Opening an account with BCL Bank (Laos) — an effective solution for companies seeking to enter the Asian market or expand their presence in the region, in order to optimize cash flow management and strengthen their positions in this jurisdiction. In accordance with the principles of customer focus, this bank provides a differentiated approach to servicing by customer category, including individuals registered as individual entrepreneurs and legal entities classified as large corporations. Opening a corporate account with BCL Bank (Laos) provides clients with competitive advantages in foreign exchange transactions and financing for the implementation of foreign economic projects.

Bank for Foreign Trade Lao Public, inaugurated in 1975, stands as one of the preeminent state-controlled financial institutions within the Lao Republic. The institution boasts an expansive lattice of branches and operational entities spanning the whole expanse of the nation, and occupies a dominant stature in the execution of avant-garde technological infrastructures.

Establishing an account with BCEL in Laos is attainable for both indigenous and foreign individuals as well as juridical entities. The Bank furnishes a vast array of amenities, encompassing, yet not confined to, furnishing deposits, extending credit, inaugurating and maintaining letters of credit, issuing letters of guarantee, effectuating cash and settlement operations, executing foreign exchange dealings, issuing and overseeing debit and credit cards, alongside mobile and Internet banking provisions. The BCEL network is distinguished by the existence of 20 branches, 95 service locations, 10 currency exchange bureaux, and more than 100 correspondent banks globally, underscoring its paramount significance in the financial sphere.

This publication provides a comprehensive analysis process of opening a bank account at BCL Bank (Laos), including a detailed consideration of the legal regulation of this procedure, an analysis of the products and services offered by the bank, as well as a study of the bank’s tariff policy.

Opening an account with BCEL in Laos for corporate clients

Establishing a corporate account in Laos is an imperative undertaking for any enterprise aspiring to secure its position in the domestic market. BCL Bank (Laos), with its strategic upper hand in the locality, proffers an extensive array of fiscal services and offerings, encompassing bespoke financial resolutions meticulously crafted to meet the distinct demands of commercial establishments. BCL Bank extends a variety of account types, comprising operational and deposit accounts for both individuals and corporations, alongside exclusive accounts designed for transnational clientele.

Establishing a transactional ledger with BCL Bank (Laos) serves as a fiscal tool devised to regulate and enhance the solvency of account holders, affording the capacity to securely settle dues for commodities and provisions via drafts, which serves as a substitute for employing currency. This variety of account is appropriate for organizations involved in vigorous commerce or pursuing entrepreneurial undertakings marked by a continuous monetary circulation. Initiating a transactional ledger within Laos BCEL bank is attainable in the denominations of: Laotian kip (LAK), Thai baht (THB), and the American dollar (USD).

The minimum initial deposit and bank account balance must meet the established threshold equivalent to LAK 500,000 / USD 500 / THB 2,000 / CNY 100. For opening a current account in Laotian bank BCEL a fee of 10,000 LAK / 2 USD / 50 THB / 10 CNY is charged for each account and for each request. The cost of issuing a standard checkbook is 50,000 LAK / 7 USD / 220 THB / 50 CNY. The service of expedited checkbook issuance (with receipt on the day of application) is provided for an additional fee of 20,000 LAK / 3 USD / 90 THB / 20 CNY for each book. Account servicing is accompanied by a monthly deduction of a commission in the amount of 3,500 LAK / 0.5 USD / 16 THB / 5 CNY for each account. Each payment transaction requires the use of checks, and their validity is limited to 180 days from the date of order.

The deposit repository at BCL Bank (Laos) is most advantageous for patrons seeking protracted aggregation of capital to fulfill ephemeral pecuniary objectives. This particular repository offers the investor both expedience and efficacy in the process of amassing wealth to satisfy prospective necessities. The assets entrusted to the repository are preserved at a rate of return, the magnitude of which correlates directly to the quantum of endowments. Monetary units for inaugurating a repository for a corporation at BCL Bank (Laos) encompass LAK, THB, and USD.

