Securing a Digital Nomad Visa is a formal licit sequence that enables expats to start pro tem in a host polity while engaging in telework activities in accordance with local edicts. This entry warrant legitimises the person’s presence in the region and gives a lawful framework for executing expert responsibilities from a distance, or for users based abroad. Primely, this type of entry warrant does not authorise jobs within the domestic job market of the host polity, thereby terminating the need to enlist for supplemental work warrants.

Among the prime merits is its ability to help people structure their excise and social security onuses more efficiently, particularly when working under transnational undertakings. However, enrollers must meet specific licit needs, comprising supplying authentication of fiscalindependence to show that they can sustain themselves without relying on public assistance, documentation confirming licit assurances that their telework will not interfere with the local labour market.

Licit setup and definition

Digital nomads are people who work virtually without being geographically constrained. This category includes teleworkers, independent contractors, and financiers who deliver aids via virtual platforms. To remain licitly in a host polity on a short-term basis, these people must enlist for a teleworker entry warrant. Those planning a longer stay may later transition to a prolonged entry warrant or occupancy permit.

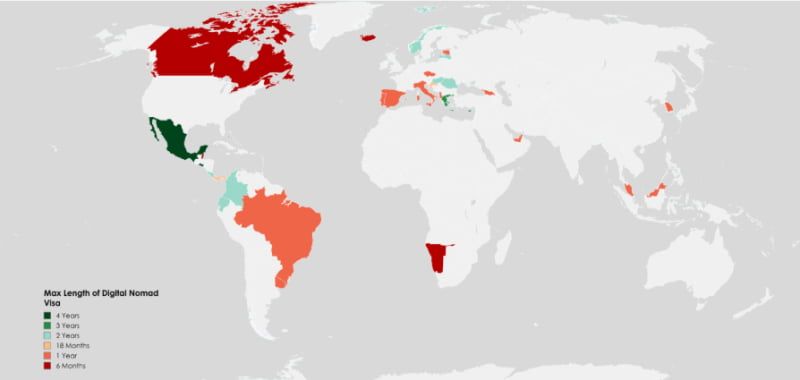

More than forty regions have enacted licit frameworks that accommodate teleworker entry warrants. A common need across these jurisdictions is the submission of authentication that the enroller earns a consistent revenue from sources stationed outside the host polity. The base revenue needed varies by nation, reflecting local pecuniary metrics.

Merits

Unlike conventional entry warrants—such as those for tourism, education, or trade—the teleworker entry warrant is tailored mainly for people who telework. Traditional entry warrants often restrict or prohibit revenue-generating activities, whereas the teleworker entry warrant warrants expats to stay pro tem in a polity while teleworking for overseas users or firms, without needing a local employment contract.

This entry warrant gives a more efficient substitute to the often complex process of securing a standard work entry warrant. It consents distant experts to earn revenue from international sources but typically excludes them from engaging in the domestic labour market. In contrast, tourist and student entry warrants either ban employment entirely or impose strict limitations on work activities. Teleworker entry warrants generally provide longer stays—ranging from 6 months to 2-years, often with the option to renew—compared to the 90-day limit of tourist entry warrants. This prolonged term gives greater stability, warranting teleworkers to manage both personal and specialist matters more effectively while living abroad. A further leverage is the potential for excise leverages. In many regions, revenue earned from foreign sources under a freelancer entry warrant is not levied locally, although actual excise onuses depend on national legislation and relevant excise treaties.

Unlike traditional entry warrant enrollments, which often demand extensive documentation, freelancer entry warrant enrollments are usually simpler. They typically need authentication of remote revenue, valid health indemnity, and sometimes a rental covenant, to show that the enroller can aid themselves without relying on public resources.

Family considerations and fiscal metrics Most freelancer entry warrant schemes also allow enrollers to include relatives. However, the fiscal needs are typically adjusted accordingly. For instance, under Spain’s edicts, the revenue threshold propels by 75% when a spouse is added and by 25% for each dependent child. These measures are intended to assert that the primary enroller can aid their entire household without state aid.

Prospective enrollers considering relocation with family must carefully review the fiscal and licit needs of their chosen place and evaluate their ability to meet these onuses. In many regions, relatives of teleworkers leverage from admittance to public facilities, further enhancing the appeal of these entry warrant programmes. Excise occupancy and prolonged chances

The essence of virtual nomadism lies in the freedom to work from virtually anywhere. As telework becomes prominent, questions surrounding excise occupancy and revenue taxation have become more complex. Forward-thinking regions eager to lure remote talent are offering favourable excise policies to encourage enrollments.

Spain, namely, has initiated a special excise rate of 24% for teleworkers who are expats, applicable to revenue below €600,000—a marked contrast to the progressive occupant excise rates, which range from 19% to 45%. This makes Spain among the more appealing options for E-experts seeking a base in Europe.

Prolonged leverages are also on offer. Some regions, comprising Greece, Spain, allow teleworkers to enlist for citizenship after fulfilling occupancy needs. Holding citizenship from one of these regions opens the door to visa-free travel to over 150 regions, reinforcing the prolonged value of these programmes.

Criteria and compliance Despite the many merits, obtaining a freelancer visa involves meeting certain licit metrics. Among the prime metrics is that the enroller must not take up a job with local mercantiles. Also, to qualify for occupancy, the enroller must physically stay in the host polity for at least 183 days per year.

