Opening an account in the Verifo payment system provides users with access to innovative financial instruments that allow them to effectively manage cash flows in an international environment, while minimizing financial risks. Verifo is an innovative financial services platform that provides a wide range of tools to optimize international business operations.

Opening an account with Verifo offers an integrated solution for cross-border payments and acquiring. Whether you are a small business or a large international corporation, Verifo provides a personalized approach that meets the high demands for reliability and efficiency in financial transactions.

The purport of this treatise is an examination of the operability of the Verifo remittance framework. The principal merits of the platform shall be deliberated, and it shall also be elucidated how to establish an account within the Verifo pecuniary system.

Open an account with Verifo: advantages of the payment system

Opening a dossier in the Lithuanian remittance scheme Verifo is a frugal method to obtain, remit, and govern worldwide disbursements. The pioneering Verifo framework endows patrons with the privilege to initiate and operate an IBAN fiscal dossier, facilitating the simplification of engaging in transnational pecuniary dealings. Owing to an unambiguous interface and mechanized mechanisms, the clientele is afforded the prospect to promptly commence acquiring remittances in any locale globally. Furthermore, initiating a corporate dossier in Verifo shall enable the utilization of an extensive array of remittance apparatus, encompassing SEPA and SWIFT transmissions.

The SWIFT apparatus furnishes the prerogative to execute transnational pecuniary remittances in an extensive array of fungible denominations (exceeding 35) at advantageous mercantile valuations, curtailing concomitant fiscal expenditures. This provision enables patrons to streamline their forex dealings and procure paramount advantages from global disbursements.

- Each transfer is protected by a multi-level security system regulated by the NBL.

- The remittance procedure has been streamlined to make all transfers fast.

- Tracked, same-day cross-border payments backed by real-time notifications.

The European Union Directives have established a consolidated juridical sphere for non-physical euro disbursements throughout the EU. The SEPA apparatus enables Verifo's clientele to effectuate cross-border remittances by fulfilling a disbursement instruction involving the beneficiary's bank account identification numeral, appellation, and transference sum.

- More than half a megaton of persons within the SEPA domain perform 120 megamillions of digital money transmissions each year.

- The fund dispatch ledger facilitates augmented scrutiny of ingress and egress fiscal activities.

- SEPA guidelines mitigate duties for intra-territorial exchanges, permitting economization of capital and assets.

Henceforth, to satiate the burgeoning demand for dependable and efficacious fiscal asset orchestration instruments, Verifo proffers its patrons a groundbreaking contrivance enabling perpetual surveillance and stewardship of pecuniary dealings for both natural persons and juridical entities.

Patrons possessing an extant account with Verifo may solicit the fabrication of a debit card, an integral constituent of the mobile application, endowing the beneficiary with copious prerogatives to execute pecuniary maneuvers. The mechanism ensures an elevated echelon of inviolability through the capability of instantaneous incapacitation and annulment of the card. A malleable framework of thresholds, stipulated by the patron singularly, facilitates the rationalization of expenditures. The planetary ambit of the remittance framework renders the card a quintessential apparatus for effectuating fiscal transactions.

Moreover, Verifo has devised a dependable and impregnable remuneration acquiescence framework that adheres to global information fortification stipulations within the pecuniary facilitation sector, enabling Commercial patrons to execute remittances with negligible perils of chicanery.

Opening an account in the Lithuanian payment system — Verifo solutions for business

To refine transnational remittance mechanisms and amplify the efficacy of pecuniary flux administration, commercial enterprises may avail themselves of a groundbreaking recourse — inaugurate a ledger in the Verifo pecuniary apparatus (Lithuania). This conduit endows its clientele with the prerogative to establish corporate ledgers facilitating instantaneous polycurrency remittances via the digital realm.

To embark upon juridical affiliations for effectuating disbursements, one must undertake the ensuing protocol:

- Submit a petition to inaugurate a transactional account within the Verifo remittance framework in accordance with delineated stipulations.

- Furnish a compendium of credentials to initiate the protocol for discerning and substantiating the patron's commercial repute, encompassing foundational manuscripts and attestations validating the legitimacy of the enterprise in execution.

- Procure entrée to an ethereal account following an affirmative adjudication concluding the authentication process.

The Verifo platform furnishes corporate entities with bespoke fiscal instruments that facilitate holistic asset administration, encompassing deposits, loan obligations, and investment portfolios. The provisions proffered afford an elevated degree of adaptability and are meticulously customized to the distinct exigencies of each patron.

In addition to SEPA and SWIFT remittances, a settlement system unlocks entrée to the Currency Cloud service. This represents a multi-currency vault, permitting instantaneous transnational transfers around the clock, thereby ensuring swift execution and dependability of disbursements. Patrons possess the latitude to conduct conversion transactions at advantageous rates by harnessing cutting-edge methodologies. The Currency Cloud platform sustains approximately 500 patrons across more than 180 territories.

- Absolute dominion over your multi currency ledger within the Verifo remittance framework, as well as the governance of transnational monetary streams at your prerogative.