This account is crafted for facile augmentation and adept administration of assets, while the investor is endowed with the ensuing privileges:

- Reckons lucre accruals tetrahedrally predicated on the pecuniary establishment’s usury quotient.

- Facilitates facile pecunious augmentation, abstraction, consignation, and metamorphosis at any BCEL chancery.

- Endows ingress to supplementary appurtenances such as cash dispensers, pecuniary drafts, Japan Credit Bureau vouchers, and Conjoined-Emblem certificates.

- Proffers unremitting hoard ingress via fiduciary automatons and esoteric consoles.

- Bestows plenary dominion over shekels and repository flux through telematic pecuniary frameworks.

International clients can receive deposit services. A deposit account concluded for a certain period is an investment instrument with a low level of risk, providing income in the form of a fixed interest charge, the amount of which is determined by the period of placement of funds chosen by the client. This product helps optimize financial planning for the long term. Open a deposit account in BCL Bank (Laos) preferred by clients who have free funds that are not intended for use at the current time.

The following deposit product options are available:

- Deposit account at BCL Bank (Laos) with a placement period of 6 months at an interest rate of 10.05% per annum.

- Deposit account with a placement period of 3 months at an interest rate of 9.52% per annum.

The least quantity for initiating a deposit account in BCL Bank (Laos) is 10 million bales. The utmost deposit sum is unbounded. The expiration date of the deposit account coincides with the date of complete restitution of the principal sum of the deposit and accumulated interest. There exists no stipulation for premature termination of a deposit account prior to the expiration date. Augmentation of the deposit account is feasible at any BCEL branch dispersed across the nation. Virtual deposit account augmentation is likewise attainable via the BCEL One platform.

The Institution, steered by the tenets of civic duty and aspiring to establish propitious circumstances for the cultivation of small and medium-sized enterprises, has devised particular crediting schemes: overdraft or recurring loans, customary commercial loans, and so on. Establish a diminutive enterprise account with BCL Bank (Laos), and micro and mid-sized ventures may solicit a loan to inaugurate entrepreneurial undertakings, augment extant enterprises, or as operational funds. Amongst other provisions, a credit facility is afforded with a stipulated interest rate of 3% per annum.

Proposal open a corporate bank account in BCEL (Laos) and receive a loan addressed to enterprises falling under the category of small, medium and retail businesses operating in the following sectors:

- Enterprises engaged in the production of various types of products, including, but not limited to, industrial production, consumer goods production, agricultural production, etc.

- Commercial organizations specializing in the purchase of agricultural products for the purpose of further supply of these products and export operations.

- Enterprises providing tourism services, whose activities are related to serving tourists and organizing tourist trips.

Conditions for opening an account with BCL Bank (Laos) and obtaining a credit limit include providing the bank with a valid Certificate of Registration of a legal entity, a copy of the business license, business and project documentation reflecting the strategy and expected results of operations, financial documentation that meets regulatory requirements and certified by the competent authority, additional documents confirming the legality and financial solvency of the enterprise.

Credit limit:

- Micro enterprises up to 2.5 billion kip.

- Small enterprises up to 4 billion kip.

- Medium enterprises up to 5 billion kip.

The disbursement sanction charge is 1% of the aggregate loan sum. The pledge evaluation levy is 0.2% of the total loan sum, but not exceeding 5 million kip. The credit duration is limited to no more than a decade. Repayment of the debt is executed considering the enterprise's monetary influx, in alignment with a bespoke repayment timetable. Entities seeking to establish a commercial account with BCL Bank in Laos may anticipate brief-, intermediate-, and protracted-term crediting.

|

Loans |

|||||

|

Short |

Medium term |

Long term |

With overdraft |

Cash |

|

|

Description |

Loan financing, scheduled to be repaid over a period not exceeding one year, is primarily aimed at ensuring the stability of cash flows and maintaining the liquidity of a business entity in a growth stage, in particular, to cover transaction costs such as the acquisition of raw materials, the purchase of equipment or the payment of wages to employees. |