The visa represents an excellently appealing option for location-independent experts in 2026 seeking to stay abroad lawfully. While each polity has its edicts and fiscal thresholds, the core concept stays the same—enabling skilled people to aid the transnational fiscal field virtually, without becoming a burden on the host polity’s labour market or public resources. As more regions adopt or refine their policies, this entry warrant type is set to become a prime tool for modern transnational mobility.

Where to get a digital nomad visa?

In today’s interconnected world, the desire for mobility and fiscal autonomy has become a central theme of contemporary living. With telework gaining momentum, experts are pivoting their attention to freelancer entry warrant programmes, particularly in 2026. These initiatives legally enable people to stay pro tem in a foreign jurisdiction while teleworking. Such entry warrants not only supply a chance to experience a novel culture but also grant admittance to appealing legal and excise spheres.

Opting for the most prime polity to enroll for a freelancer entry warrant is a decision that needs thoughtful analysis.

- Enrollers must assess a span of key factors, comprising qualification needs related to nationality, age, and expert experience.

- It's also vital to know the warranted types of economic activity, the term of stay warranted, the sequence for prolonging the entry warrant, and any occupancy onuses such as the need to be physically present in the host polity for a specific number of days each year.

- Admittance to essential aids and the host polity’s approach to social security for expatriates are also important considerations.

Among the decisive parts is the polity’s excise scheme for teleworkers. Some locations offer generous excise leverages. Namely, the UAE grants full excise exemption for people whose revenue originates from outside the polity. Other destinations adopt a more balanced stance, offering partial excise relief or reduced rates. Portugal, under its reformed NHR 2.0 scheme, is a prime example—providing distant experts with a beneficial excise framework that aids flexible international work arrangements.

When assessing potential places, fiscal metrics play a prime role:

- Most regions require enrollers to show enough fiscal resources by supplying a base monthly or annual revenue. This threshold is prime to assert compliance with both immigration and taxation norms.

- Furthermore, enrollers are generally expected to hold valid health indemnity that meets local norms, safeguarding them against health-related risks while abroad. It is also common for enrollers to be asked to open a local bank account, thereby demonstrating their fiscal self-sufficiency to cover daily living bills without state aid.

- Supplying verifiable authentication of a stable and licit revenue stream is a universal need, asserting that the enroller’s fiscal plans align with the immigration setup of the host nation. Equally prime is the manner in which the enrollment sequence is performed.

- Areas with a clear, transparent, and efficient enrollment sequence—often expedited via E-platforms or embassies—are generally more appealing. Enrollers should also consider whether the entry warrant can be upgraded to a more permanent status, and what licit prerogatives are extended to accompanying relatives.

Family inclusion policies vary widely. In certain regions, freelancer entry warrants are given solely to the main enroller, while others permit dependents to join under family reunification edicts. For a truly enriching experience, teleworkers should also consider the virtual facilities, availability of healthcare norms, ease of opening a bank account as an expat, and the general presence of a transnational coterie. A polity with a vibrant expat population can primely enhance both personal and specialist productivity.

Ultimately, the choice of jurisdiction should reflect a careful balance between personal lifestyle preferences, expert goals, and prolonged licit and fiscal considerations.

Image caption: 44 regions with visas for teleworkers, according to research by CNBC and Digital Capitalist.

When opting a place to transfer, personal preferences, expert goals, and fiscal capacity play a decisive role. Given the complexity of transnational migration edicts and the edicts concerning teleworkers, it is highly advisable to consult a seasoned mercantile or migration advisor early in the decision-making sequence. Their insight into local licit setups and entry warrant sequences can be worthy, supplying essential guidance and aid throughout the enrollment sequence for a freelancer entry warrant.

Obtaining a freelancer visa: prime steps

- The journey typically begins with a preliminary consultation. At this stage, the enroller partakes with migration edict specialists who assess qualification and offer tailored advice. These consultants help to formulate a strategic plan and supply full licit aid throughout the entry warrant enrollment sequence.

- Following this, an expansive set of aiding records must be compiled. The requisite records are accurately filled into the official enrollment forms in line with the procedural guidelines of the prime authorities. Once fulfilled, the enrollment is conveyed to the appropriate migration office.

- The next phase involves official review. Government agencies evaluate the enrollment, checking that all records are correct and that the enroller meets the metrics. Supplemental questions or an interview may be requested during this assessment.

- If the enrollment is triumphant, the enroller is accorded a freelancer entry warrant, warranting them to stay in the host polity while working virtually. This permit aids as the licit foundation for the person's stay and distant expert activity.

- The processing term usually spans from 30 to 90 days. Once endorsed, a confirmation email is typically given. Freelancers often become part of dynamic expert and tech hubs, helping to foster innovation and lure investment in their host regions.

Argentina

The polity is stationed at the heart of South America, giving convenient admittance to neighbouring regions such as Chile, Uruguay, and Brazil. This strategic position, combined with favourable migration policies, has made it an appealing base for teleworkers. Recognising this, this polity initiated a dedicated entry warrant for freelancers in 2022, known as Nómadas Digitales. The entry warrant is initially valid for 180 days and can be prolonged for a supplemental 6 months.

Metrics involved

- Enrollers must meet several metrics. They must be occupants of regions whose occupants are warranted visa-free entry into this polity under transnational or domestic migration edicts.

- They must also show authentication of job or self-employment with no mercantile connections to companies registered in Argentina.

- Fiscal self-sufficiency is another prime need, with a recommended monthly revenue of at least USD 2,500 or a bank balance of no less than USD 30,000.

