A banking license in Serbia would be of interest to fiscal firms thinking about growing in South-Eastern Europe. Serbia is distinguished by its stable economic growth rates and advantageous regulatory framework. Nevertheless, acquiring a banking license in Serbia necessitates not just a calculated approach but also evidence of sound fiscal standing and adherence to legal requirements.

The National Bank (NBS) overseas bank licensing in Serbia. The regulator verifies that banks are adhering to corporate governance norms before granting them licenses, and it enforces stringent requirements for the establishment of efficient internal control, audit, and monitoring systems. Businesses must put in place thorough systems for keeping an eye on their operations, guaranteeing that management choices are transparent, and adhering to global regulatory requirements.

The aforementioned steps boost trust in the nation's fiscal system overall and guarantee dependable protection of customers' money. These steps improve the banking industry's sustainability and transparency, which boosts speculations, advances the opulence, and solidifies Serbia's standing in the global fiscal community.

Regulation of banking activities in Serbia

The statute on Banks (Official Gazette of the RS, No. 107/2005, 91/2010, and 14/2015) and the Regulation on its implementation, which went into effect in 2015, govern the opening of banks and the acquisition of banking licenses in Serbia. Regulations pertaining to bank establishment procedures, management structures, banking activities, restructuring, and liquidation procedures are among the requirements for acquiring a banking license in Serbia. The National Bank of Serbia's supervision responsibilities are outlined in the statute.

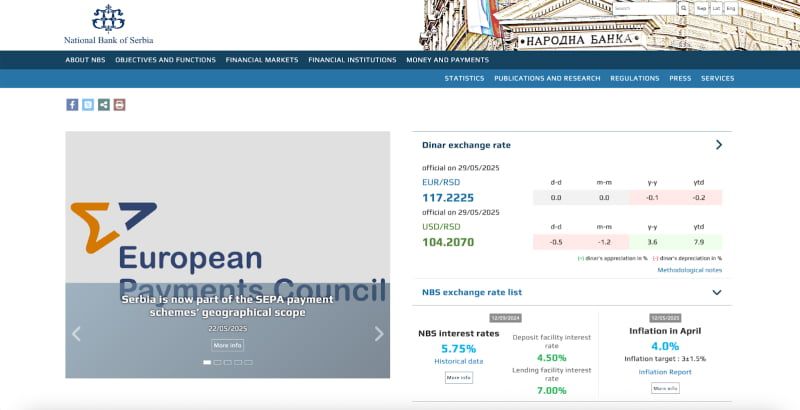

Official website of the National Bank of the Republic of Serbia

The body in charge of supervision is in charge of keeping an eye on the solidness of outside trade exchanges, carrying out fiscal and remote trade approach measures, and making beyond any doubt that cost solidness and a solid budgetary position are to and kept up. Not as it were, monetary teachers have to take after the statute, but they moreover have to take after the regulator's counsel on things like hazard administration, capital prerequisites, detailing and bookkeeping benchmarks, and divulgence rules.

Along with the NBS, other vital keeping money bunches incorporate the Securities Commission, the Office for the Avoidance of Unlawful Exchanges, and the Affiliation of Serbian Banks. The AML/CTF statute is implemented by the Office for the Anticipation of Illegal Exchanges, whereas the Securities Commission is in charge of making sure that capital mercantiles work securely. As the voice of their individuals, the Affiliation of Serbian Banks works to progress and harmonize bank operations and advance their common goals.

Since Serbia needs to connect the EU, the National Bank is still putting a part of exertion into making beyond any doubt that the country's money related rules are in line with EU rules. In expansion to attempting to take after the Dissolvability II Order in the protection industry, Serbia sticks to EU rules and proceeds to utilize Basel III measures as they are reexamined and put into put at the EU level.

Obtaining a bank license in Serbia: stages

The Law on Banks, the Law on Companies, the National Bank of the Country's statutory, and other bylaws pertaining to licensing, corporate governance, conformance with minimum authorized capital standards, and conformance procedures are just a few of the statutes that govern the multi-stage process of opening a bank in Serbia. The primary procedures for obtaining a banking license in Serbia are listed below.

A legal entity's registration

Before anything else, the bank needs to officially register as a legal organization in Serbia. The whole registration process can be done in a few weeks. After the process is done, the bank will be added to the Unified National Register.

Giving initial permission

In Serbia, the first stage in getting a bank license is to get a temporary permit. The NBS will only accept the application if it comes with the following set of indentures:

A business plan that includes calculations, a strategy, and a description of how the bank will work in the future; a list of all the important management and control mechanisms that make up the bank's structure; and a list of the owners and investors who attest to their business reputation and solvency.

