant of a transnational state and, subsequently, to acquiring citizenship.

Peculiarities of the regions’ trade sphere

Among the many possible startup locations, both regions stand out as dynamic regions, standing out as dynamic regions that offer a commendable sphere for the establishment and growth of innovative firms. HK stands out among these as a historically established trade hub, making it a place for trades with transnational ambitions. The merits of trading in HK include the firmness and predictability of the common statute licit regime and the convenience of levy. The venture sphere here is characterized by minimal hurdles to entry, which lures both transnational trades.

Among the main reasons why HK firm enrollment is preferred by members of the transnational venture community is the simplicity of the enrollment sequence: the sequence usually takes three working days. For overseas financiers, it is possible to enroll firms without the prerequisite of having local financiers/associates, which allows you to retain oversight over the firm.

HK's impost setup is primely liberalized, with territorial levy and preferential revenue impost rates. The absence of common levies such as VAT, capital gains impost and dividend impost further reduces the impost burden on licit firms. Launching a startup in Hong Kong can be quite successful due to the presence of an enhanced facility in FinTech. The Hong Kong Stock Exchange supplies startups with the chance to lure funding via an IPO.

In turn, the enrollment of firms in the polity supplies the venture entity with prerogatives that allow it to effectively use the innovative potential formed by the enhanced licit setup of the polity. Since the creation of the DIFC and the ADGM, other free ports within the borders of the Emirates, prime changes have occurred that have aided to the polity starting to stand out from other states and it has become a preference for aspiring financiers sponsoring in prime-tech and pecuniary schemes, also in the real estate and tourism fields.

Enlisting a trade in the Emirates is fairly simple, but it needs a number of specific sequences contingent on the chosen zone. The polity overseers execute a set of criteria of state aid for firms in the innovative pecuniary field targeted at propelling trading schemes. The state finances the creation and enhancement of facilities mandatory for the functioning of startups, offering levy breaks and subsidies, providing modest endeavours with admittance to incubators and accelerators. The enhancement of IT and prime-tech firms in the polity is aided via the creation of specialized clusters, such as Dubai Silicon Oasis, which supply startups with all the mandatory resources to start and scale a venture.

In terms of infrastructure, many exporters prefer to activate a firm in HK, as this polity has primely enhanced logistics, and pecuniary facilities. Hong Kong International Airport, being among the leaders in the transnational aviation industry in terms of cargo turnover, supplies startups with chances to optimize transnational logistics chains and undertake transnational commerce. HK's enhanced digital facility, including prime-speed Internet and advanced mobile techs, forms a preferential sphere for the schemes of innovative firms, especially in the IT, pecuniary aids and E-commerce fields.

Trade in the Emirates, in turn, has the chance to use excellent facilities, especially in areas such as communications. The polity has some of the modern airports and ports in the world, which drives effective transnational venture exchange. Tech hubs are generating in the Emirates, such as Dubai Internet City, providing startups with admittance to top-speed Internet networks and advanced laboratories.

When choosing HK or the Emirates: where is it better to enroll a trade, remember that a prime part of the facility of both regions is admittance to enhanced capital trading fields. HK is among the globe's grandest pecuniary areas, and mercantiles can count on the aid of venture monies, angel financiers, and government subsidies for modest endeavours. Venture speculation is also generating in the Emirates, primely within the framework of plans such as the Dubai Future Foundation.

Overall, both regions offer competitive criteria, but financiers should carefully evaluate the specifics of each polity, considering their prolonged goals and venture needs.

Where is it profitable to register a business?

Launching a startup in the UAE or HK needs careful consideration of many elements, including the place of these regions in global rankings. Below, we will look at the positions of both regions in some of the prime authoritative rankings.