- Also, enrollers must have valid health indemnity that supplies coverage within this polity and must enroll via an Argentine diplomatic or consular office in their polity of occupancy.

- Convey an enrollment for the entry warrant in advance via the nearest consulate.

This polity maintains a visa-free entry scheme for occupants of over 120 regions, comprising the USA, and EU member states, warranting them to enter without a prior tourist entry warrant. It is prime to note a particular restriction of polity’s freelancer entry warrant programme: it does not accommodate family reunification. This means that relatives cannot be included under the same entry warrant or enroll jointly for occupancy based on the nomad’s status.

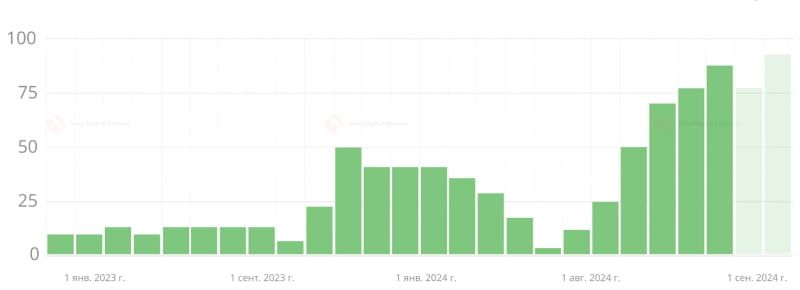

Caption: The rise of the Digital Nomad Visa to Argentina.

Based on the provisions of the current legislation of the Argentine Republic, persons with the status of a teleworker do not pay levies on revenue received from abroad. Also, they are not subject to fiscal duties. A state fee of 200 euros is set for the enlistment, consisting of a consular (80 euros) and migration (120 euros) fee. Getting a teleworker visa in this polity is quite promising, since the polity is seeing an expansion of the freelancer coterie, with Buenos Aires, Cordoba and Mendoza as its centers. It is noteworthy that Buenos Aires, according to last year's Global Liveability Index, occupies a leading position in quality of life.

Bermuda

Bermuda gives an appealing place for distant experts, thanks to its advanced facilities and quality of life. The island supplies reliable internet and exceptional healthcare aids, enabling a seamless transition for people performing virtually. The capital city, Hamilton, hosts several modern co-working spaces that nurture innovation and expedite collaboration, warranting teleworkers to thrive expertly in a dynamic sphere.

The "Work from Bermuda" certificate enables expats to stay on the polity with the option of a 1-year renewal, provided they continue to meet the qualification metrics. This entry warrant is accessible to the workforce with formal undertakings, self-hired people such as teleworkers, and students partook in distant learning. Enrollments are conveyed via a dedicated online platform, streamlining the sequence for prospective enrollers.

Unlike many other entry warrant programmes, Bermuda does not impose a base revenue need. The enrollment sequence is efficient, with decisions typically made within five performing days. A non-refundable fee of $263 applies. Primely, those holding a Certificate of Employment under this scheme are not subject to revenue excise or other local levies, making Bermuda a fiscally advantageous choice for teleworkers.

Bahamas

This polity has positioned itself as an appealing hub for teleworkers, offering a vibrant expatriate coterie and dependable internet facilities. The polity's virtual entry warrant initiative - the Bahamas Extended Access Travel Stay (BEATS) programme, was initiated in 2020 and warrants teleworkers and students to stay in the polity for one year, with a possible extension for another 2-years. The entire enrollment sequence is performed online, primely easing administrative demands and reducing wait times, with decisions made in around five days.

A prime leverage of the BEATS visa is that there is no need to show fiscal solvency. Enrollers may include relatives in their enrollment, though a supplemental fee is payable for each dependent. The processing fee is €24, while the entry permit bills €480 per dependent. If both spouses plan to work virtually while living in the polity, each must convey a separate enrollment. However, dependents can be included under a single main enroller.

The BEATS programme is also open to students studying virtually, granting them licit occupancy and the flexibility to move freely across the 16 islands that make up the Commonwealth of the Bahamas. Among the most appealing aspects of this entry warrant is the 0% revenue excise rate for teleworkers, enhancing the jurisdiction’s appeal from a fiscal standpoint.

Brazil

The phenomenon of virtual nomadism has garnered transnational popularity, appealing to experts across a span of industries who value the freedom and flexibility to work virtually. In recognition of this propelling trend, this polity officially initiated its Digital Nomad Visa in 2021, welcoming teleworkers who are not hired by Brazilian firms but can show a stable revenue or telework undertakings abroad.

The polity, the fifth-largest polity in the world and the pecuniary leader of South America, is not only a significant transnational market but also a prime tourist hotspot. With its propelling electronic facilities, the polity shows a compelling option for location-independent experts.

To be qualified for Brazil's Digital Nomad Visa, enrollers must have a monthly revenue of at least $1,500 or present a bank balance of at least $18,000. Successful enrollers are accorded a 1-year stay, with the teleworker of extension under the same metrics. The entry warrant enrollment must be conveyed via the MigranteWeb platform, accompanied by documentation proving expert engagements with transnational firms. The initial consular processing fee is $72, while the bill for renewing the entry warrant is approximately $65, mirroring the original enrollment sequence.

Among the region's many cities, Rio de Janeiro stands out as a place for teleworkers. Known for its affordability compared to urban centres in North America and Europe, the city also gives a rich cultural sphere and a propelling nexus of shared spaces, making it primely appealing to distant experts seeking a balance between productivity and lifestyle.