A loan product, repayment of which is carried out over a period of one to five years, is intended to financially support the current activities of business entities aimed at maintaining and increasing current assets necessary for operating activities, including, but not limited to, the acquisition of raw materials, materials, equipment, payment of wages and other expenses associated with the production and sale of goods, work or services. |

A variety of pecuniary encumbrance that is payable within an interval exceeding five years. Acquiring a protracted-term credit furnishes a juridical person with ingress to operational capital, which may be employed to acquire immovable property, stockpiles, or apparatus utilized for the production of supplementary revenue. |

A loan agreement extension initiated by the lender provides the client with the opportunity to continue using loan funds in excess of the balance in his current account, within the limit set by the lender. This financial instrument, known as an overdraft, is primarily aimed at meeting working capital needs. Duration no more than 1 year. |

An indebted individual may procure a credit with a reimbursement duration of up to three lunations whilst anticipating the culmination of a disbursement or pecuniary exchange to resolve. |

|

Advantages of this type of lending |

Ensuring continuous liquidity during commercial transactions. Promptly attracting financing in order to satisfy client obligations for settlements and debt repayment. Flexible schedule for fulfilling loan obligations. |

Continuous maintenance of financial solvency during the implementation of activities. Expected increase in profitability through increased investment. Reduced interest rate, helping to minimize the debt burden. Differentiated payments (with a time interval, taking into account the dynamics of cash receipts from borrowers). |

Optimizing the capital structure by reducing the share of equity financing to ensure long-term investment commitments. Application of preferential interest rates. Differentiated distribution of payment obligations within established deadlines, determined by the dynamics of receipt of funds from borrowers. |

Borrowers have the right to withdraw funds in amounts exceeding those previously deposited into current accounts. Ensuring an increase in the company's current assets in order to maintain its financial liquidity and continuity of business activities. Application of a reduced interest rate, helping to reduce the debt burden and optimize financial obligations. |

Borrowers have the right to spend the provided financial resources until the debt is fully amortized. Optimization of financial flows in order to increase working capital volumes. Calculation of interest obligations is carried out on the basis of the actual amount of the principal debt, subject to reduction in each reporting period. The interest rate is characterized by a reduced level of financial burden. Fractional payments can be made within a specified time interval. |

|

Types of loans |

Cash advance, overdraft, revolving line of credit, etc. |

Fixed capital. |

|||

|

Currency |

LAK, USD, THB (contingent on the pecuniary unit of the debtor’s emolument). |

||||

|

Loan amount |

The supplicant's stipulations, the prospect of lucre augmentation, the surety's appraisal, and pecuniary institution tenets all exert influence. |

Zenith: LAK 500 myriad / USD 50 myriad / THB 1.2 myriad or contingent upon pecuniary institution deliberation |

The quantum of the pecuniary advance shan't surpass 85% of the supplicant's desiderata or the sum procured as restitution, albeit it might be loftier. |

||

One may also inaugurate a private account at BCL Bank (Laos) to procure a mortgage credit. The BCEL mortgage sum reaches up to 70% of the project valuation. This loan is dispensed for the acquisition of land, edifice, and refurbishment of a domicile. The utmost term of the loan commitment spans 10 years. Interest disbursements are computed in accordance with the quantity of pending indebtedness. Candidates must maintain a formal employment affiliation and possess the nationality of the Lao Republic.

Contact our specialists

Bank account for non-residents with BCL Bank in Laos: deposit and credit cards

Foreign applicants can open an account with BCL Bank (Laos) and a corporate Visa credit card. The card is equipped with standard EMV chip technology and supports contactless payment functions, providing strong security measures for transactions. The card limit can reach $50,000 or more. Online payments are protected using 3D Secure. Card users receive privileged access to waiting rooms and can take advantage of additional benefits under the terms of special offers.