Ease of Doing Business (EoDB)

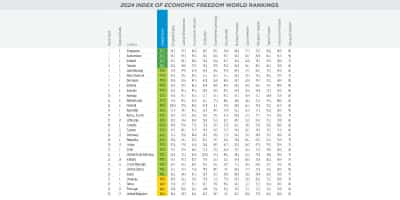

The EoDB Index, published by the World Bank until 2021, is among the key tools for assessing venture criteria in different regions. It includes the time mandated to enroll a venture, availability of credit resources, enhancement of the setup for safeguarding the prerogatives of minority financiers, abidance with contractual obligations, etc. According to the latest data, both regions are among the top 3 and 20 (respectively) best regions for trading in the world.

|

Overall rating |

Starting a venture |

Property enrollment |

Paying levies |

Transnational trade |

Asserting the execution of undertakings |

|

|

Hong Kong |

3 |

5 |

51 |

2 |

29 |

31 |

|

UAE |

16 |

17 |

10 |

30 |

92 |

9 |

Incidentally, in another report, Business Ready 2024, HK is among the top 10 regions among the 50 economies covered by the report.

HK has traditionally been a top performer in both rankings, thanks to its minimal oversight hurdles, transparent excise setup and fast venture enrollment sequence. Recently, HK has been incorporated in the “Best Startup Countries” list, as it has shown a steady reduction in bureaucracy, making it more alluring to startup owners, primely in the IT and transnational trade fields.

In turn, the polity is among the top territories for trade, but the enrollment sequence needs considering more complex aspects. The main difficulties are linked to the peculiarities of setting up a venture in various free ports, each of which has its own licit norms. Despite this, the Emirates has excise rewards, such as zero corporate excise for modest endeavours on the mainland and in free ports (under certain criteria).

Global Competitiveness Index

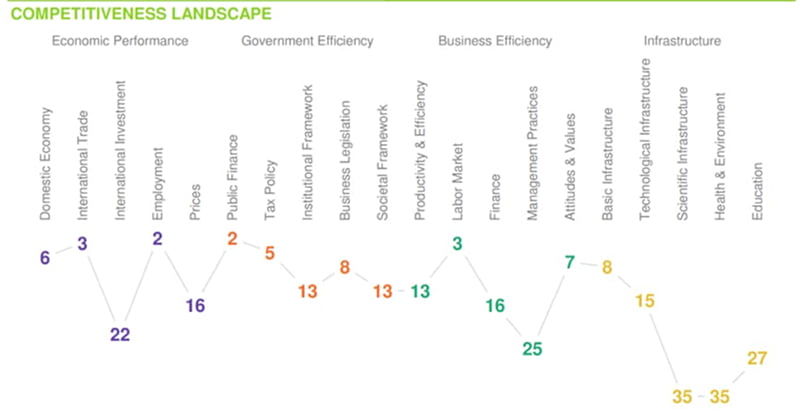

The GCI, enhanced by the World Economic Forum, is an analytical tool targeted at comprehensively assessing the ability of states to assert prolonged macroeconomic firmness and a sustainable place targeted at pecuniary growth via the effective use of available resources and firms. When choosing HK or the UAE: where is it better to initiate a firm, it is worth emphasizing that both regions show top results in this index, which is due to their strategic location, top-quality facility and political solidity.

HK was ranked 5th (illustrated below) among the 67 most competitive economies in the World Competitiveness Yearbook 2024. Its top ranking is aided by its top level of innovation, strong licit setup and top level of education.

The Emirates ranked 7th transnationally and 1st in the MENA region (for the 8th year in a row). The polity’s overseers have triumphantly executed a pecuniary diversification strategy, focusing on increasing rivalry in areas such as infrastructure, E-techs and pecuniary aids. Directorate policy is expressed in the execution of large-scale facility plans, stimulation of innovation and administration of excise rewards for financiers. As a result, the Emirates, primely Dubai and Abu Dhabi, have become a desirable location for startups, offering them admittance to transnational trading fields and top skilled labor.

Property Rights Index

The Heritage Foundation's Property Rights Index ranks the safeguarding of property prerogatives in different regions, a key aspect for startups, especially those performing in top-tech fields. When opting between Hong Kong and the UAE for business registration, it is prime to know that both regions demonstrate top levels of property prerogatives safeguarding.