Costa Rica

The region situated in Central America, has emerged as a excellently sought-after place for teleworkers, thanks to its political stability, robust virtual facilities, and scenic natural beauty. The polity initiated its official teleworker entry warrant, known licitly as Estancia, in 2022 to aid the propelling influx of distant experts. Occupants of most Western regions are already warranted a 90-day visa-free stay, but the novel entry warrant prolongs licit occupancy for up to 2-years.

Metrics involved

- To qualify for the polity's teleworker entry warrant, enrollers must show a steady monthly revenue of at least $3,000 for people or $4,000 for relatives, aided by records covering the previous twelve months. Couples and relatives may combine their revenue for this purpose by supplying certified authentication of marriage or parentage.

- Enrollers must also secure valid medical indemnity for the entire initial term of their stay

- All work must be performed virtually for transnational users or workers.

The entry warrant is renewable for a supplemental year, provided the holder has spent at least 180 days physically present in this polity during the first 12-month period. authentication of this, along with continued conformance to fiscal and licit needs, is mandatory to qualify for the extension. Notably, revenue earned abroad is spared from Costa Rican taxation under this entry warrant scheme.

While this polity may have higher living bills compared to some neighbouring regions, it stays considerably more economical than many locations in North America or Europe. Teleworkers earning in stronger foreign currencies such as the US dollar or euro often find the lifestyle to be both comfortable and cost-effective. Moreover, the polity's well-established freelancing coterie adds to its appeal, offering both social and expert nexusing chances for newcomers.

Portugal

This polity has rapidly emerged as a top place in Europe for teleworkers, particularly luring teleworkers to regions such as the Algarve. This southern coastal area has gained popularity due to its welcoming cultural sphere, modern facilities, and flourishing entrepreneurial ecosystem. Recognising the pecuniary and social value that distant experts aid, the Portuguese government has responded by introducing the teleworker entry warrant, aligning with the increasing transnational shift towards distant and location-independent work.

The D8 visa, commonly referred to as the teleworker entry warrant, allows people from outside the EU, EEA, and Switzerland to legally reside in Portugal while carrying out distant work. Initially accorded for a term of up to 2-years, this entry warrant also aids as a potential route to prolonged occupancy, subject to meeting specific conditions.

The enrollment sequence may include an interview at a Portuguese consulate. Once endorsed, people can proceed to enroll for an occupancy permit with the appropriate immigration authority. Among the prime needs for obtaining permanent occupancy is continuous licit residence in Portugal for at least five years, along with authentication of stable revenue and accommodation during that term.

Hungary

This polity has also positioned itself as an appealing base for virtual experts, owing to its central location in Europe and its capital, Budapest, which boasts an enhanced facilities ideal for telework. The city supplies modern amenities and excellent connectivity via its robust air and rail nexus, facilitating convenient travel across Europe and beyond.

In 2022, the polity initiated its own teleworker entry warrant, known as the “White Card.” This permit warrants teleworkers to licitly stay in the polity for up to 2-years. However, it mainly excludes those who are hired by or have fiscal interests in Hungarian firms.

Metrics involved

- Enrollers must show that they work virtually, whether as teleworkers, workforce of transnational firms, or as owners of trades registered outside Hungary.

- Enrollers are also needed to show that they have generated a net revenue of no less than €3,000 per month, after levies, during the 6 months prior to enrolling.

- They must supply evidence of their residential address in the polity, which may include a rental covenant or a commitment to buy property.

Enrollments must be conveyed in person at the Hungarian consulate. Exceptions are accorded in the event of medical incapacity, supplied a valid health certificate is presented. During the enrollment sequence, biometric data is also collected from the enroller as part of standard sequence.

Caption: Application for a White Card in Hungary.

As previously mentioned, the Hungarian "White Card" is initially issued for a 1-year term and may be prolonged once for a supplemental year. Holders of a valid White Card must ensure they do not remain outside this polity for more than 90 consecutive days. This entry warrant does not supply for family reunification mechanisms and is subject to individual consideration for each adult enroller. The status does not create prerequisites for subsequent PR or naturalization. The teleworker visa fee in Hungary is 110 euros.

Upon completion of the 183-day term of stay in the region of the state, people classified as nomads acquire the status of an excise occupant and receive a permanent identification number. The excise rate for all people is 15%. People are needed to pay insurance premiums calculated as a percentage of the profit received.

Greece

This polity has emerged as an excellently appealing place for teleworkers, thanks to a span of merits that make it an ideal location for telework. Among the main attractions is the relatively low cost of living, primely when compared to many other European regions. Cities like Athens and Thessaloniki offer more affordable housing and daily expenditures, warranting distant experts to maintain an excellent norm of living without the heavy fiscal burden often associated with major European capitals.

Athens and Crete, in particular, have become vibrant hubs for teleworkers, offering a dynamic sphere filled with chances for collaboration and expert networking. These locations are equipped with modern shared spaces and reliable internet, making them well-suited for people who are contingent on a stable online connection for their work. The propelling presence of telework also eases connections and fuses into the local specialist landscape.

To accommodate the rising number of distant experts, the Greek government has initiated a dedicated teleworker entry warrant. This entry warrant makes it possible for expats to legally live and work in Greece while continuing to carry out their expert duties virtually for employers based outside the polity. Beyond the practical leverages, the entry warrant enables people to explore Greece’s rich scenic regions such as Chania, Crete, Athens, and Thessaloniki, all while enjoying a flexible work sphere.