- Remittance levies and schedules are lucid and unambiguous.

- You have the capacity to peruse instantaneous revisions and supervise pecuniary matters, exchanges, valuations, documentation, and additional features from a single ledger.

You can inaugurate a multi-monetary account with Verifo and relish all the boons of the Currency Cloud service. Here a compendium of currencies endorsed by Currency Cloud is accessible. Nevertheless, you ought to be cognizant of an array of limitations spanning diverse sectors, endeavors, and nations (follow the link).

Verifo provides a vast array of virtual commerce amenities via sophisticated transaction reception apparatuses such as Apple Pay, Google Pay, and JCB. These contrivances augment consumer assistance and comply with rigorous statutory stipulations for intangible remittances, safeguarding clientele cognition's circumspection.

The suggested service-oriented cooperation framework for the Verifo payment system’s operational ledger, followed by the amalgamation of this platform's API, entails furnishing patrons with a broad spectrum of fiscal mechanisms. The execution verification for the Merchant API ensures an enterprise's capacity to perform safeguarded and lucid pecuniary exchanges, encompassing the reception and processing of all varieties of payment solicitations. The platform affords apparatus for exhaustive surveillance of the payment status, the creation of intricate documentation, and proffers steadfast technical assistance.

To institute juridical associations with the platform and procure entry to its software interfaces, one must undergo the enrollment process on the internet gateway. Initiating a ledger with Verifo entails the submission of veracious particulars and validation of the electronic mail as a stipulation for ratifying a patron accord.

Upon triumphant inscription authentication, the participant may commence cultivating a computational instrument that amalgamates the Verifo API. They are allocated a probationary sphere to assay the efficacy of the contrived implement. Subsequent to triumphant fulfillment, the participant may deploy the Verifo API in accordance with the stipulatory accord.

Conditions for opening an account with Verifo for private clients

Verifo and System Check proffer adaptable account initiation and upkeep alternatives for overseas nationals, guaranteeing that fiscal hazards are attenuated amidst transnational remittances. Verifo furnishes safeguarding against deceptive endeavors and illicit exchanges, whereas System Check permits instantaneous multi-currency settlements.

|

Rates for provisions pertaining to individual accounts |

||

|

Standard |

Standard+ |

|

|

Initiation of an account |

For free |

49,99€ |

|

Account sustenance (monthly) |

1,99€ |

22,99€ |

|

Intra-account remittances |

For free |

|

|

Inbound SEPA |

For free |

0.1% (min. 2,49€) |

|

Outbound SEPA |

0,39€ |

0.1% (min. 4,99€) |

|

Inbound SWIFT |

0.20% (min. 5€) |

0.50%, (min. 15€) |

|

Outbound SWIFT |

0.50% (min. 20€) |

0.80% (min. 30€) |

|

Remittance verification |

15€ |

|

|

Report via Online Banking |

For free |

|

|

Charge for account balance retention |

0.30% |

0.50% |

Contact our specialists

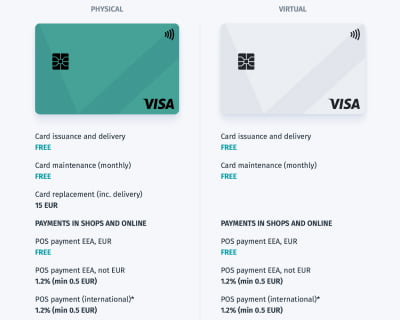

By opening an account in the Lithuanian payment system Verifo, customers have the right to order a physical or virtual card.

The disbursement of the payment token and its conveyance are without expense, and the mensal account upkeep is likewise gratis. However, in the event of forfeiture, impairment, or substitution, the patron is obliged to recompense 15 euros for the fabrication and conveyance expenditures.

|

VISA debit cards |

||

|

Disbursements in emporiums and on the web: |

Physical |

Virtual |

|

EEA POS payment, EUR |

For free |

|

|

POS-remittance EEA, not in euros |

1.2% (min. 0.5€) |

|

|

POS remittance (global) |

||

|

ATM fees: |

Physical |

Virtual |

|

Withdrawal of funds (EEA, Euro) |

1.5% (min. 1.25€) |

|

|

Repatriations (EEA, non-EUR) |

2.5% (min. 2.5€) |

|

|

Repatriation (global) |

||

How to open an account in the Verifo payment system (Lithuania)?

The distant initiation of accounts in payment mechanisms by international firms constitutes a pivotal progression in the evolution of contemporary banking. This procedure is accompanied by the necessity to adjust domestic statutes to the emergent circumstances of the virtual economy, to ascertain conformity with the axioms of KYC and AML. Corporate bodies desiring to utilize the service "distant account initiation in the Verifo payment apparatus" must be primed for an exhaustive scrutiny process.

The procedure for inaugurating an account within the Verifo remittance system has been fine-tuned with cognizance of contemporary paradigms in the sphere of fiscal technologies. Owing to the mechanization of pivotal procedures, patrons may establish an account expeditiously. The financial institution assures an elevated echelon of service and all-encompassing assistance.