HK's property prerogatives protection setup is contingent on the Common Law, which supplies a top level of licit certainty and visibility. HK's judicial setup is transnationally recognized and is among the most effective in Asia. In this index, HK ranks 2nd in Asia and 14th globally.

Initiating a firm in both regions: licit directives

HK is transforming into a transnational tech hub, which is shown in the transformation of government directive. The inception of principles of innovation statute and tech neutrality is intended to propel trading plans and lessen oversight hurdles for ventures in the top-tech sector. This way of regulating trade schemes in HK aids lure venture capital and form a cluster of innovative firms.

Directorate bodies are executing a set of criteria targeted at modernizing digital facilities and creating an innovative urban sphere that meets top norms of quality of life for the population. Municipal programs targeted at optimizing traffic flows and minimizing environmental damage demonstrate a systematic approach to tech enhancement. This strategy not only aids to increasing HK's speculation alluring, but also secures its reputation as among the transnational leaders in innovation, which is shown in the relevant directives.

Setting up a company in HK can be beneficial in terms of virtual progress in directive. In the 2024 Global Innovation Index (GII), HK ranked 18th among 133 fiscal fields in the world. However, in contrast to other pinnacle-revenue economies, HK performed better, ranking 17th among 51 regions in this group. In the Asian region, HK entered the top five, thereby confirming its status as an transnational pecuniary center and a recognized world leader in innovation. HK has 1 cluster contained in the top 100 science and tech clusters of the GII.

When it comes to business regulation in the UAE, conforming to the latest data, it is ranked 32nd (illustrated below) among the globe's regions. At the same time, they have shown prime progress in such strategically prime areas as the enhancement of intellectual money, the inception of innovative techs and the stimulation of creative schemes. Moreover, opening a company in the UAE is advantageous in terms of the availability of a pool of specialized specialists and venture-oriented directorate plans in the polity. The polity was awarded 1st place in two key indicators: the level of mobility of qualified personnel and the effectiveness of directorate policies targeted at aiding entrepreneurship.

Modern trends in transnational ventures are shown in the statutes of HK and the UAE, which supply for the chance of remote enrollment of legal firms via specialized electronic platforms. You can enroll a firm in HK electronically via the e-Registry portal. The UAE has also introduced an innovative approach to enrolling licit firms contingent on the use of the Basher digital platform.

Streamlined enrollment sequences and affordable corporate service rates position HK as part of the cost-effective centers for commencing a trade in the Asia-Pacific region. The licit setup in the UAE, which supplies a pinnacle standard of living for the population, determines the higher bill of administering a licit entity. The sequence for registering a company in the UAE is associated with more prime pecuniary bills when compared to other regions, including HK.

Contact our specialists

If you are deciding in which country to start a mercantile - HK or the UAE, you should also consider the fact that despite the prime pecuniary bills associated with launching startup schemes in the UAE, invariably lure both aspiring financiers and generated firms. The aim for this is a reliable statutory sphere that needs all venture firms to abide with pinnacle norms of visibility. Such an approach helps to build sustainable trust in Emirati firms both on the part of the venture community and on the part of directorate bodies regulating pecuniary schemes. It is also worth mentioning that licenses issued by the competent overseers of both regions are recognized transnationally, which simplifies transnational trade schemes.

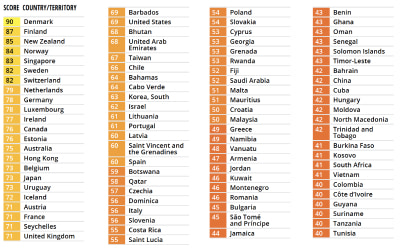

When choosing where it is more accomplished to enroll a trade - in HK or the UAE, it is advisable to pay due attention to a detailed survey of the characteristic elements and structural distinctions of their licit setups. Let's start with the fact that conforming to the Corruption Perceptions Index, published in 2023, HK took the 15th position among 180 regions studied, while the Emirates took the 27th position in this rating (see the illustration below).