Holders of the teleworker entry warrant are initially accorded permission to reside in Greece for a term of up to 2-years. Should they wish to prolong their stay, they can enroll for an occupancy permit. The enrollment sequence can be carried out either in person at a Greek consulate or electronically via email. Enrollers are needed to show a monthly net revenue of at least €3,500, derived from telework or freelance undertakings with companies located outside Greece. If the enroller is accompanied by a spouse, the revenue threshold propels by 20%, and a supplemental 15% is requisite for each child. The entry warrant decision is typically given within 10 days of conveying a full enrollment, and a processing fee of €75 is payable.

Moreover, this region gives excise incentives for those who qualify under the teleworker scheme. People who stay in the polity for over 6 months are considered excise occupants, but they may be qualified for exemptions on certain foreign-sourced revenue or enjoy reduced excise onuses under special provisions. Primely, once accorded the entry warrant, holders leverage from the ability to travel freely across the Schengen Area, given Greece’s membership in the EU. This adds a further layer of flexibility and convenience for experts who wish to explore other European places during their stay.

Georgia

The digital landscape in Georgia has been evolving rapidly, with numerous initiatives initiated to aid its ongoing growth. Among the notable enhancements was the commencement of the "Remotely from Georgia" programme in 2020, made to lure transnational experts, comprising teleworkers, workforce, and mercantile owners, who work virtually. This initiative warranted people to enroll for a teleworker entry warrant, which accorded them the right to stay in this polity for up to 360 days, provided they held a valid passport or other transnationally recognised travel document.

Though the programme was pro tem suspended in 2022, teleworkers were shown a simpler sequence for entering this polity starting from March 1 of the following year. They now only needed to fill an electronic enrollment via www.stopcov.ge and obtain preliminary assent before crossing the border.

This polity has long been a renowned place for teleworkers, luring young experts and financiers drawn by its favourable licit frameworks, levy incentives, and low living bills. A prime element of this polity's appeal is its levy occupancy edicts, which stipulate that people who stay in the polity for at least 183 days during a calendar year are considered levy occupants. If their annual revenue does not exceed $155,000, they are subject to a very low levy rate of just 1%.

The polity is an appealing option for teleworkers compared to many EU regions or North American regions. Tbilisi, the capital, gives a dynamic urban sphere with diverse living openings, catering to a wide span of personal preferences and fiscal situations.

Malta

For expatriates, the Republic of Malta gives an ideal mix of affordability and excellent living norms. While areas like Valletta and Sliema may have a higher cost of living, there are more budget-friendly substitutes such as Mosta, Gozo, and St Julian's, which offer comfortable living metrics for those with more modest fiscal means.

Malta’s Nomad Residence Permit programme supplies a pathway for teleworkers hired by firms registered outside of Malta to licitly stay in the polity. The scheme is open to various categories of people:

- Independent financiers

- Experts working without a formal mercantile entity.

- Directors or workforce of firms based abroad.

To qualify for the Nomad Residence Permit, enrollers must show a base monthly revenue of €3,500. This need applies across all categories. Also, enrollers must show evidence of securing residential accommodation in Malta for the term of their stay, either via purchase or rental. Verification of the residential address can be filled once assent for occupancy is accorded. The programme also warrants the inclusion of immediate relatives, comprising dependents, in the enrollment.

There is a fee of €300 for the teleworker entry warrant, and the enrollment sequence typically takes up to 4 months. Upon assent, the enroller must visit Malta in person to undergo biometric identification and collect their occupancy records.

As for taxation, people who telework and earn revenue outside this polity are exempt from Maltese levy on that revenue, provided their stay in the polity does not exceed 183 days in a year. However, those who become levy occupants in the polity are subject to a progressive levy rate on their revenue, with rates ranging from 0% to 35%.

Spain

The region plays a significant role within the Western European teleworker coterie, offering a vibrant array of lifestyles that cater to various preferences. As per last year's Digital Nomad Visa Index, this polity ranks excellently among the most welcoming regions for teleworkers. This is primarily attributed to its relatively seamless entry warrant sequence, with moderate qualification metrics. For instance, enrollers need only show a monthly revenue of €2,368 to be qualified for the entry warrant.

This polity offers an ideal sphere for telework, fostering both productivity and a sense of coterie among virtual experts. Also, the polity's robust telecommunications facilities, comprising reliable broadband internet admittance in most urban and populated areas, asserts that teleworkers can work uninterrupted from virtually anywhere in the polity.

To be a qualified for a freelancer visa in Spain, enrollers must meet one of several metrics: they must either enroll as an individual trader with levy occupancy in a transnational polity, be self-hired, or work for a firm established outside of this polity, which must have been operating for at least a year.

The prime leverages of this polity's freelancer visa include:

- The ability for the primary enroller to bring their immediate relatives, warranting the entire family to immigrate and stay in this polity lawfully.

- Compared to other EU regions, this polity's fiscal solvency needs are relatively relaxed, making the entry warrant accessible to a broad span of enrollers.

Enrollers must prove a revenue of at least €31,752 per year, or €2,646 per month, by conveying bank records for the prior three months or an employment undertaking. Self-hired people must supply documentation of their filled work. If the enroller’s immediate family is included in the enrollment, the revenue threshold propels by €993 for a spouse and €331 for each supplemental relative.