The application is looked at within ninety days. The regulator checks to see if everyone is following all the rules, from the minimal amount of money to the initiators' business repute. The NBS can refuse the request or ask for more information if they find any differences.

Obtaining a banking license in Serbia

The final step is to obtain an operating license for a National Bank. Prerequisites for applying for a license include a legal entity's state registration, the creation and full payment of authorized capital in the designated amount, the approval of the management structure and the appointment of qualified managers, and the implementation of internal procedures and systems that comply with AML/CTF, risk management, internal control, and information security statutory.

When applying for a bank license, the following indentures must be submitted to the Serbian regulator:

- confirmation of the original capital contribution; indentures confirming the availability of suitable space and the fulfillment of the operational and technical prerequisites for the establishment of a bank;

- confirmation that an external auditor has been hired;

- information on human resources and the management group.

A bank's introductory authorization is great for 60 days after it is issued. To get a last minute money permit, the candidate must convey the entirety of documentation to the authorized company some time before the due date. If the due date is missed, the temporary allow will immediately lose its legitimate specialist. By doing this, the controller won't have to make a moment choice. Any already recorded reports or choices will be regarded as void, and the candidate will have to yield an unused preparatory authorization application if the due date is missed. The permit preparation may require to be totally revamped as a result. The permit application that was recorded inside 30 days of the enrollment date is surveyed by the National Bank. When choosing whether or not to give a permit to a person, the assessment comes about.

In understanding Serbian statute, banks that do not meet permit prerequisites and due dates hazard punishments. After the permit for the movement in address has been authoritatively gotten, the constituent assembly must put inside thirty calendar days. The overseeing body must look at and favor each choice and report that is made and marked at this assembly. After the related acts are submitted for assessment and endorsement, the controller has sixty days to wrap up the survey and decision-making preparation.

Requirements for obtaining a banking license in Serbia

Getting a license to run a bank in Serbia requires adhering to the regulations on the pioneers' composition and the first amount of capital permitted. The Republic of Serbia's banking activities licensing procedure includes a comprehensive evaluation of the management's commercial soundness. The stringent selection criteria established by legislation include the availability of specialized education, work experience, a clean criminal record, and other elements that impact their capacity to manage the school.

The bank's capital structure comprises Level I capital, which includes the central and supplemental capital, as well as Level II capital, as commanded by the controller. The beginning endorsed capital may comprise cash ventures and property. The statute commands that a least of 10 million euros, changed over utilizing the dinar trade rate, must be contributed in cash to the allowed capital. These controls are steady with the standards of Basel III.

The National Bank of Serbia is exclusively dependable for the foundation of the authorized capital, which incorporates its amount, composition, and source of subsidizing. Extraordinary consideration is given to the legitimateness and straightforwardness of the financing sources. Proprietors are required to yield documentation that confirms the real esteem of any non-monetary resources they propose to contribute as capital, counting mental property, apparatus, or genuine bequest. This assessment is conducted by an fair-minded pro who has been certified in understanding with the set up preparation. Furthermore, it is basic that all supporting documentation be created and displayed in exact agreement with the NBA's statutory.

Fiscal teachers are required to keep up capital levels that surpass the least prerequisite, in expansion to observing the cash adjustment of resources and liabilities, keeping up liquidity proportions, and following other administrative criteria on monetary steadiness.

Banks may be built up by both normal and legitimate substances in the Republic of Serbia. In order to get a banking license in Serbia, legitimate substances must yield detailed monetary articulations that illustrate the company's strength and steadfastness, as well as its steady monetary position. This is a complicated preparation. The possession structure's openness is given extraordinary thought, and data of almost the extreme recipients must be uncovered. Moreover, the candidate must confirm conformance with worldwide benchmarks, especially in the setting of AML/CTF.

If the forebear is a remote organization, the NBS saves the right to ask for supplementary documentation. These archives incorporate the official assent of the administrative specialist of the nation of enlistment and affirmation that the company is beneath the lasting solidified supervision of the important specialists. This permits the controller to assess the remote pioneer's straightforwardness and steadfastness, subsequently bringing down potential dangers for the Serbian monetary system.

As a confirmation of their judgment, candidates looking for managing account licenses in Serbia must show up-to-date certifications of no criminal record that are substantial for no longer than six months. An intensive memoir that illustrates considerable involvement in the budgetary industry is too essential, as it verifies the applicant's competence and responsibility. Giving charge records confirming the authenticity of the source of pay is another pivotal component.

