Cryptocurrencies have become a so-called sensation. Virtual technology these days is hard to surprise someone with. One of the technologies of the future is thought to be blockchain technology. Numerous experts believe that this technology has the potential to advance cybersecurity and enhance many aspects of corporate operations.

The interest of individuals in cryptocurrency has sharply increased over the past years. This industry is constantly evolving. More and more private individuals and companies have started to wonder how to create a cryptocurrency. This article presents information on the key legal aspects of virtual currency creation, as well as the importance of legal support for crypto startups.

What is blockchain?

The initial step entails grasping the very concept: what is blockchain technology? It is a contemporary technology whose popularity burgeons by the day alongside the escalating demand for cryptocurrency. Literally translated as "chain of blocks", its primary distinction from conventional databases lies in its immutability; information cannot be altered or entirely eradicated from the database. Blockchain technology operates on a distributed ledger principle: even if one link falls out of the communal transaction chain, data pertaining to it remains stored on devices and computers of other independent users.

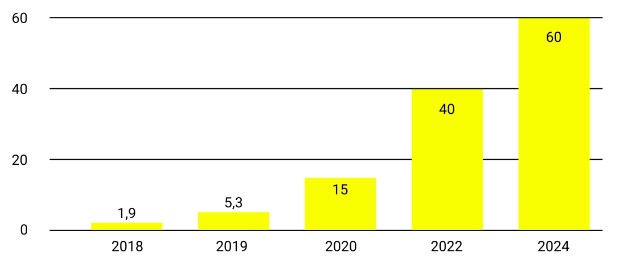

As for investments in this sphere, their volume in the global market is increasing every year, and by 2024, a growth in investments of more than 200% per annum is expected, indicating the profitability and prospects of the project. The diagram below demonstrates the trends in blockchain development.

What is cryptocurrency?

Cryptocurrency is a decentralized, digital, encrypted method of payment. Unlike the US currency or the euro, the value of cryptocurrencies is not controlled or guaranteed by a single organization. Rather, these assignments are dispersed broadly throughout the Internet among users of virtual money. Anonymity, decentralization, and security are key characteristics. As of today, the number of cryptocurrencies is 9,941 (Investing.com source), and their number continues to grow. All the aforementioned information prompts companies and individuals to perceive the advantages of blockchain and contemplate creating their own cryptocurrency.

Cryptocurrency trends in 2023 and their consolidation and development in 2024

The year 2023 in the cryptocurrency sector was marked by bullrun market expectations, associated with the impending approval by the SEC of a spot Bitcoin ETF and, of course, the eagerly anticipated Bitcoin halving in April 2024.

Apart from these events, other compelling trends have emerged that are reshaping and fortifying the industry, specifically:

- Ordinal tokens represent a numeration system assigning a unique serial number (ordinal) to each satoshi and tracking its movements during transactions (satoshi being the smallest indivisible unit of Bitcoin, equal to 0.00000001 BTC).

- BRC-20 is an experimental token standard on the BTC blockchain, created in March 2023. BRC-20 signs satoshis with JSON (JavaScript Object Notation) data, making the token (Ordinals) suitable for deployment, minting, and transfers. The BRC-20 ecosystem significantly lags behind the Ethereum ecosystem and its ERC-20 standard, and also has minimal functionality as it does not support smart contracts. However, these two standards differ in market capitalization. As of mid-May 2023, the BRC-20 market approached $450 million, while ERC-20 tokens significantly exceeded the mark by only $150 billion.

- The profound integration of AI and cryptocurrencies unveils novel prospects for trade automation, prognostic analytics, and data governance.

- SocialFi, an abbreviation for "social finance", represents the convergence of DeFi and social networks. This domain, where the social potential of blockchain applications integrates with financial mechanisms, showed significant progress in 2023 and continues to grow to this day."

- Acceleration of Ethereum price growth. It is anticipated that in 2024, Ethereum will demonstrate a significant increase in price, potentially doubling, attributed to the forthcoming critical update known as EIP-4844, expected in the latter half of the year, which aims to increase network throughput to 100,000 transactions per second and reduce transaction costs by 90%, rendering the network more accessible to a broad audience and incentivizing its adoption.

- The evolution of stablecoins: in 2023, JP Morgan announced an enhanced platform for tokenized payments; PayPal launched its stablecoin, and Visa expanded its capabilities for settlements in stablecoins. These developments reinforce an optimistic forecast for stablecoins in 2024, with the Bitwise Investments report for Q1 2024 predicting they will surpass Visa in transaction volume.

These crypto trends provide sufficient impetus to contemplate launching our own crypto project. Our consultants will gladly assist you in navigating the intricacies and nuances of this process. Beyond the launch of a prospective cryptocurrency in 2024, attention must primarily be directed towards the technical and legal aspects of the project. Implementation methods of such technologies in business necessitate contemporary and legally sound solutions. The aid of experienced legal counsel is paramount in the initial stages to precisely delineate potential legal risks and understand the legal boundaries within which the crypto startup will operate. In essence, legal support for cryptocurrency startups will facilitate the proper, legally compliant launch of the corresponding project, particularly considering that in most countries, cryptocurrency regulation is either partially implemented or entirely absent.