One may procure a personal banking account at BCL Bank (Laos) and acquire a BCEL Visa Platinum — a bespoke financial instrument for executing operations to extract currency, remit payment for merchandise and services, both domestically and internationally, within the auspices of the global settlement network, VISA. The cardholder is granted a credit ceiling, the magnitude of which is determined by the issuing financial institution. Should the credit balance be fully reconciled within a leniency span of up to 45 calendar days from the initiation of the transaction, no surcharges are levied on the expended funds. The specified leniency period may fluctuate depending on the occurrence date of the transaction.

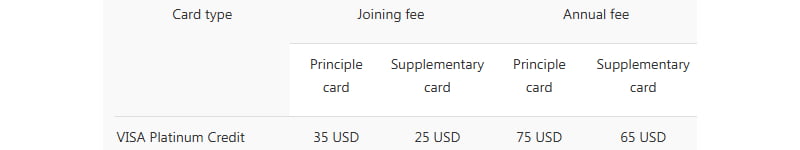

The cardholder has the right to make a partial payment of credit card debt, but the amount of such payment cannot be less than 10% of the total amount due on the credit card statement and cannot be less than $20.00. Credit limit for BCEL Visa Platinum card ≤ $100,000. Card fees are illustrated below.

Debit card VISA Platinum - pecuniary draft is a planetary e-remittance contrivance utilized for extricating pecuniary reserves or disbursing pecuniary obligations for commodities and amenities. It permits immediate pecuniary dispensation straight from a benefactor’s fiscal depository, with an uppermost boundary of $5,000 per pecuniary conveyance. To procure a Visa Platinum pecuniary draft, postulants must uphold a singular fiscal stronghold at BCL Bank, Laos.

Aloof prepaid virtual voucher BCEL Mastercard with the capability for balance augmentation. Candidates are entitled to solicit the voucher via the digital interface. An annual upkeep levy is nonexistent. The utmost augmentation sum per voucher per diurnal period oscillates between 10 and 5,000 United States dollars.

BCEL Co-Brand Credit Cards are UnionPay cards disseminated in collaboration between BCEL, Lao Airlines, and UnionPay. Presently, there exist three classifications of card commodities, encompassing BCEL Co-Brand Platinum, BCEL Co-Brand Aurum Sky (in dual variants: insured and non-insured), BCEL Co-Brand Argent Cloud. The credit thresholds assigned to these commodities are as delineated below:

- for BCEL Co-Brand Platinum - from USD 30,001 and above;

- for BCEL Co-Brand Gold Sky - from 10,001 to 30,000 US dollars;

- for BCEL Co-Brand Silver Cloud - from 300 to 10,000 US dollars.

You can familiarize yourself with other options for using deposit and credit cards follow the link. Opening an account with BCL Bank (Laos) for non-residents gives the right to use funds transfer services from South Korea to Laos. The transfer can be made using the BCEL One mobile application, which operates around the clock. To make a transfer, the following conditions must be met:

- Having an account in the BCEL system, as well as an account in the BCEL One application and a bank account in South Korea.

- Maximum transfer amount not exceeding US$5,000 per transaction, with an annual limit of US$50,000.

- Funds are credited instantly, both in kip and in US dollars.

- The transfer processing fee is 5,000 Korean won (KRW), which is equivalent to approximately US$4 for each transaction, regardless of the amount.

It is conceivable to effectuate receiving international transfers via SWIFT in multitudinous denominations, encompassing USD, THB, AUD, EUR, SGD, HKD, AUD, and others. An individual possessing an account in BCEL (Laos) may acquire monetary remittance from Chinese financial institutions via the Border Trade E-bank network, tailored for RMB disbursement. Patrons may avail themselves of the provision at any BCEL locales or service outposts nationwide.