To open an account in the Verifo payment system, a number of mandatory procedures are required:

- Fill out the form, indicating all the required information about the legal entity.

- Determine the type of account that corresponds to the purposes of conducting financial activities.

- Go through the verification procedure.

A requisite stipulation for a prosperous enrollment operation is the presence of an all-encompassing assortment of paperwork. Corporate patrons must tender the establishment’s foundational documents, particulars about the ultimate stakeholders, and a commercial blueprint containing an exhaustive delineation of the actions being executed. Allow us to remind you that the advent of virtual innovations has facilitated the complete mechanization of the Verifo account initiation sequence. Digitized documents with juridical potency ensure the swift conclusion of the operation.

The monetary establishment performs an exhaustive scrutiny of patron data prior to inaugurating an international currency account utilizing the Verifo remittance mechanism. They adhere to the Client Prudence Methodology to avert unlawful capital manipulation and may solicit supplementary particulars to forestall the legitimation of nefarious proceeds.

As a consequence of the prosperous fulfillment of the discernment and verification protocol, the patron attains the privilege to ingress their individual dossier. Allow us to reiterate that the Verifo service bundle furnished upon the initiation of a dossier encompasses the capacity to execute transmutation dealings with diverse denominations, amalgamation with extrinsic disbursement systems, and assistance in the procedure of configuring software to mechanize commercial operations.

To avoid any questions, contact relevant experts who will offer consulting services and support in the process of opening an account in the Verifo payment system.

Account for a company in the Verifo payment system — tariffs

Opening an account in the Lithuanian payment system Verifo offers corporate clients access to an optimized tariff structure that allows them to achieve significant savings.

|

Tariff plans |

|||

|

Standard |

Growth |

Pro |

|

|

Initiating a B2B ledger with Verifo |

For free |

200€ |

I am. 800€ |

|

Initiating a partitioned account |

350€ |

From 1500€ |

|

|

Monthly B2B ledger upkeep |

5€ |

50€ |

From €200 |

|

Intramural remittance |

For free |

1€ |

|

|

Incoming SEPA remittance |

For free |

0.01% (min. 1€) |

From 0.20% (min 5€) |

|

Outgoing SEPA remittance |

0,25€ |

0.05% (min. €) |

From 0.20% (min 5€) |

|

Incoming SWIFT transfer |

0.20% (min. 5€) |

0.25% (min. 7€) |

from 0.0% (min 15€) |

|

Outgoing SWIFT transfer |

0.50% (min. 20€) |

0.65% (min. 23€) |

From 0.80% (min 30€) |

|

Surplus levy |

No commission. |

0.15% |

|

|

Levy for maintaining account surplus |

0.30% |

0.50% |

0.80% |

Another available service is Verifo partnership agreement, which establishes mutually beneficial relationships between the company and individuals or legal entities (partners). According to the terms of the agreement, the partner receives the right to receive a percentage of the income received by the company as a result of attracting new clients.

The quantity of solicited associates and the extent of recompense accrued are unbound by any covenantal stipulations. The recompense quantum is no less than 20% of the expenditure for the ensuing amenities: inaugurating an account in Verifo (Lithuania), account custodianship, internal and SEPA transmissions. A 10% gratuity is allotted for SWIFT transmissions. An auxiliary surcharge to the entity's customary tariffs is liable to an impost of 50%.

The associate is vested with the entitlement to accrue a recompense for every patron who enlists in the Verifo system via an exclusive referral hyperlink bestowed upon the associate. One may acquaint oneself with additional provisions and requisites of the initiative follow the link.

In general, initiating an account in the Verifo monetary mechanism may be categorized as an efficacious method to streamline pecuniary currents for juridical persons involved in extramural commercial endeavors, as well as for individuals partaking in entrepreneurial undertakings without constituting a corporate body.

Conclusion

Verifo, an accredited digital currency dispenser overseen by the Principal Reserve of Lithuania, furnishes an extensive assortment of pecuniary services tailored to fulfill the requisites of transnational conglomerates. The establishment, utilizing avant-garde methodologies in the realm of global remittances, proffers its clientele with all-encompassing resolutions to streamline fiscal exchanges and amplify commercial efficacy.

One of the main advantages of Verifo is its tariff policy, which provides clients with transparency of all financial transactions, which allows to significantly minimize the costs of a business entity. The cost of international payments offered by this platform is significantly lower than bank tariffs, while the efficiency of transaction processing guarantees their execution in a short time.

Our company’s specialists offer specialized services for support of the procedure for opening an account for a foreign company in the Verifo payment system. Our experts have in-depth knowledge of international financial law and will provide comprehensive support to clients, ensuring compliance with all legal regulations and requirements for non-residents.

Liquidation of the company in Lithuania

Liquidation of the company in Lithuania  ICO in Lithuania

ICO in Lithuania  Open an account for a Lithuanian company

Open an account for a Lithuanian company  Supporting Investment Activities in Lithuania: From Planning to Protecting Investor Rights

Supporting Investment Activities in Lithuania: From Planning to Protecting Investor Rights