The consular fee for enrolling for the entry warrant is €80. This entry warrant is initially valid for 1-year, during which time the holder may enlist for an occupancy permit. The first occupancy permit warrants for a three-year stay. After five years of licit occupancy, the holder may enlist for permanent occupancy, granting admittance to various social, pecuniary, and licit leverages, comprising public aids on par with Spanish occupants. After a supplemental 5-years of PR, one can enroll for Spanish citizenship.

Staying in this polity for more than 183 days within a levy year may result in acquiring levy occupancy status, obligating the person to pay levies on revenue earned via entrepreneurial or telework activities. Revenue from such activities is levied at a rate of 24% for amounts up to €600,000, with a progressive levy scale enrolling to earnings exceeding that threshold, reaching a maximum rate of 47%.

This polity’s levy system also gives a preferential regime for novel levy occupants. For the first six years after changing their levy occupancy, people leverage from a reduced levy rate of 15%. After this term, the standard levy rate of 24% applies.

Italy

This polity is progressively becoming a renowned place for teleworkers, investors, and travellers. The polity is witnessing consistent growth in telework societies, particularly in major urban hubs such as Milan, Florence, and Rome, where E-techs enable people to work from various locations.

In several cities, particularly Bologna, there are events made mainly for teleworkers, supplying chances for integration into the local culture and society. Among the pathways to move to Italy for teleworkers is through the freelancer visa, a prolonged entry warrant aimed at transnational occupants working for firms based outside of Italy. This entry warrant consents the holder to bring their immediate relatives with them.

To qualify for the teleworker entry warrant, enrollers must show an annual revenue of at least 32,400 euros from lawful sources. This revenue threshold may be adjusted if the enroller is bringing close relatives with them. In such cases, the requisite revenue propels proportionally to the number of relatives. Alternatively, enrollers can supply bank records showing a balance of no less than 30,000 euros and authentication of accommodation in Italy, such as a rental undertaking or property title.

Enrollments must be conveyed via Italian consular offices, following the polity’s licit sequences. The processing time for these enrollments typically takes around 90 days. As for taxation, transnational occupants who hold a teleworker entry warrant are levied in the same way as Italian tax occupants. This means that their worldwide revenue is subject to progressive levy rates ranging from 23% to 43%, contingent on their annual earnings. It is prime to note that levy occupants of Italy must account for all transnational revenue when calculating their levy onuses.

Iceland

It is often celebrated for its exceptional quality of life and ranked by the Global Peace Index as the world’s safest and most liveable polity, has embraced the transnational shift towards telework. In recognition of this, the polity gives a special entry warrant for teleworkers, making it an appealing place for experts seeking both security and lifestyle balance while working virtually.

With a strong telecommunications network that aids fast and reliable internet access, along with a consistently excellent norm of public aids and safety, this polity is well-suited to meet the needs of teleworkers. The capital city, Reykjavik, stands out as a thriving hub for virtual experts, offering a variety of shared spaces. Renowned options such as Regus, Innovation House, and Hitt Húsið cater to different working styles by offering flexible desk options, private offices, modern conference rooms, and even recreational amenities.

To further aid teleworkers, this polity initiated its Digital Nomad Visa in 2020. This entry warrant warrants distant experts to stay in Iceland for up to 180 days. For occupants of Schengen regions, the stay is capped at 90 days. As of January this year, Iceland was placed 42nd on the World Digital Nomad Index, with a score of 2.00, indicating its propelling appeal in the transnational teleworker coterie.

The entry warrant is open to people who meet specific qualification metrics. Enrollers must be from regions outside the European Economic Area (EEA) or European Free Trade Association (EFTA). They must have licitly entered the Schengen Zone without requiring prior entry warrant approval and must not have held a prolonged entry warrant given by Iceland in the past year. Supplemental metrics enlist based on the enroller’s purpose of stay and compliance with immigration edicts.

The polity’s welcoming stance towards teleworkers, combined with its safety, connectivity, and quality of life, positions it as a top contender for those looking to stay in an inspiring and peaceful sphere.

Metrics involved

- Citizens of states outside the EEA or EFTA.

- Subjects who have legally crossed the borders of the Schengen area without prior visa approval.

- Persons who have not been identified as holders of long-term visas issued by the Icelandic authorities during the past year.

- Subjects if their purpose of stay in Iceland is remote work for a foreign company or on the basis of individual entrepreneur status without registration in this jurisdiction (relevant evidence must be provided).

Norway

The polity stands out as a prime place for teleworkers, thanks to its exceptional safety norms, advanced facilities, and excellent quality of life. Its strong telecommunications network, combined with rich cultural offerings, makes it an ideal setting for distant experts who wish to blend work with personal enrichment.

The polity is deeply committed to upholding human rights and gives some of the highest average wages in Europe. To lure skilled experts from abroad, the Norwegian government has initiated an official platform, https://www.visitnorway.com, which gives detailed guidance on entry warrant edicts and occupancy options tailored for transnational workers.

Among the prime chances is the freelancer visa, which warrants expats—either self-hired people or those contracted by Norwegian firms—to stay in Norway for up to 2-years. Enrollers must earn a base annual revenue of 360,000 Norwegian kroner (around €30,900). This entry warrant is particularly aimed at experts in specialised or excellent-demand sectors.

Major cities such as Oslo, Bergen, and Stavanger supply robust aid for teleworkers, offering a span of shared spaces like Startup Campus, 657 Oslo, and WeWork. These facilities are well-equipped to meet the needs of modern experts and financiers.