Since the NBS is required to evaluate the dangers related to the conceivable impact on the bank's autonomy, getting a banking license in Serbia requires providing detailed data with respect to the possession structure. For occasion, it can be considered an endeavor to control the showcase when one proprietor has sizable pieces of offers in different monetary organizations. Lawful substances must yield review reports from certified inspectors for a long time in order to illustrate a steady budgetary condition and be allowed to manage an account permit in Serbia. The NBS has the specialist to look for a review examination to decide dissolvability if there are no required assessments administered by the pioneer's state statute.

In Serbia, getting a banking license requires the candidates' cooperation in the budgetary institution's organization being endorsed by the National Bank of the country. Their encounter and proficient appropriateness are inspected by the NBS. Moreover, when allowing a permit, the NBS confirms adherence to worldwide AML/CTF necessities, which incorporates looking at the owner's capital, finance beginning, and exchange history. The controller has the control to inquire for more points of interest if the originator is associated with resources that are considered to be tall.

In Serbia, assembly administration structure benchmarks are vital to get a banking license. At least three of the five individuals of the board of executives must have earlier monetary industry encounters. One part must moreover live in Serbia for all time and talk the dialect fluidly. Autonomous agents must make up at least one-third of the board. These details ensure competent organization and encourage effective communication with neighborhood clients and authorities.

At least two changeless workers, counting the chairman, must make up the official board. To maintain a strategic distance from clashes of interest and to guarantee the institution's progressing operations, the Banking Act prohibits outside administration. At the same time, proof of the board's autonomy is a requirement for licensure.

The official board chairman must have the specialist to choose on things relating to the bank, such as capital structure, liquidity, and hazard administration. This is one of the most vital steps in getting a banking license in Serbia, which is firmly directed by enactment. When deciding whether to allow a bank a permit, the National Bank of Serbia considers the management's track record of polished skill and sound commercial judgment. Candidates may be rejected or subject to extra screening if they do not meet certain conditions, such as having a vague work history or deficient mastery in the budgetary industry.

Banks must frame committees to handle reviews, credit, resources, and liabilities. The review committee makes beyond any doubt that inner controls and budgetary announcements are being taken after; the credit committee looks at credit dangers and chooses whether to grant advances; and the resource and obligation administration committee looks at intrigued rate dangers, liquidity, and makes beyond any doubt that assets are conveyed reasonably.

Contact our specialists

Can a foreign bank operate in Serbia on the basis of a domestic license?

Through subsidiaries with a national license, foreign banks are permitted to conduct lawful business in Serbia. The process of creating a foreign bank subsidiary is identical to that of registering a bank in general, but there are two additional prerequisites.

A foreign organization must provide the following paperwork to the regulator when requesting a preliminary permit:

- affirmation that the foreign entity's participation in the establishment of a bank in the Republic of Serbia has the approval of the country's regulator, or evidence that such approval is not required;

- confirmation of apt collaboration between the NBS and the pioneer's regulatory agency, which oversees the company on a consolidated basis in conformance with the regulator's requirements.

Benefits of obtaining a banking license in Serbia

For money related education and fiscal specialists looking to enter or extend in the Balkan locale, Serbia has developed as a key area in recent times. Due to a few solid reasons that are fueling this developing interest, Serbia is an alluring area for keeping money activities.

One of Serbia's most eminent benefits is its geographic area. The nation is situated on critical fiscal and transportation links that interface to the Mediterranean and Middle Eastern mercantiles, and it is at a pivotal crossing point between Eastern and Western Europe. This position makes it conceivable for banks working in Serbia to reach a more extensive territorial clientele exterior of the household advertisement and makes strides for cross-border monetary services.

From an administrative point of view, Serbia has made extraordinary advances in bringing its money related statutes into conformance with both worldwide and EU measures. The National Bank of Serbia, which manages the monetary industry, guarantees soundness and straightforwardness. Due to its adherence to built up controls, Serbia is a solid and secure area for keeping money operations, which advances certainty among speculators and universal money related organizations.

Another imperative advantage of doing trade in Serbia is how reasonable it is. Working costs, such as labor, office rentals, and charges, are comparatively moo when compared to a few Western European countries. Serbia is moreover favored with a profoundly taught workforce, especially in the ranges of data innovation, bookkeeping, and fund. Authorized banks can offer top-notch administrations and embrace advanced advanced keeping money arrangements much obliged to the accessibility of gifted specialists, which reinforces their position in the mercantile.