MoneyGram is a transnational mechanism for expeditious pecuniary remittances betwixt individuals, affording the capability to dispatch and obtain funds in consonance with the stipulations of convenience, efficacy, and safekeeping. Acquiring capital is feasible sans remitting a levy. Non-native individuals are obligated to possess a legitimate passport with a visa, save for nationals of ASEAN confederation states and sundry territories excused from visa enrollment mandates pursuant to pertinent accords.

Transfer of funds (for regular customers) is carried out on the following tariff conditions:

- Salary 15 000 LAK / 60 THB / 2 USD.

- If the amount of a cash transfer exceeds LAK 20,000,000, the commission increases by 0.05% of the total transfer amount.

- The minimum commission amount is 15,000 LAK / 2 USD / 60 THB per transaction.

- The maximum commission limit is LAK 200,000 / USD 25 / THB 700 per transaction.

Registering an account with BCL Bank (Laos): financial liquidity services for international trade transactions

Applicants aspiring to inaugurate a commercial account with BCL Bank in Laos possess the entitlement to petition for an array of pecuniary provisions pertaining to trade finance, in consonance with the stipulations enshrined in the prevailing statutes and ordinances of the bank. These provisions encompass import-export facilitation, letters of indemnity, and the option to engage with the bullion exchange service.

|

Import services |

Export services |

|

|

|

Letter of guarantee |

Gold Trading Service |

|

Gold Trading Service is one of the specialized services provided by BCEL to help investors profit from fluctuations in gold prices in global markets. The advantages of this service include the absence of restrictions on the volume, number and duration of holding orders, and the absence of fees for holding assets. The terms of service include mandatory opening an account with BCEL, such as a savings or checking account. Additionally required to open a specialized Gold Trading Account with BCEL. After completing these procedures, BCEL issues an individual security code consisting of 10 digits, which is required to authorize each trading order. Transaction fees are $35 per transaction. |

How to open an account in BCL Bank (Laos) and use electronic banking services?

BCL Bank in Laos permits expatriates to inaugurate a pecuniary ledger via the OnePay mechanism, facilitates recompense via the PromptPay QR enigma. This apparatus is acknowledged by multitudinous tradespeople and is employed by alternative fiscal establishments such as Bangkok Bank, Bank of Ayudhya, Kasikorn Bank, and Krungthai Bank.

BCEL Bank proffers a digital trust-based service enabling patrons to remotely oversee their banking tomes and fiscal assets. To avail oneself of this service, a deposit and transactional ledger is necessitated. FastTrack permits clientele to instigate fiscal remittance requisitions through the BCEL One online-based interface, obtainable on the App Store, Google Play Store, and App Gallery repositories.

Establish a ledger with BCEL in Laos via the digital medium, appropriate for commercial entities aspiring to vend their wares or offerings via a cyberspace interface with perpetual accessibility; proprietors eager to broaden their ventures into transnational domains; corporations desiring to guarantee a fortified procedure for receiving remittances from cards through their online portal; institutions possessing a webpage and intending to initiate e-commerce utilities. BCL Bank is the inaugural financial institution in Laos to be duly authorized to proffer online disbursement alternatives.

We offer a wide range of online payment solutions, including:

- Receiving remittances via BCEL ATM terminals accommodating UnionPay, Visa, MasterCard, JCB, American Express, and China UnionPay International cards.

- Capability for settlement through Chinese QR codes such as Alipay, WeChatPay, and UnionPay QR.

- E-commerce facilitation via the Onepay platform.

- Guaranteeing remittance security by adhering to global safety protocols, encompassing 3D Secure, MasterCard SecureCode, Verified by Visa J/Secure, and Amex SafeKey mechanisms.

- Endorsement of multi-currency transactions.

BCEL acquiesces plastic tenders and cryptographic matrices for remittance, with transmutation levies commencing at 3% and a 1.5% exaction for cryptographic matrix disbursements. The pecuniary obligation oscillates contingent on the fiduciary facilitator and cryptographic emblem. Sustentation expenditures amount to $45 per lunation.

