Incorporation in Bosnia and Herzegovina shall facilitate assimilation into the European commercial milieu with trifling expenditure. It represents a burgeoning marketplace with an equilibrium of enterprise prospects and impediments, situated at the juncture of Oriental and Occidental trade pathways. This nation beckons businesspersons with diminutive levies and streamlined bureaucratic formalities. Establishment of an entity in Bosnia and Herzegovina affords ingress to burgeoning territories in Eastern Europe.

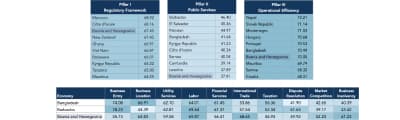

It is acclimatizing to the exigencies of the planetary marketplace, exhibiting auspicious kinetics. Enumerated beneath is Bosnia and Herzegovina's standing in the Business Ready 2024 dossier, which delineates particulars on 50 polities apportioned into quintets from paramount to least adept contenders. This taxonomy elucidates spheres for amelioration in a sovereign economy: ordinances, administrative provisions, or functional efficacy.

Image caption: indicators of Bosnia and Herzegovina in B-READY 2024.

Amidst the perks of enterprise enlistment in Bosnia and Herzegovina, modest expenditure requisites and burgeoning prospects of the indigenous marketplace stand prominent. The nation, throughout the preceding decennium, has exhibited strides in fiscal metamorphosis, fortifying macroeconomic metrics and ascending to an upper-median revenue echelon. A plethora of pivotal domains within the economy is experiencing ascendancy.

It is consolidating its position as a manufactory nexus for outward-directed trade towards the European Union and adjacent regions. Since 2023, the preponderance of shipments are funneled to Croatia, Germany, and Serbia, with Serbia, Germany, Croatia, and China as paramount partners. The European Union prevails in extrinsic trade.

Expanding the outward-bound capacity in pivotal domains like the vehicular, fabric, and furnishing sectors is generating a substantial stimulus for the progression of transnational commerce. These alterations enable the inflow of external resources and furnish notable avenues for the establishment of enterprises in Bosnia and Herzegovina by non-nationals to secure advantageous standings within these arenas.

Preliminaries for induction bolster the global fellowship's trust in the constancy of the nation's fiscal framework, spurring the inflow of assets and transnational synergy. Over the protracted span, EU integration may serve as a formidable propellant for enduring economic proliferation and the refinement of pivotal sectors.

The administration has delineated a blueprint targeting the enhancement of sustenance for diminutive and intermediate enterprises (SMEs) for the interval 2021–2027. The scheme encompasses the inauguration of avant-garde methodologies intended to streamline bureaucratic processes, prerequisites for initiating ventures in Bosnia and Herzegovina, and safeguarding perpetual advancement of commercial undertakings.

This treatise delineates an orchestrated roadmap to inaugurate a venture in Bosnia and Herzegovina. The discourse elaborates upon the juridical intricacies, pivotal measures to inscribe enterprises in Bosnia and Herzegovina, peculiarities of stewardship, encompassing nuances of fiscal obligations.

Benefits of enlisting a corporation in Bosnia and Herzegovina

It is a latent situs for inaugurating a venture owing to its pivotal locus at the intersection of Europa and the Balkans, presenting effortless ingress to marts of the European Union and the Levant, and its near adjacency to Croatia, Serbia, and Montenegro, rendering it a compelling venue for founding cosmopolitan commercial establishments.

Secondly, notwithstanding financial adversities, the nation's fiscal framework persists in showcasing consistent augmentation. As per the World Bank, yearly GDP enhancement oscillates between 2% and 3%. This metric signifies propitious trajectories within the region, encompassing the resurgence of consumer inclination, fortification of internal commerce, and amplification of entrepreneurial vigor. These dynamics might emanate from streamlining regulatory frameworks and incentivizing proprietary capital infusion.

Bosnia and Herzegovina's ingress into the European Union necessitates harmonizing its regulations with EU doctrines. The Stabilization and Association Pact permits ingress to the EU market for indigenous goods sans import duties. The Central European Free Exchange Concord (CEFTA) offers tariff-free commercial opportunities with contiguous nations such as Serbia, Montenegro, and Albania.