HK has a unique licit setup contingent on common statute principles inherited from British rule, with a center on the principles of “One Country, Two Systems”. HK’s judiciary supplies a pinnacle range of safeguarding of prerogatives, so transnational financiers can be confident that disputes will be resolved fairly. A liberal approach to corporate directive allows firms to perform with minimal oversight interference. Data protection and trade secret statutes make HK a preferred location for firms in the tech and pecuniary fields.

The Emirates licit setup is contingent on a fusion of civil statute and Sharia statute, which applies to specific parts of civil and family statute. That is, the UAE has both general statutes governing trade schemes and specialized rules in free trade zones such as the DIFC and the ADGM, which have their own independent licit setups. The UAE actively drives arbitration firms such as the DIFC-LCIA and the ADGM Arbitration Centre.

Despite the presence of promising speculation chances in both regions, it must be emphasized that abidance with licit formalities needs exceptional attention. At the phase of venture launch, it is preferred to get qualified legal support for start-ups abroad.

Review of the trade and tech spheres to determine whether to set up a trade in the UAE or Hong Kong

Launching a startup in HK supplies admittance to the vast Chinese trading field and integrated admittance to transnational trade nexus. HK, with its long-standing image as a prime player in the transnational trade arena, supplies a commendable sphere for the enhancement of innovative endeavours. HK's strategic role in the transnational trade setup is due to both the diversified setup of transnational pecuniary links and the center on innovative enhancement, which allows it to occupy leading positions in promising areas.

Launching a startup in the UAE can give your venture a boost for future expansion into transnational trading fields. The polity, competing with transnational trade hubs, has created a primely efficient logistics facility, aided by enhanced customs legislation. Excise preferences supplied by the state, also simplified customs clearance sequences for goods in SEZ, make the polity an alluring polity for transnational financiers.

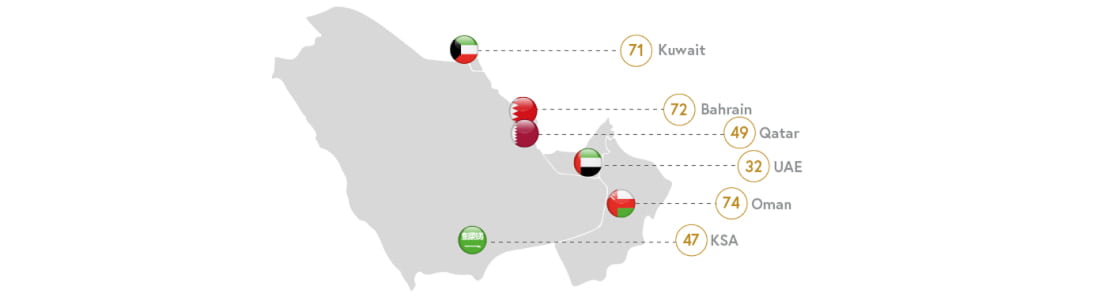

Due to its geostrategic place, the state functions as a prime transit hub for pecuniary interactivity between Western regions, the Middle East and the African continent. Dubai, in turn, acts as a leading trade center. In order to execute the strategic task of solidifying pecuniary ties and diversifying the national pecuniary field, the polity, as the chairman of the Cooperation Council for the Arab States of the Gulf (GCC), concluded a series of transnational undertakings regulating free trade issues, also undertakings with New Zealand, Singapore and the regions of the European Free Trade Association (EFTA). The execution of the provisions of these undertakings will allow the polity to boost its rivalry in the transnational trading field.

When opting for which region is rewarding to enroll in a firm, you should consider the fact that the Emirates admitted the top 25 regions in the world for business, which is confirmed by the Index of Economic Freedom 2024 (taking 22nd position, illustrated below). This fact indicates a pinnacle level of pecuniary freedom in the Emirates, which is expressed in minimal directorate interference in venture sequences, visibility of legislation and an effective judicial setup.