Advantages of cryptocurrencies

Cryptocurrency is a "hot topic". If you are considering launching a cryptocurrency, you may be interested in the benefits provided by virtual currencies. The advantages of cryptocurrency are as follows:

- Decentralization. The primary argument in favor of cryptocurrencies lies in the blockchain technology underpinning them. This renders cryptocurrency independent of authorities, with no entity able to dictate rules to developers and currency holders. Swift and unrestricted transactions. Processing and settlement of fiat currency transactions sometimes necessitate significant time. Cryptocurrency enables an unlimited number of transactions to be conducted and practically instantly transmitted to any individual possessing a crypto wallet, anywhere in the world.

- Low fees for transfers (or in some cases, no fees at all). Banks and other financial institutions may impose relatively high fees for transactions. This does not imply that no commission should be paid for cryptocurrency operations. However, the amount to be paid is relatively small.

- Global scale. The sender and receiver of funds may be located in different parts of the world and still engage in cryptocurrency exchange. Savings can be achieved on currency conversion.

- Transparency. Thanks to the distributed nature of the blockchain, each transaction is recorded and immutable.

All of the above can compel companies to more earnestly contemplate the launch of their own cryptocurrency.

How to create a new cryptocurrency?

The most crucial aspect to determine when launching a new cryptocurrency is selecting a suitable jurisdiction for the project. Currently, governmental regulation of cryptocurrencies is in its infancy in most countries. Essentially, consulting with an expert in this field is advisable, as legal counsel for cryptocurrency launch facilitates not only the proper structuring of processes from a legal perspective but also ensures the successful licensing and approval procedures with relevant authorities.

You should be aware that such products require licensing, and legal support is indispensable in this regard. Obtaining a crypto license in certain countries is a pivotal requirement for conducting legitimate operations. Additionally, drafting a White Paper, which serves as a document precisely delineating what the currency can offer or how you can enhance established processes through your currency, is crucial. This document must be informative and comprehensive.

Regulation of the cryptocurrency market in different countries

Legislators worldwide are endeavoring to discern how to establish laws and guiding principles to render cryptocurrency safer for investors and less enticing for cybercriminals. Legal regulation of cryptocurrencies stands as one of the paramount concerns within the global crypto industry. For instance, in September, China declared all transactions involving virtual currency within the nation as illegal, effectively impeding any cryptocurrency-related activities within the country.

In turn, the Chairman of the Federal Reserve System in the United States recently stated that he has "no intentions" to prohibit cryptocurrency in the States.

New regulatory measures in various countries regarding cryptocurrency activities may streamline the detection of tax evasion instances and facilitate accurate reporting of such transactions, ultimately providing investors with greater confidence in cryptocurrency.

As different jurisdictions progress at varying paces in implementing legislative norms regulating virtual currencies, comprehensive legal support for a crypto startup plays a pivotal role. Specialized professionals possess the requisite knowledge across diverse legal domains and stand ready to assist interested parties in creating a cryptocurrency in compliance with all requirements of the selected jurisdiction's legislation. Another characteristic feature necessitating legal support for crypto startups in Europe, Asia, and other regions is that supervisory authorities in each jurisdiction have their own perspectives on specific projects. This aspect must be taken into account when launching a blockchain project.

Crypto-friendly countries

Interested parties in launching a cryptocurrency in 2024 often ponder over which countries' laws are most conducive to such endeavors. Representatives of YB Case provide legal support for cryptocurrency startup launches in Europe, assisting in navigating the legislative intricacies of crypto projects. Among the countries that have embraced cryptocurrency and developed legislation to regulate transactions involving digital currencies, Estonia, Georgia, Portugal, Switzerland, Malta, and the United Kingdom stand out.

Estonia has enacted numerous laws and resolutions enabling blockchain proponents to engage in cryptocurrency-related activities. Estonia was the first country to implement an e-residency program based on blockchain. The nation has positioned itself as a leading state in blockchain technology. This exemplifies how developing countries can significantly leverage the advantages provided by new technology.

Lithuania's regulatory bodies are making significant efforts to keep pace with their Estonian counterparts in terms of new financial instruments. Now, businesses from within or outside the EU can apply for a cryptocurrency license issued by the regulatory authorities of the Republic of Lithuania. Many banks in the country are becoming crypto-friendly, so once you obtain all the necessary permits to be able to convert fiat to cryptocurrency and vice versa, you will be able to open an account for a crypto company in Lithuania.

Georgia ranks among the world's top countries embracing cryptocurrencies, with no legislative restrictions on virtual currency exchange. Furthermore, licenses for crypto activities in Georgia are not mandatory for conducting lawful operations. The government ensures tax certainty for registering cryptocurrency businesses. Additionally, there are banks where you can open an account for a crypto company.