Sarajevo, the metropolis of Bosnia and Herzegovina, garners worldwide notice as a burgeoning hub for nascent enterprises. Well-forged liaisons with overseas financiers, gateways to scholastic and investigational assets, coupled with aid from both governmental and nongovernmental entities, render Sarajevo a magnetic nucleus for fledgling ventures. Indigenous undertakings and hastened development schemes, alongside burgeoning enthusiasm for avant-garde innovations, cultivate an auspicious milieu for enterprise initiation across myriad domains—spanning information technologies, biomedical advancements, to eco-conscious and renewable methodologies.

The jurisdiction distinguishes itself by the steadfastness of its legal tender, the Bosnian mark, tethered to the euro. This attribute mitigates fiscal unpredictability for enterprises collaborating with European affiliates. The nation’s governance advances stratagems to bolster external investors, extending inducements to those channeling capital into select realms, encompassing industrial fabrication, technological innovation, and agronomy.

The inception of a contemporary mechanized transit operations governance framework has emerged as a momentous stride in refining customs workflows. This ingenuity streamlined operations by facilitating electronic submission and processing of customs declarations. This methodology not solely curtailed the duration expended finalizing procedures but also amplified their lucidity, diminishing the propensity for inaccuracies and bureaucratic hindrances.

Notwithstanding the boons of instituting a mercantile entity in Bosnia and Herzegovina, tribulations such as the convoluted politico-bureaucratic edifice, deficient infrastructural substratum in select cantons, and an intricate juridical lattice mandate augmented jurisprudential cognizance and comprehension of the nation’s legal fealty.

The firm's erudition in Bosnia and Herzegovina's mercantile enrollment procedure, conjoined with its cognizance of indigenous trade mores and stipulations, empowers them to furnish exhaustive succor in constituting enterprises and effectuating concomitant amenities.

Atypical commercial ordinance within Bosnia and Herzegovina

Bosnia and Herzegovina's mercantile ordinance is intricate owing to its sovereign scaffold, comprising three principal gubernatorial partitions: the Federation of Bosnia and Herzegovina, Brčko Protectorate, and Republika Srpska, each endowed with its idiosyncratic juridical and bureaucratic mechanism.

Foreign tycoons desiring to inscribe or procure a corporation in Bosnia and Herzegovina, it is paramount to engage adept backing. Absent the proficient aid of seasoned commercial advisors who are sagacious in the indigenous juridical framework, there is a peril of stumbling upon legal impediments, which may culminate in hindrances in conducting trade and pecuniary setbacks.

Company forms in Bosnia and Herzegovina

The Enterprise Statute regulates the inscription of mercantile bodies in Bosnia and Herzegovina, delineating establishment frameworks, capital stipulations, accession formalities, fiduciary obligations, and disbandment methodologies for indigenous and extraterritorial conglomerates.

Pursuant to the Statute of the Foreign Economic Investment in Bosnia and Herzegovina, external capitalists may engage foreign laborers in compliance with labor and migration ordinances, unencumbered by restrictions on repatriating earnings, and possess the entitlement to acquire immovable assets and benefit from proprietorship privileges akin to those granted to domestic stakeholders.

In Bosnia and Herzegovina, industrialists possess an extensive array of disparate juridical configurations for initiating and administering a commercial endeavor. Every one of these establishments exhibits its unique attributes, encompassing the rudimentary capital prerequisites and the level of intricacy in governance. Fundamental structures to establish an enterprise in Bosnia and Herzegovina include limited liability corporations (d.o.o. / d.d.), associations, and restricted liability associations (k.d.), subsidiary and proxy office.

Limited liability company. The Društvo s ograničenom odgovornošću (d.o.o.) framework constitutes a juridical entity in Bosnia and Herzegovina wherein the accountability of the progenitors is adjudged by their fiscal endowments. The monetary quantum requisite for circumscribed obligation enterprises in Bosnia and Herzegovina fluctuates based on the precinct and mercantile classification, yet customarily aggregates to 2000 BAM (native currency), roughly equating to 500 EUR.

Register D.O.O. in Bosnia and Herzegovina may have a solitary initiator, and a minimum of one executive must be designated to oversee the quotidian administration of the enterprise. Owing to minimal fiscal encumbrance, LLC establishment in Bosnia and Herzegovina is prevalent among kin-owned ventures and fledgling enterprises.