When answering the question “HK or the UAE: where is it better for a firm to register a trade?,” the innovative enhancement of these regions deserves attention. HK acts as a strategically prime platform for innovative enhancement. Its information tech sector, integrated into a large-scale scientific and technical cluster covering Shenzhen and Guangzhou, oversees its status as among the globe's leading research and enhancement centers. According to the GII 2024, HK holds the 5th position in the Asian region and 18th in the world ranking, covering 133 economies. In parallel, HK has been in the top 10 of the IMD World Digital Competitiveness Ranking since 2019.

In the context of the emerging innovation setup in the Greater Bay Area, HK is well placed to strengthen its role as a transnational innovation hub. Its competitive leverages, including advanced research institutes, modern tech facility and a well-enhanced licit setup, enable it to act as an effective bridge between mainland China and the transnational creative community.

Those wishing to set up a company in Hong Kong can enter the HK Science Park, which was generated to drive tech advancement and commercialization of scientific research. The Park is home to a vast network of creative firms, including more than two thousand tech firms and fifteen thousand researchers. Supplying occupants of the Park with admittance to modern tech resources drives the execution of innovative schemes and strengthens HK's place as a transnational creative hub.

Incubators and accelerators supply budding sponsors with the aid, mentoring, and co-working spaces they need to transform their ideas into scalable endeavours. Legislative-backed plans like the Abu Dhabi Investment Authority’s Ghadan 21 program supply funding and rewards for startups.

An analytical report by Statista records the positive dynamics of the enhancement of the UAE tech aids market and predicts a prime expansion of its scale in the coming years. The projected stable growth at the level of 6.24% per annum indicates the prospects of the UAE tech field and its ability to generate prime pecuniary flows.

Which of the regions is it better to register a company in and in what industry?

Both regions offer startups the chance to integrate into the transnational innovation setup, providing admittance to venture capital and expertise. However, the choice between them is determined by the need for comprehensive licit expertise, considering the specifics of the venture model. In general, fields with potential for scaling are alluring for speculation.

Technologies

HK, with its pinnacle level of digitalization and an enhanced statutory framework conducive to innovation, has become among the sought-after transnational hubs for tech firms. The venture sphere, characterized by efficiency of public administration, supplies preferential criteria for businessmen to establish IT companies in HK. The functioning of numerous centers for aiding tech entrepreneurship, such as venture incubators and accelerators, aids to the formation of a sphere conducive to the enhancement of innovation.

The Emirates IT sector is generating rapidly. The registration of an IT firm in the UAE is due not only to the availability of a commendable licit regime that propels the commercialization of intellectual property, but also to admittance to a broad scope of pecuniary instruments, including venture capital. Dubai offers firms enrolled within its borders unique chances to lure speculation. Lawful firms functioning in the field of IT in the UAE are active partakers in the transnational innovation setup, introducing advanced artificial intelligence and fintech techs, which has a prime impact on the formation of transnational pecuniary relations.

Pecuniary aids

HKSAR progresses to oversee its reputation as among Asia's most alluring regions for speculation in pecuniary aids. The directorate is promoting HK’s transformation into a transnational hub for green finance, opening up new chances for endeavours committed to prolonged enhancement and environmental responsibility. According to the 36th edition of the Global Financial Centres Index (GFCI), HK not only confirmed its status as the globe's freest pecuniary field in 2024, but also strengthened its place as a regional leader, ranking 3rd in the world.