In Portugal, tax authorities have opted to adopt a favorable stance towards investments in cryptocurrency. It is known that Portuguese legislation is cryptocurrency-friendly. Individuals in Portugal deriving profits from the buying and selling of cryptocurrency are not subject to capital gains tax. Furthermore, the exchange of cryptocurrency for another currency is not subject to tax. In simpler terms, individual investors interested in launching their own cryptocurrency may consider Portugal due to its advantageous tax position.

Switzerland is renowned for its favorable regulatory stance towards crypto investors. However, the unique system of regions, known as cantons, significantly influences regulation. Each of the 26 cantons has its own legal definitions and requirements regarding cryptocurrency transactions. Taxation rules may vary within each canton. At the cantonal level, Switzerland remains one of the most open jurisdictions for launching cryptocurrencies.

Alongside Switzerland, Malta establishes clear and concise definitions of cryptocurrency, ICOs, and blockchain. Maltese policy fosters the growth and development of the cryptocurrency market. Establishing a company in Malta to engage in cryptocurrency activities is not as daunting as it may initially appear. The country has implemented the Digital Innovation Act. However, creating a cryptocurrency independently without industry knowledge and an understanding of the legislative environment is challenging. Therefore, it is prudent to seek legal assistance for cryptocurrency startup endeavors in Malta from qualified attorneys.

The United Kingdom holds the second position in the number of blockchain startups within the industry. Local authorities have planned to enhance the regulations concerning financial services with proper implementation of blockchain technology. In August 2016, the government launched the "Blockchain as a Service" (BaaS) technology under the "Innovate UK" program.

Investments in ICOs in the United Kingdom have surged by 300% over the past few years. Brexit has spurred the British government to more actively support the London blockchain ecosystem to offset missed opportunities in the traditional financial services industry. The UK's cryptocurrency target group is focused on regulating and fostering the growth of virtual currencies in the country.

Launching its own cryptocurrency in 2024 in Asia

Singapore is renowned as one of the most stable and advanced economies globally and as a hub for financial technology in Southeast Asia. Monetary and credit management contends that innovation cannot be stifled, while the cryptocurrency ecosystem must be regulated to prevent money laundering and other illicit activities. Such a regulatory stance has positioned Singapore as a balanced legislative environment for cryptocurrency startups, attracting numerous interested parties in launching cryptocurrencies.

The Payment Services Act 2019 establishes clear regulatory requirements to prevent illicit activities and equalizes the growth environment for cryptocurrencies. Cryptocurrencies are also exempt from capital gains tax here.

Japan boasts a flourishing crypto-industry, having emerged as one of the pioneering and few nations to formally recognize cryptocurrency within its legal framework. The Financial Services Agency is actively engaged in crafting regulatory frameworks for cryptocurrencies in Japan. As a forefront technological nation, Japan leads the pack with 16 of the largest cryptocurrency exchanges domiciled within its borders having obtained approval to establish self-regulatory bodies, heralding auspicious prospects for cryptocurrency-adapted businesses.

When it comes to blockchain implementation, the UAE stands out as one of the conducive jurisdictions. Since 2016, the Emirates have embarked on developing their own cryptocurrencies and are now on the brink of enacting pertinent regulatory frameworks at the legislative level. Consequently, many startups and investors perceive the UAE as a favorable ecosystem for launching a new cryptocurrency.

Crypto industry in the USA

The United States accounts for over 40% of the entire blockchain startup market, establishing itself as a major player in the blockchain and cryptocurrency ecosystem. States such as Montana and Texas are regarded as the most conducive to launching cryptocurrency startups.

Cryptocurrency launch in Australia

Australia is a progressive jurisdiction in the realm of cryptocurrency industry development, aiming to emerge as a hub for innovative blockchain technologies.

Cryptocurrency in Australia is considered as one of the potential modalities for conducting payments. Accordingly, transactions involving virtual currency are subject to standard taxation regulations (corporate income tax and profit tax) with the exception of VAT. In August 2017, the government introduced a bill on cryptocurrency regulation in Australia.

Furthermore, in this country, over the past few years, new banking service opportunities have emerged for cryptocurrency companies and crypto traders.

Support for cryptocurrency launch projects

Legal consulting services for crypto projects include full support at every level, from consultation to the creation of pertinent documentation and the representation of the client's interests during coordination with authorized bodies. These services are not restricted to the accomplishment of particular tasks for the client.

At the initial stage, legal support for a cryptocurrency launch project consists of providing:

- General consultations on choosing a jurisdiction to launch a crypto project.

- Analysis of the regulatory environment in different countries.

- Assistance in developing draft documents for launching cryptocurrency (including White Paper).

- Consultations regarding the legality of launching crowdfunding in a particular jurisdiction.

- Support in obtaining licenses for crypto activities.

- Consulting on current legal environment changes for regulating digital currencies across various countries.

Conclusion

While long-term predictions for the crypto industry remain elusive, observing the shifts occurring in the world of cryptocurrencies today allows for a better understanding of this market, enabling the formulation of forecasts for those interested in launching a cryptocurrency in 2024. Despite the impossibility of precise forecasts, we are prepared to assist with the launch of your own cryptocurrency, focusing attention on trends in the crypto industry.