Joint Stock Company (d.d.). A dioničko društvo (d.d.) is a more intricate juridical framework that is appropriate for sizable enterprises that aim to procure extrinsic capital via the issuance of stocks. The stockholders of d.d., akin to the proprietors of d.o.o., bear no personal responsibility for the corporation's obligations; their accountability is restricted solely to the worth of the equities they possess.

A joint-stock combine in Bosnia and Herzegovina necessitates a considerable supplementary quantum, customarily 50,000 BAM for a circumscribed JSC, tantamount to approximately 25,000 EUR, and 4 million BAM for an unshackled JSC, tantamount to roughly 2,044,065 EUR.

The principal benefit of a corporation is the capacity to enlist supplementary pecuniary assets by promulgating stock certificates. Nevertheless, in entities such as d.d., there exists a hierarchical management schema, encompassing a council of overseers for tactical orientation and a chief administrator accountable for quotidian functions. Subsequent to the formalization of the enterprise D.D. in Bosnia and Herzegovina, a convocation of stockholders must be effectuated.

Partnerships. Consortia are assemblages of personages collaborating to accomplish mercantile objectives, customarily necessitating diminished pecuniary endowment compared to syndical configurations. Within Bosnia and Herzegovina, instituting a consortium transpires with greater celerity and facility than syndicates. There exist two delineations: omnibus consortia wherein all adherents assume unmitigated onus, and delimited accountability consortia wherein adherents remain liable solely commensurate with their monetary allotment in pecuniary reserves.

In the inaugural instance, should arrears or supplementary pecuniary quandaries emerge, creditors are entitled to exact reimbursement of liabilities not solely from the firm’s resources, but also from the individual possessions of the associates. This configuration is fitting for associates possessing an elevated degree of mutual confidence and an overarching propensity to apportion hazards. In the subsequent instance, restricted participants (limited participants) engage merely as financiers, relegating administration and an augmented degree of accountability to unqualified participants. This configuration is frequently employed by specialized service enterprises.

Enterprises incorporated overseas may secure their foothold within this nation through the establishment of agencies or subsidiaries.

A branch is a subdivision of a foreign conglomerate that functions according to its prescribed statutes, yet is not a discrete juridical person. Representation, often employed for promotional or emissary roles, its faculties are confined to specific undertakings, such as fostering commercial liaisons or endorsing offerings.

To institute a satellite branch in Bosnia and Herzegovina, the progenitor entity must proffer primordial manuscripts, an edict articulating the satellite's inception, and a mandate for custodian appointment. Registering an emissary outpost likewise necessitates an ordinance and managerial particulars.

To inaugurate a concern in Bosnia and Herzegovina, deliberate upon the undertaking’s magnitude, pecuniary exigencies, administrative convolution, and singular onus, which fluctuates contingent upon the juridical scaffolding and the intricacy of the concern.

Contact our specialists

How to set up a business in Bosnia and Herzegovina?

The establishment of a corporation in Bosnia and Herzegovina entails traversing numerous phases. This procedure necessitates a conscientious disposition, as various entities are engaged, each possessing distinct requisites and time constraints.

Stages of opening a company in Bosnia and Herzegovina:

- Opting for a business classification.

- Booking and inscribing a singular commercial appellation.

- Amassing foundational parchments.

- Presenting a petition and manuscripts for formalization.

- Incorporating particulars into Register of legal entities (upon registration).

Before you commence lodging, it is paramount to ascertain which category of juridical body is fitting for your commercial objectives. It should likewise be considered that enterprise incorporation in Bosnia and Herzegovina is executed in suitable establishments, such as local magistrates or tribunals at the locale of intended operations.

To inaugurate an establishment in Bosnia and Herzegovina, one must select a singular designation that does not correspond with those previously inscribed. The distinctiveness can be verified via regional archives or official registering bodies. The appellation must be selected in rigorous alignment with the stipulations of prevailing statutes. It should unequivocally and indubitably denote the purview of the endeavor, guaranteeing a precise comprehension of the firm’s delineation by prospective patrons, collaborators, and overseers.

To commence the protocol for instituting an enterprise in Bosnia and Herzegovina, one must compile a comprehensive assemblage of paperwork, encompassing:

- Delineating aims, structure, and operational methodologies.

- Determination on constitution of an establishment.

- Data on proprietors, comprising passport facsimiles.

- Verdict on manager or executive consortium nomination and qualifications.