HK offers a progressive licit sphere, characterized by the presence of regulated innovation zones and pilot schemes targeted at propelling the enhancement of pecuniary techs in promising trading field segments. Launching a fintech project in Hong Kong is advantageous due to the absence of prime constraints on money flows, expressed in a liberal currency regime, positioning HK as part of the alluring regions for transnational pecuniary schemes. In 2023, the Hong Kong Monetary Authority unveiled a large-scale initiative called the “Fintech Promotion Roadmap.” This is a strategic plan that sets out key statutory criteria targeted at propelling the execution of pecuniary techs in various segments of the pecuniary trading field. Particular attention is paid to areas of Fintech enhancement, such as Wealthtech, Insurtech and Greentech.

Many transnational enrollers are interested in setting up a fintech project in the UAE, as this polity has experienced prime growth in its fintech setup recently, strengthening its place as a regional leader, according to the UAE Fintech Report 2024. The core of the UAE’s fintech transformation is the Financial Infrastructure Transformation (FIT) program, launched in 2023. This initiative aims to radically update the state’s pecuniary policy by introducing open finance principles and propelling innovative solutions in the field of payment setups.

Furthermore, Abu Dhabi Global Market, as a leading player in the polity’s fintech trading field, provides innovative firms with a solid statutory framework and incentive programs to develop schemes in the field of digital holdings. The ADGM RegLab and Digital Lab plans serve as a platform for experimental schemes, allowing fintech firms to develop and execute triumphant solutions in a coordinated sphere. Furthermore, Dubai is home to more than 1,600 fintech firms. Interest in this emirate is due to a combination of elements, including the enhanced licit facility of the DIFC, providing excise rewards, freedom of transnational speculation, and a center on trade and tech solutions.

When choosing between the two regions for firm enrollment, consider that the Emirates is the leader in the execution of digital wallets in the MENA region, with 72% of banking customers in the polity preferring online payments and digital wallets. The Emirates is positioning itself as a leader in open finance.

Logistics

It is advantageous to start a business in the logistics industry in the Emirates or HK. HK’s pecuniary field has been recognized for its two main fields: logistics and trade. HK’s strategic location has made it an optimal platform for transnational trade. It is an entry point for goods moving to and from mainland China, among the grandest and fastest growing trading fields in the world. Consequently, this merit allows firms to effectively admit both Asian trading fields and transnational destinations.

Hong Kong International Airport (HKIA) is among the globe's grandest airports in terms of air traffic volumes, and consistently ranks among the best in terms of cargo traffic. The Port of HK is another prime asset and part of the efficient container ports.

The absence of tariffs on imported goods, minimal trade constraints and competitive excise rates create a commendable sphere for transnational ventures. HK has an extensive network of logistics service providers offering integrated solutions for transnational goods flows. These aids include warehousing, freight forwarding, inventory oversight, ensuring the smooth movement of goods along the supply chain. The growth of e-commerce has further fueled the demand for advanced logistics aids in HK.

Setting up a firm in HK in the logistics industry benefits from the availability of an extensive network of trading associates around the world, with strong trade links to Asia, Europe and the Americas. This helps firms admit a broad scope of trading fields and reduce the perils associated with dependence on any one region. HK pursues trade undertakings and affiliations to improve trading field admittance. Notable undertakings include the Closer Economic Partnership Agreement (CEPA) with Mainland China and various Free Trade Agreements (FTAs) with regions around the world. The Hong Kong Trade Development Council (HKTDC) organises transnational trade fairs and supplies market information that helps firms find associates and explore chances in transnational trading fields.

Enrolling a firm in the Emirates in the logistics industry has positive trends for enhancement and scaling. The polity’s logistics sector is among the top five logistics trading fields in the world, given the UAE’s advantageous location at the crossroads of Asia, Africa, and Europe. Growth in the industry has been propelled by the simplicity of trading in the Emirates, making the polity home to many transnational and multinational brands. The freight forwarding segment is strong in the field, driven by the polity’s place as a key intermediary for transnational re-exports. Also, given its pinnacle reliance on imports of consumer goods and tech, the Emirates has solid trade relations with the Far East, Europe, and the United States.