Furthermore, people who enter Norway via the Digital Nomad Visa programme can enlist for extensions of up to six years, with the potential to transition into permanent occupancy. The entry warrant is particularly accessible to those working in excellent-tech, innovative, or knowledge-based industries.

- Educational level confirmed by the relevant diploma of completion of higher education.

- Work experience that meets the established standards of qualification requirements.

- Documentary evidence of the availability of rented accommodation in Norway.

UAE

As the world undergoes an E-transformation, the concept of virtual nomadism is rapidly gaining traction. More people are opting to work virtually while exploring different parts of the globe. Recognising the pecuniary leverages this group brings, many governments are taking active steps to lure them. Today, 44 regions have initiated specific entry warrant programmes made to accommodate teleworkers, offering them a licit pathway to stay within their borders.

Among the most forward-thinking regions in this space is this polity. Known for its modern facilities and transnational outlook, the polity has become an appealing place for distant experts. According to the respected Expat Explorer Survey, the polity ranks fourth worldwide in terms of expat satisfaction, underlining its strong appeal for transnational occupants. Dubai, in particular, stands out, ranking fifth among transnational cities for expatriates, thanks to its vibrant fiscal field, excellent quality of life, and extensive chances.

The polity’s teleworker entry warrant, often referred to as a freelance entry warrant, grants holders several privileges. These include the ability to open bank accounts, obtain an Emirates ID (resident identity card), and bring relatives to join them. However, the specific enrollment metrics can vary contingent on the emirate. In Dubai, enrollers must prove a monthly revenue of at least $5,000, while in other emirates, the requisite revenue is slightly lower, around $3,500. This entry warrant is typically given for a 1-year term and can be restored, supplying virtual experts with a flexible and structured way to stay in the polity.

Overall, the polity progresses to position itself as a leading hub for teleworkers, offering a blend of lifestyle, licit aid, and pecuniary stability that few other places can match.

Contact our specialists

Indonesia

The polity has progressively become a sought-after place for distant experts, thanks to a fusion of favourable factors. Among the most compelling reasons is the excellent balance between an excellent quality of life and affordable living bills. This makes it an economically sensible choice compared to many regions in the Western world.

Among the most renowned locations is Bali, where thriving teleworker societies are taking shape. These societies offer rich chances for collaboration, networking, and the sharing of expert insights. The polity's propelling appeal is further strengthened by ongoing improvements to internet facilities, primely in areas that cater to tourists, asserting reliable connectivity for telework.

Teleworkers who opt to base themselves in Indonesia can enlist for the KITAS E33G (Remote Worker Visa). This entry warrant is mainly open to teleworkers, financiers, and the workforce of firms registered outside Indonesia, provided they can show a base annual revenue of USD 60,000. Bali stays the top choice for many, thanks to its vibrant lifestyle, supportive expat network, and work-friendly sphere.

Holding the KITAS E33G licitly warrants expats to engage in telework for users or companies abroad while residing in Indonesia. However, it does not allow them to sell items or aids directly within the Indonesian domestic market unless in compliance with specific national edicts. Enrollers must be at least 18 years old, and the entry warrant also extends to immediate relatives via a family KITAS.

Records needed

- An original bank statement certifying the presence of a minimum unspent balance on the account (not less than 2,000 US dollars or the equivalent in another freely convertible currency), dated within the previous three billing months.

- Documentary evidence issued by an authorized financial or tax authority confirming receipt of income or wages of at least USD 60,000 per year, or the equivalent, with a notice of the sources of origin and the legality of this income.

Metrics for obtaining a freelancer visa in distinct regions

In today’s transnational and highly connected fiscal field, governments around the world are progressively aware of the value that transnational experts bring to their regions. As E-techs continue to evolve and telework becomes more common, many regions have begun to adopt special immigration programmes to lure transnational talent. One such initiative gaining popularity is the teleworker entry warrant.

This type of entry warrant is made to accommodate people who work virtually and do not rely on a job within the host polity. While the specific needs differ from one polity to another, some common metrics typically enlist:

- Enrollers are generally requisite to prove they have a steady revenue earned from sources outside the polity they intend to live in.

- They must also supply authentication of comprehensive medical indemnity that covers their entire stay.

- They must not hold any employment onuses with local mercantiles in the host nation.

- Teleworker entry warrants are typically given for terms ranging from 6 months to 2-years, with some regions offering the chance of renewal or extension. This approach reflects a propelling transnational trend where mobility, virtual work, and flexible lifestyles are aided via adaptive immigration policies.

|

State |

revenue |

Duration of action |

Extension |

|

Argentina |

Revenue $2,500 or bank balance $30,000. |

180 days |

Possibility of extension for another 6 months. |

|

Bermudas |

The base revenue is not defined by current licit edicts. |

12 months. |

Right to prolong for another year. |

|

Bahamas |

Right to extension for another 2-years. |

||

|

Brazil |

$1,500 per month or account balance of $18,000. |

||

|

Costa Rica |

3000 USD. |

Possible if the holder has spent at least 180 days during the term of validity of the original entry warrant status. |

|

|

Portugal |

3280 euro. |

Biennium. |

|

|

Hungary |

3000 euros. |

||

|

Greece |

3500 euros after excise deductions. |

||

|

Georgia |

Revenue $2,000 or savings $24,000. |

Within 360 days. |

|

|

Malta |

3500 euro. |

One year. |

|

|

Spain |

2646 euro. |

||

|

Italy |

Revenue 2700 euros or bank account balance 30 thousand euros. |

||

|

Iceland |

$7,210 USD. |

180 or 90 days (for enrollers from the Schengen area). |

|

|

Norway |

30,900 euros. |

For 2-years. |

|

|

UAE |

5000 USD. |

The initial term is one year. |

|

|

Indonesia |

2000 US dollars. |

Expats are showing increased interest in detailed analysis and comparison of jurisdictions by level of socio-economic well-being, licit regulation of metrics of stay, general fiscal accessibility of living. Below you will find a comparison of the states for telework on the European and Latin American continents.