- Appraisal of juridical abode of the entity within the state.

- Trustworthy guarantees, such as consignment of sanctioned patrimony or substantiation of solvency.

To inscribe a commercial confederation in Bosnia and Herzegovina, proffer a parchment to the territorial or prefectural clerical chancery for approbation. If sanctioned, the cabal shall obtain an enrollment decree, endowing it with prerogative. The procedure customarily endures a decem of diurnal spans, yet might protract owing to gubernatorial procrastinations or superadded scrutinizations. Bureaucratic demarcations’ jurisprudence might likewise impinge upon the span and idiosyncrasies.

Establish a corporation and ledger in Bosnia and Herzegovina

The post-enrollment stipulation in Bosnia and Herzegovina necessitates the inception of a mercantile codex for monetary dealings, given the nation's unwavering pecuniary framework and vigorous contention among fiduciary establishments.

A corporate account functions as the enterprise's primary pecuniary implement. Monies deposited into this account substantiate the fiscal solvency of the establishment and its capacity to discharge commitments to associates and personnel. A corporate account is indispensable to execute monetary operations, such as:

- Placing and administering pecuniary resources.

- Disbursement of dues, remunerations, levies, and other compulsory disbursements.

- Executing transnational remittances and safeguarding the legitimacy of dealings.

To inaugurate a proprietary ledger in Bosnia and Herzegovina, adhere to particular protocols and select a fitting pecuniary establishment. Autochthonous financiers proffer sundry amenities, encompassing transfrontier succor, pivotal for mercantile barter enterprises. Establishing an account in Bosnia and Herzegovina mandates the submission (the enumeration is partial):

- Constituent manuscripts.

- Resolutions on the designation of a director.

- Intelligence regarding proprietors and directors.

- Explications of the intended undertakings.

Registering a bank account in Bosnia and Herzegovina necessitates contemplating numerous determinants. Banks establish divergent tariffs and levies for managing accounts, executing transactions, and furnishing other pecuniary amenities. The expenditure for these provisions can fluctuate considerably contingent on the particular monetary establishment and account classification. Crucial determinants swaying the quantum of remunerations include the category of banking service and the provincial situs of the bank.

Moreover, banks frequently impose imposts on financial dealings. For instance, remittances of funds both domestically and abroad may incur disparate imposts based on the volume of the transfer, currency, intention of disbursement, and other considerations. It is prudent to contemplate dues for utilizing ATMs, which may differ depending on whether the ATM is incorporated within the bank's own consortium or a third-party entity.

A comparably pivotal facet when selecting a financial institution for inaugurating a commercial account in Bosnia and Herzegovina are exactions for the issuance and maintenance of bank cards. Contingent on the category of card, its rank (credit or debit), ancillary services (such as gratuity schemes, indemnity), levies can be considerable. In the event of credit cards, banks might impose exactions for utilizing the credit threshold and for extracting currency from ATMs.

The levy for transnational disbursements and monetary transmutation should be contemplated singularly, as these can diverge based on the establishment, disbursement modality, and specie. Furthermore, a monetary transmutation impost may ensue if the exchange entails specie interchange.

Image caption: some banks in Bosnia and Herzegovina working with international clients.

Business licensing

In Bosnia and Herzegovina, procuring permits is essential to execute specific undertakings pertaining to security, ecology, well-being, fiscal sphere, and sundry domains that wield considerable influence on the communal welfare. A few instances are delineated beneath.

Monetary establishments like banking houses, indemnity corporations, microfinance entities, and investment establishments are compelled to secure licenses from their corresponding overseers. To acquire a permit, enterprises must fulfill rigorous capital stipulations, unambiguous corporate stewardship, and adherence to anti-money laundering statutes.

Endeavors in the puissance domain also necessitate authorization. This pertains to the fabrication, dissemination, and vendition of electricity, prospection, and extraction. Authorization considers ecological stipulations and repercussions on indigenous populations.

Any pursuit pertaining to therapeutics, pharmacology, or wellness necessitates authorization by the Ministry of Health or its provincial subdivisions. Engaging in commerce within the tourism domain in Bosnia and Herzegovina mandates a permit, particularly when it pertains to:

- Assistance of excursion arrangers.

- Arrangement of itineraries.

- Supervision of lodging establishments or personal habitation venues.