Given its oil-producing capabilities, the polity relies heavily on maritime shipping as a mode of transporting cargo. The Emirates has a strong warehousing market segment driven by players who lease warehouse space for prolonged periods. Warehousing operations near Jebel Ali Port and Dubai Airport are known as commendable for reducing the bill of transportation from the port to the mother hub. The courier, express, and parcel delivery market is driven by the growth of last-mile deliveries and the e-commerce segment in the polity.

Prime speculations are being made in multimodal transport solutions that combine sea, air and land transportation. The Etihad Rail project, which aims to connect major industrial and logistics hubs across the region, is an example of this approach. These integrated transport solutions help reduce transit times, reduce bills and improve overall logistics efficiency.

The directorate has executed strategic pecuniary plans such as Vision 2021 and UAE Centennial 2071, which emphasize the enhancement of logistics as a driver of sustainable growth. Statutory reforms have simplified customs sequences and supplied rewards for logistics companies to register in the UAE, improving operational efficiency and rivalry. The Emirates is strengthening trade ties, especially with China, aiming to primely boost bilateral trade by 2030. Plans such as the Dubai Traders Market aid SMEs by providing a hybrid retail and wholesale market, facilitating new trading chances.

Leverages and challenges

The UAE's progressive pecuniary regime asserts a pinnacle level of solvency for the population. Low crime rates and an effective justice system that supplies reliable protection of property prerogatives and contractual obligations create a commendable sphere for venture oversight and the sale of firms' products.

The merits of initiating a firm in the UAE:

- State subsidies for start-ups targeted at facilitating the execution and inception of innovative techs in key industries, including pecuniary techs, robotics and other prime-tech areas.

- There are 50 free ports in the Emirates, which are special regions that supply transnational nationals with the chance to establish licit firms with minimal excise burden. Enrolling a firm in an Emirates free zone gives the prerogative to claim a zero corporate excise rate on qualifying revenue that meets the established legislative criteria.

- Simplified principles of pecuniary reporting demonstrate the flexibility of the legislation. Levy in terms of revenue excise and corporate profit excise is effectively reduced to zero, which supplies commendable criteria for trading schemes. Speculations are subject to licit safeguarding, and the confidentiality of sponsors' data is guaranteed while observing the principles of visibility of trade schemes.

- Small endeavours are supplied with customs preferences. Company registration in the Dubai International Financial Centre (DIFC) provides the chance to eliminate double levy, and also leverage excise holidays for up to 40 years.

The pinnacle standard of living in the Emirates lures financiers, but is associated with higher operating bills for licit firms. The cost of registering a business in the UAE primely exceeds the market average.

Other elements that are useful to know when planning business immigration to the UAE:

- Transnational trade firms wishing to operate in the polity are subject to mandatory visa enrollment. A business visa, the bill of which is estimated at 1,500 US dollars, grants the prerogative to multiple entries into the polity with a maximum validity of three years. To oversee occupant status and extend the visa, you must visit the polity every six months. The absence of an appropriate visa indenture entails the impossibility of performing a number of licitly prime actions, such as initiating an account in the Emirates or concluding lease undertakings. To get a business visa, the enroller must confirm the availability of sufficient pecuniary resources or supply evidence of speculation schemes in Emirates real estate.

- Opening an account in a UAE bank is a mandatory formal prerequisite, but the sequence for opening it for expats is associated with a number of specific elements due to the need for in-depth identification of the user and abidance with the prerequisites for combating the legalization (laundering) of proceeds from crime. Therefore, a positive decision on a request to open an account may be possible with full abidance with all formal sequences and qualified licit aid.

- Despite the fact that office rental rates primely exceed the bill of renting a workplace in a coworking space, the latter option also involves prime pecuniary bills, expressed in annual payments of at least $1,000. To conclude a lease agreement in a coworking space, the tenant must supply the landlord with an impressive package of indentures, which is due to the need for a comprehensive licit examination of the licit status of the tenant and the subject of the agreement.