BCL Bank, in its activities, complies with the requirements of all applicable regulations, including, but not limited to, legislation on banking, personal data protection and combating fraud and financial crimes. The Bank also ensures compliance with internal regulations aimed at ensuring the security and confidentiality of customer transactions. Below is the process of opening an account at BCL Bank (Laos).

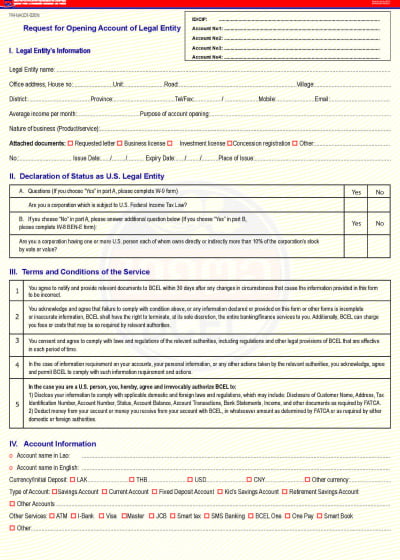

At the initial stage of opening a bank account at BCL Bank the client must decide on the type of account: current, deposit or savings. An integral part of the process is the preparation of a complete package of documentation. For opening an account in Laotian bank BCL Bank a corporate client is required to undergo a comprehensive identification procedure, which includes providing a full list of constituent documents and conducting a legal verification of beneficial owners. A legal entity is required to provide detailed information about the types and scope of its economic activities.

Application form for opening an account for a company in BCL Bank.

To inaugurate a banking ledger with BCL Bank (Laos) for commercial purposes, one must tender duly ratified corporate records, along with supplementary documents stipulated by in-house banking protocols. Commencing an account with BCL Bank (Laos) for non-domiciled individuals mandates adherence to augmented identification protocols, encompassing documentary verification of lawful sojourn within the nation, the objective of account inscription, and the provenance of capital.

Submission of a complete package of documentation, drawn up in accordance with the requirements of current legislation, is carried out by personal appearance at a bank branch or through remote banking systems, including mobile and Internet banking. The bank, in turn, verifies the provided documents for their compliance with the norms of current legislation, internal banking regulations and procedures.

Timeframes for inaugurating an account at BCL Bank (Laos), contingent upon the standing of the client, are determined based on an exhaustive scrutiny of the papers provided by the client, in harmony with the provisions of Lao financial statutes, inclusive of the stipulations governing client verification. Ordinarily, for natural persons, inaugurating a current account with BCL Bank (Laos) demands up to one week. For juridical entities, particularly those foreign, this procedure may span several weeks owing to the necessity of performing thorough due diligence and client identification in consonance with AML/KYC protocols.

Based on the results of due diligence, the client is notified by an official letter of a positive decision regarding his application to open an account. This document contains bank details and a full list of banking services available to the client, including the possibility of remote account management using modern digital technologies. For legal entities opening corporate accounts with BCL Bank, you have the opportunity to take advantage of additional products and services, such as integration with accounting systems and issuance of corporate payment cards.

Conclusion

Bank accounts in Laos BCEL offer entrepreneurs basic current accounts, specialized deposit accounts, and credit lines that meet the needs of business entities of various profiles. Opening an account with BCEL, both for individuals and legal entities, is associated with a number of legal nuances that require special knowledge and experience. To optimize the procedure, it is recommended to seek help from professional experts.

Our team of highly qualified experts has knowledge of the legal aspects and formalities governing the registration and administration of accounts in banking institutions in Laos. We are ready to provide comprehensive advice on all legal nuances, and provide support in the process of opening an account at BCL Bank (Laos).

Registering a company in Laos

Registering a company in Laos  Open a corporate account in Laos

Open a corporate account in Laos