Accreditation in this realm is aimed at ensuring the preeminence of stipulations and conformity to safeguard procedures.

Enterprises functioning within the edification sector are mandated to acquire permits for the conceptualization, erection, and utilization of property. Fundamental stipulations:

- Furnishing accredited undertakings and technical resolutions.

- Existence of adept personnel possessing pertinent credentials.

Enterprises furnishing telecommunication provisions or devising software must be authorized by national or provincial overseers.

For what activity? for a foreigner to open a company in Bosnia and Herzegovina?

Commencing an enterprise in Bosnia and Herzegovina unveils prospects for overseas industrialists in an array of domains.

The manufacturing sphere is augmenting and progressively amalgamating into worldwide provisioning systems. The nation's industrial substratum encompasses diverse domains, including mechanized fabrication, textiles, construction substances, and so forth. Enlisting a corporation in Bosnia and Herzegovina by a non-domiciliary is rather auspicious if one intends to engage in commerce within these fields. This serves as an avenue for those desiring to curtail production expenditures through economical workforce reserves and competitive terraqueous valuations.

In spite of agronomy's momentous input to the fiscal structure, its latent capacity remains far from depleted, notably in domains such as ecological and regenerative agriculture. State functionaries have intensified their endeavors to render augmented governmental and pecuniary assistance for hinterland infrastructural enhancement. Specific focus is directed towards ameliorating the thoroughfare system, as it assumes a pivotal function in supplying cultivators with requisite services and linking them to mercantile zones.

Agrarian refinement proffers supplementary prospects for industrial rejuvenation and fulfilling demand in both indigenous and global markets. For external financiers, this could present an advantageous occasion to inaugurate a plantation, establish an enterprise in Bosnia and Herzegovina to effectuate undertakings in the refinement of agrarian commodities or a nascent venture in the realm of organic cultivation.

Bosnia and Herzegovina is undergoing a cybernetic metamorphosis that is exerting a considerable influence on the fiscal domain, mercantile commerce, and administrative services. Information technology neophytes are flourishing within the nation, bolstered by burgeoning technological enclaves and nurseries. Eager innovators and fledgling professionals are in quest of prospects to forge information technology corporations in Bosnia and Herzegovina within domains such as software engineering, portable application creation, and web architecture.

The sustainable power domain is manifesting prospects as the nation endeavors to attain its ecological objectives on its journey to EU accession. There is an accelerated surge in capital infusion into solar and aeolian energy reservoirs. Nonetheless, hydroelectricity persists as the most auspicious trajectory within the realm of sustainable energy resources. Furthermore, abundant resource capability engenders prospects for the establishment of extractive corporations in Bosnia and Herzegovina.

Bosnia and Herzegovina's pivotal emplacement in the Balkans renders it a crucial nexus within the regional conveyance lattice. The nation's groundwork enhancement, encompassing thoroughfares, ironways, and nautical harbors, unveils prospects for commercial proliferation in freightage and transit endeavors.

Modernization of infrastructure serves as the cornerstone for enduring economic advancement in times ahead. Particular heed ought to be given to paramount undertakings in the realms of transport and energy, which unveil avenues for external financiers. Integrating public-private alliances into these undertakings may present a potent means of enticing capital and fostering the conditions for protracted investment.

The servile domain manifests considerable promise, particularly within the domain of tourism. In the past epochs, the nation has been evolving into a captivating excursionist locus that entices both wayfarers and mercantile financiers. Annually, the zeal for the cultural and terrestrial marvels of the locale burgeons, thereby fortifying the stature within the global theater.

Conducting commerce: levies and documentation

Bosnia and Herzegovina, comprising Republika Srpska and Brčko, imposes a 10% corporate impost and administers fiscal decrees at both sovereign and civic tiers. The standard VAT quota is 17%, and entities surpassing BAM 100,000 (USD 53,770) must enroll for VAT.

The nation has instituted toll-free mercantile enclaves to entice external investments, enabling effortless dispensation of assets, transferal of profits, and restitution of provisions. These enclaves are situated in Vogošča, Visoko, Herzegovina-Mostar, and Holc-Lukavac, all within the Federation. Brčko County is orchestrating its maiden Autonomous Exchange Enclave (AEE). Establishments within these enclaves are absolved from excise levies and customs exactions.