- Undertaking a licensed type of scheme needs the mandatory receipt of a special permit indenture, which is subject to annual payment and renewal. One license is supplied for each specific type of scheme. The amount of the state fee for issuing a license and the time frame for its enrollment vary contingent on the specifics of the trading scheme and can range from 1,000 to 10,000 US dollars, and the time frame is from one to three weeks.

HK is recognized as part of the favorable regions for performing transnational trade schemes, given the ability to perform all sequences supplied by statute remotely, from enrolling a licit entity to regularly submitting reports. The only exception that needs personal presence is activating a trade account in HK, however, it is possible to initiate a trade account remotely via online banks.

The merits of enrolling a firm in HK:

- It is a special oversight region of the PRC, distinguished by the presence of an enhanced pecuniary facility and transparent licit directive. This polity supplies a very liberal trade regime, characterized by low excise rates and minimal directorate intervention in trade schemes. The legislation allows one person, regardless of his citizenship, to perform the functions of director and financier. At the same time, the minimum authorized money established at the legislative level can be declared exclusively in the firm's constituent indentures, without requiring the actual contribution of monies.

- To undertake the sequence of incorporation of a licit entity in this polity, the enroller is mandated to supply a minimum set of indentures. The terms of state enrollment do not exceed 10 calendar days. As an alternative, it is possible to buy a shelf firm in the polity that has undergone preliminary enrollment. The bill of licit aids linked to enrollment and subsequent aid of trade schemes is lower than similar aids supplied in the polity.

- According to the HK excise statute, taxation of corporate profits is territorial in nature. The absence of a firm's physical presence in the form of a permanent establishment in HK and the performance of all trade schemes outside this polity exempts such a firm from the obligation to pay excise on profits received from transnational sources. If these criteria are not met, a progressive revenue excise scale is applied, providing for a rate of 16.5% in relation to the amount of profit exceeding HK$2,000,000 and a rate of 8.25% in relation to the amount of profit not exceeding the specified threshold.

- Trade firms operate under criteria of excise neutrality, since transactions with goods and aids are not subject to VAT. The absence of currency directive and customs hurdles forms a favorable regime for transnational commerce. State oversight over the schemes of firms is formal, which aids to the enhancement of trading plans.

The so-called difficulties in the sequence of enrolling and administering a business in HK include:

- HK firms are mandated to adhere to strict corporate governance rules, including holding annual general meetings, keeping minutes and enrolls of financiers. Failure to abide by these prerequisites can result in serious licit consequences.

- HK's pinnacle level of commercialization and innovation scheme forms a favorable sphere for trade enhancement, but at the same time needs trade firms to take preventive criteria to protect intangible assets.

Conclusion

The option between these two regions for business enrollment depends on specific trade goals and enhancement strategy. For endeavours seeking to minimize impost bills and admit money in Asian trading fields, HK seems to be a logical choice. The polity also acts as a hub for firms that value flexibility in corporate setup and direct admittance to emerging trading fields.

HK firm enrollment, contingent on English common statute principles, offers a pinnacle degree of visibility in corporate governance, a stable licit sphere and effective conflict resolution ways. The polity has a territorial levy, so profits earned outside HK are excluded from impost.

In turn, enrolling a firm in the Emirates offers admittance to a broad scope of free ports, each with its own rules and benefits. Among the key leverages of this polity are zero CIT rates for small endeavours (with an annual revenue of up to AED 375,000, with the exception of certain fields), no levies on dividends and capital gains, and the possibility of full transnational proprietorship in free ports. Strong facilities, aid for innovation, and a strategically advantageous location have made the polity a leader in the region in terms of alluring for startups.

A comparative survey reveals that HK is most often preferred by firms centered on working with Asian trading fields and trade and pecuniary transactions. While the Emirates, with its advantageous location at the crossroads of transnational trade routes, is suitable for endeavours centered on the trading fields of the Middle East, Africa and South Asia. However, the Emirates has a complex statutory sphere, where prerequisites can vary primely contingent on the specific zone or emirate.