At the moment, we can say, that England is one of the most popular financial and business centers in the world. Since, the country is an attractive jurisdiction and enables entrepreneurs to profitably arrange international tax planning. Although England is known as a standardized tax jurisdiction, UK law allows registering an LLP (Limited Liability Partnership) in UK, which provides a zero tax rate to non-resident owners.

It is also possible to register an LP company in England. A main difference between English LLP and LP (Limited Partnership) is, that LP must have one partner with an unlimited liability and one with a limited liability. This responsibility is limited only by a partner’s contribution to the company's capital.

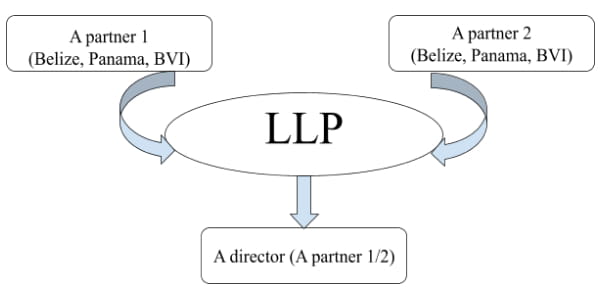

In LP partners are responsible only for what they have invested in the partnership. In order to set up an LLP in England, you need at least two legal entities or individuals. The main advantage for businessmen, who want to open LLP in England is, that the English state does not care, what country you are resident in. But registered LLPs in England must file financial statements. Companies like LLP do not pay a tax, if the company’s profit was obtained outside the country, because founding partners are residents of another country, but not the UK.

If we talk about privileges of registering an LP company in UK, the first thing to note is, that all data about beneficiaries are not disclosed. Even, if you register LP in England, you can get rid of all requirements for the annual reporting. LP’s companies are exempt from a tax in the UK state. But, the minus is, that taxes should be paid to the country, of which these partners are resident. Therefore, for entrepreneurs, who have decided to open an English enterprise, YB Case experts recommend choosing LP or LLP partnership options in England with a nominee service, where partners are residents of tax-free states.

Competent YB Case specialists will advise on registering a commercial company in UK for the shortest possible time.