Serbia's endeavors to connect the EU include its charm. In spite of not being a part however, the country is directly working to rebuild its budgetary and fiscal teaching in conformance with EU directions. In expansion to making strides compatibility with European budgetary mercantiles, this opens up potential roads for banks authorized in Serbia to in the long run amplify their operations all through the EU.

A favorable charge framework and particular motivations for money related institutions—especially those that contribute in economical funds and cutting-edge technology—define Serbia's speculation climate. In order to accomplish long-term victory, these motivating forces energize the advancement of vigorous and dynamic managing account models.

Finally, modern showcase participants take advantage of the regulation setting. The National Bank of Serbia has taken steps to decrease regulatory detours and speed up the authorizing method. In the meantime, government programs aimed at fortifying the management of an account division offer assistance to advance universal cooperation and speculation.

In conclusion, Serbia's vital get to, administrative arrangement, gifted ability, moo costs, advertise development, and strong regulation and legislative back make it a more alluring area for getting a banking license and building a long-term budgetary nearness in the region.

Denied in Serbia

The method of applying for a banking license in Serbia is complex and intensely controlled, requiring fastidious planning and total adherence to regulation and administrative criteria. As the controlling body, the National Bank of Serbia (NBS) altogether assesses the candidate and the supporting information. Agreeing to proficient ability and information of the administrative environment, applications are as often as possible denied for a number of critical reasons. An applicant's chances of victory can be enormously expanded by being mindful of these.

First of all, one of the fundamental grounds for dismissal is not assembly guidelines for proficient competence and notoriety. The individuals who possess and run the bank must meet strict prerequisites set by the NBS. These individuals must show a strong proficient record, a spotless legitimate history, and a tall degree of keenness both actually and professionally. Candidates are right away precluded from holding vital positions inside the proposed keeping money institution if they have a history of criminal activity or unscrupulous behavior, in any case of whether it has a coordinate association to cash. Making beyond any doubt the authority group is qualified, solid, and suited to direct money related exercises capably is a best need for the regulator.

Second, another visit lurching piece is lacking straightforwardness in record accommodation. Total straightforwardness is required for the permitting strategy, particularly with respect to the proprietorship structure, company demonstration, subsidizing source, and characters of all administration and shareholders. Applications are treated suspiciously if they incorporate sly avocations, inconsistencies, or deliberate exclusions of data, especially when it comes to the source of financing. Any equivocalness is seen by the NBS as a conceivable threat of cash washing or other unlawful conduct. Hence, indeed little divulgence blunders may lead to the application as a entirety being rejected.

Weak liquidity and deficient capital are other vital variables. Candidates must illustrate that the proposed bank is adequately financed and able to fulfill its monetary commitments in understanding Serbian statute. This involves showing great liquidity and having the uncovered least of capital required to ensure operational soundness. Clients and the bigger monetary biological system may be at risk, agreeing to the controller, if the recorded budgetary forecasts show signs of undercapitalization or cash stream shortcoming. The application is improbable to move forward in such circumstances.

In conclusion, getting a keeping money permit in Serbia includes much more than fair taking after the customs. It calls for an earnest commitment to openness, judicious budgeting, and adherence to ethical and proficient standards. To ensure the astuteness of the monetary framework, the National Bank of Serbia employs a thorough but impartial examination method. By being mindful of the ordinary reasons for dismissal, such as destitute notoriety, vague reports, or a need for reserves, candidates can significantly improve their chances of being acknowledged and dodge costly mistakes.

Conclusion

Serbia has incredible openings for those who need to begin their own bank since, in spite of strict controls and the requirement to take after universal measures, the nation is quickly modernizing its monetary division. The country's banking industry is characterized by a clear authorizing handle, negligible authoritative burden, and budgetary incentives.

Bank authorizing in Serbia is managed by a detailed control system expecting to conduct an intensive assessment of firms. The assessment handle takes into account variables counting dissolvability, proprietorship straightforwardness, picture soundness, and administrative conformance.

With a long time of down to earth involvement in the field of monetary statute, I give detailed exhortation and back at each step of getting a managing an account permit in Serbia. By bringing down conceivable legitimate and administrative dangers and expanding the plausibility of getting a permit, the engagement of a master with a specialized profile essentially makes strides the quality of archive generation.

Serbia is a state with great business opportunities in 2026

Serbia is a state with great business opportunities in 2026  Serbia - the centre of Eastern Europe's IT future

Serbia - the centre of Eastern Europe's IT future  Opening a Bank Account in Serbia

Opening a Bank Account in Serbia  Supporting Investment Activities in Serbia: A Step-by-Step Breakdown

Supporting Investment Activities in Serbia: A Step-by-Step Breakdown