The retention levy is imposed at a proportion of 5% on dividends and 10% on interest, royalties, and sundry income, unless explicitly stated in the fiscal accord. Bosnia and Herzegovina maintains dual taxation compacts with 38 nations and bilateral capital accords with 40 nations. The retention levy rate enclave is 10%.

To inaugurate an enterprise in Bosnia and Herzegovina, all establishments must perennially amass pecuniary attestations that conform to the indigenous Ledger Decree and universal paradigms. Colossal and median-scale institutions are mandated to endure obligatory perquisition to ascertain the veracity of fiduciary particulars and engender credence among interested parties.

Registration of a company in Bosnia and Herzegovina by a foreigner: tax benefits

Inaugurating an enterprise in Bosnia and Herzegovina, it is paramount to observe that if an entity garners emoluments or proceeds from mercantile endeavors beyond the Confederation, the levy may be accounted for, yet the quantum ought not to surpass the sum transmitted within the Confederation.

Contributors possessing fabrication machinery apportionments surpassing 50% of the financial period's produce are absolved from imposts at a 30% proportion. Beneficiaries with an aggregate 20 million BAM (10.7 million USD) industrial dedication within the Confederation of Bosnia and Herzegovina across a quinquennial are pardoned from 50% of the excise for half a decade.

A Republika Srpska legal entity with foreign proceeds can mitigate its pecuniary encumbrance by subtracting the extrinsic exaction from the Republika Srpska resident's pecuniary encumbrance. Levying entities can diminish their taxable substratum by investing in manufacturing possessions within the Republika Srpska. Nevertheless, if possessions are dissipated prior to the ternary functional period, levyers relinquish the privilege and must disburse an amplified impost.

If a juridical person from Brčko Oblast procures income abroad and this income is subject to levies both in Brčko Oblast and in the origin polity, the excise remitted externally (either directly or via tertiary-party withholding) is abatable from the income tax within this territorial unit.

For expatriates desirous of establishing an enterprise, the authorities are devising patronage schemes. One such initiative is the FDI Stimulus Program. This scheme was conceived with the objective of alluring extrinsic capital into domains crucial for the advancement of the regional economy (manufacturing, agriculture, energy, tourism). To partake, one must tender a petition via the Ministry of External Commerce.

For those partaking in the scheme who infuse no less than BAM 50 million into priority sectors delineated by the state and generate a minimum of 30 employments, fiscal enticements are bestowed, encompassing exemption from revenue levies for a period extending to 5 years or diminished fiscal impositions on the importation of apparatus and machinery requisite for production.

An alternative assistance scheme conceived by the state for commercial collectives in Bosnia and Herzegovina – the Employment Remuneration Subsidy Scheme. This scheme seeks to bolster enterprises that facilitate the establishment of novel vocational prospects within the nation. To engage, aspirants must tender a petition to the pertinent governmental employment bureaus and furnish a comprehensive corporate blueprint accompanied by an estimate for the volume of roles generated. The scheme affords a stipend of up to 30% of a nascent worker’s wage throughout their inaugural annum of service, alongside an exemption from societal levies for the initial 12 months of the enterprise’s tenure.

Conclusion

Bosnia and Herzegovina proffers industrialists prospects to engage in enterprising endeavors within a vivacious commercial milieu. The progression of sectors such as leisure, therapeutics, and innovation intimates that corporate enrollment in Bosnia and Herzegovina may prove to be an advantageous undertaking for global industrialists.

For expatriates desiring to incorporate a firm in Sarajevo or other urban locales within this nation, fiscal solidity and an evolving juridical apparatus emerge as paramount considerations. Specifically, firm establishment in Sarajevo affords the opportunity to capitalize on the metropolis as the economic and bureaucratic nucleus of the nation, wherein the predominant state establishments, monetary bodies, and commercial infrastructure coalesce. An avant-garde statutory structure, emphasizing the safeguarding of entrepreneurial entitlements and the procurement of proficient labor, renders Bosnia and Herzegovina an esteemed preference among overseas capitalists.

Solicit assistance in the procedure of corporate establishment in Bosnia and Herzegovina, encompassing the selection of the most advantageous structural modality, compiling and tendering a compilation of paperwork, liaising with regional administrations, inaugurating financial accounts, and procuring authorizations and certifications, should they be necessary for specific domains of operation, can be executed by the experts of our establishment.

Audit and Accounting support

Audit and Accounting support