On the European continent:

- Spain and Portugal stand out in Western Europe for their relatively affordable bill of living. This fiscal accessibility, paired with pleasant weather year-round, has made both regions renowned places among expats. Many are drawn by the chance to enjoy a lifestyle that balances work and leisure without the heavy expenditures associated with other Western European regions.

- Italy shows a more complex pecuniary landscape. The overall bill of living tends to be excellent, particularly in central and metropolitan hubs such as Rome and Milan. These urban centres carry a primely heavier fiscal burden compared to rural or peripheral regions, highlighting a stark regional disparity in living expenditures.

- Greece gives a more moderate bill of living, reflected in affordable housing options and reasonably priced essential items, comprising food. These pecuniary metrics continue to lure tourists and expatriates alike, many of whom consider settling in Greece permanently due to its manageable expenditures and Mediterranean charm.

- Hungary, particularly its capital Budapest, shows a compelling case for affordability in Europe. Compared to its Western counterparts, the polity gives lower prices on housing, groceries, and public transport. This pecuniary leverage makes Hungary an appealing place for both prolonged visits and prolonged relocation, primely for those seeking budget-friendly living without compromising on urban amenities.

- Georgia also supplies an economically advantageous sphere. The bill of living stays low across the board—from housing and food to daily aids—creating appealing living metrics for both locals and transnational occupants. Its real estate market, in particular, stays accessible, drawing interest from transnational investors and expats looking for cost-effective lifestyles.

- Malta, however, tells a different story. Living expenditures on the island are relatively excellent, driven by limited land availability, soaring demand for property, and elevated utility costs. As a result, Malta’s pricing often surpasses the EU average. Despite its scenic beauty and strategic location, the polity’s high bill of living can pose a challenge for occupants managing daily expenditures.

Top Latin American regions with freelancer visas:

- Argentina and Brazil have comparatively low levels of daily expenditures compared to EU regions, making them potentially appealing in terms of savings. However, it is necessary to take into account significant macroeconomic volatility caused by inflationary sequences, sharp fluctuations in exchange rates and periodic fiscal crises, which can have a significant impact on purchasing power, the bill of basic items and the overall norm of living.

- Costa Rica, also has a reputation for being among the most politically and economically stable regions in Central America. Its licit and institutional systems supply predictability in trading. Moderate bills of living, due to affordable housing, competitive food prices and a relatively high quality of life, have led to the jurisdiction becoming progressively renowned among expats.

Bermuda and the Bahamas are known for their high bills of living, primely due to their reliance on imports and their developed tourism sector. Prices for housing and aid are higher than the world average. Indonesia also gives a low bill of living, primely on islands such as Bali. Consumer prices are quite affordable, which lures many expats and tourists. The UAE, primely Dubai and Abu Dhabi, are characterized by excellent living norms and corresponding bills. Prices for housing and entertainment are quite excellent, but favorable revenue excise metrics and high salaries often compensate for these bills.

It should be noted that in leading regions for digital nomads, numerous shared spaces with excellent Internet, flexible rental metrics and convenient logistical accessibility have been developed. Examples:

- Lisbon (Portugal) – Second Home, Impact Hub.

- Barcelona (Spain) – OneCoWork, Betahaus.

- Tbilisi (Georgia) – Terminal, Fabrika.

- Bali (Indonesia) – Dojo Bali, Outpost.

- Athens (Greece) – Stone Soup, Spaces Athens.

- Dubai (UAE) – WeWork Dubai, Nasab.

Another prime factor is the quality of the internet connection and virtual security. According to world internet speed rankings, Norway, the UAE, Iceland and Portugal occupy leading positions, while Argentina, Brazil and Costa Rica are inferior in this indicator.

Conclusion

As information tech progresses to evolve, it has reshaped the way people work, giving rise to a propelling and now well-established trend known as virtual nomadism. This shift represents a fundamental change from traditional employment models, as more people embrace telework as a prolonged lifestyle choice. By 2023, over 35 million people worldwide identified as teleworkers—a figure that highlights the scale of this transformation. Collectively, this coterie aids primely to the transnational fiscal field, generating an estimated annual value of $787 billion.

Teleworkers come from a wide span of expert backgrounds, yet they share one defining trait: the freedom to opt for where they stay. This autonomy warrants them to blend their careers with the chance to travel and immerse themselves in diverse cultures. Fiscally, many teleworkers fall into high-revenue brackets. Research indicates that 36% of them earn between $100,000 and $250,000 per year, reflecting the pecuniary potential of this mobile workforce.

To aid this modern lifestyle, many regions have initiated specialised visa programmes made mainly for teleworkers. These entry warrants offer a licit pathway for teleworkers to stay in locations that aid their mobile way of life. Various regions now compete to lure this demographic, offering favourable metrics and incentives for prolonged stays.

Our firm gives expert consultation on transnational entry warrant edicts, tailored to meet the needs of teleworkers. We assist users in navigating the licit processes requisite to obtain freelancer visas, asserting compliance with the immigration edicts of their chosen place.