For customers whose interests coincide with the European market, opening a bank account in Georgia may be convenient. The Republic of Georgia aims to establish itself as a leading financial hub by helping people and organizations achieve their strategic goals via the use of its banking system. In Georgia, a few banks provide online account opening services.

One of the available solutions for foreigners may be the opening of an account with Pasha Bank. In this publication, we will comprehensively examine procedural formalities and key services to which clients will gain access after opening an account with Pasha Bank.

Bank account in Pasha Bank: description of the bank and its services

For effective financial management in Georgia, legal entities require a bank account. Pasha Bank specializes in providing an extensive array of corporate and investment banking solutions to enterprises of varying scales, from large corporations to small companies. Pasha Bank Georgia, part of the PASHA Holding group of companies, is a key player in the regional banking market. Since its establishment in 2013, it has solidified its position as a reliable financial institution, providing quality services and innovative solutions to its clients.

It is possible to establish a current account or investment account with Pasha Bank (Georgia) to realize strategic objectives. The bank provides a comprehensive suite of financial instruments, along with consultative guidance necessary for optimized financial stewardship and execution of capital ventures in Georgia.

In 2023, Pasha Bank Georgia concluded the year with a net profit of 1.7 million GEL, affirming its reliability and stability in the market. The bank's operational income reflected growth, increasing by 30% compared to the previous year, reaching a milestone of 42 million GEL.

According to the updated strategy for 2024-2026, the bank directs its efforts towards further expanding its corporate segment. The bank is focused on strengthening its position as the primary partner for corporate clients in Georgia.

Opening a corporate account in Pasha Bank: bank services

Pasha Bank Georgia provides its corporate clients with a wide range of financial services, including credit products, deposit programs, and a variety of innovative solutions in the field of financial trading. The bank also specializes in treasury operations and offers other solutions tailored to the needs of each client.

Banking facilities cater to enterprises of varying sizes, encompassing sizable, moderate, and petite businesses with an annual revenue surpassing 1 million GEL, or demonstrating the capability to reach such revenue levels imminently.

|

Pasha Bank Georgia offerings |

|||||

|

Monetary offerings |

|||||

|

Urgent borrowing |

Credit threshold |

Lendings to monetary establishments |

Multiple-lender borrowing |

Agricultural lending with priority |

|

|

Available for expansion of existing business and/or financing of new projects, including acquisition of capital assets, requiring long-term repayment plans and typically involving planned fixed payments. |

For short-term financing of business needs. The client may utilize the provided monetary funds within the established limits by the bank either in full or partially at any time during the validity period of the credit line. Interest is accrued solely on the utilized portion of the credit line. |

Credit programs for entities engaged in microcredit and credit activities aimed at expanding funding sources and increasing client financing. As collateral, a credit portfolio of financial institutions may be utilized. Availability of multi currency loans. |

The bank collaborates with other financial institutions to provide substantial funding to corporations or large-scale projects. Multi currency loans are available. |

The project of preferential agricultural lending is being implemented by the Ministry of Environmental Protection and Agriculture of Georgia in conjunction with the Agency for Rural Development Projects. The initiative targets the optimization of core agricultural production methods, value-added processing, warehousing, and distribution channels by providing entities with enduring and beneficial assets. |

|

|

Capital accumulation programs (for legitimate companies) |

|||||

|

Temporary contribution |

Time deposit |

Same-day deposit |

Term deposit |

||

|

Conditions of Use:

|

General provisions and conditions:

|

Term and specifications overview:

|

|||

|

Financial trading services |

|||||

|

Credit letters |

Financial indemnity |

Letter of credit on standby |

|||

|

Letters of credit are issued by the bank utilizing its own resources and in collaboration with major global banks. |

The core function of a bank guarantee centers on the bank's irrevocable undertaking to disburse the stipulated sum directly to the beneficiary upon first demand, should the client default on their contractual commitments under a specific agreement or transaction. In addition, a bank guarantee may entail payment upon presentation of specific documents or other conditions stipulated in the guarantee text. PASHA Bank offers different types of bank guarantees for both domestic and intercontinental transactions:

|

A standby letter of credit constitutes a bank's guarantee to the beneficiary, ensuring the execution of payment under a designated contract or transaction. Should the applicant fall into non-performance with the letter of credit's stipulations, the bank commits to indemnifying the beneficiary's incurred costs upon receipt of a formal written request. This bank provides its clients with the opportunity to utilize standby letters of credit as part of their financial solutions. The bank works both independently and in partnership with foreign banks to offer clients flexible and reliable financial instruments to support their businesses. |

|||

|

Operations pertaining to the treasury |

|||||

|

Financial services |

Transactions involving the exchange of currencies. |

Forward, SWAP, Option contract |

|||

|

Currency exchange rates at the link |

|

|||

The financial institution also extends its participation to the "Georgian Enterprise Initiative," providing customized banking solutions to large, medium, and small businesses. This program falls under the purview of the Georgian Ministry of Economy and Sustainable Development. The program prioritizes the following strategic directions:

- Industrial business;

- Hotel business;

- Tourist services;

- Eco-tourism industry;

- Farm tourism.

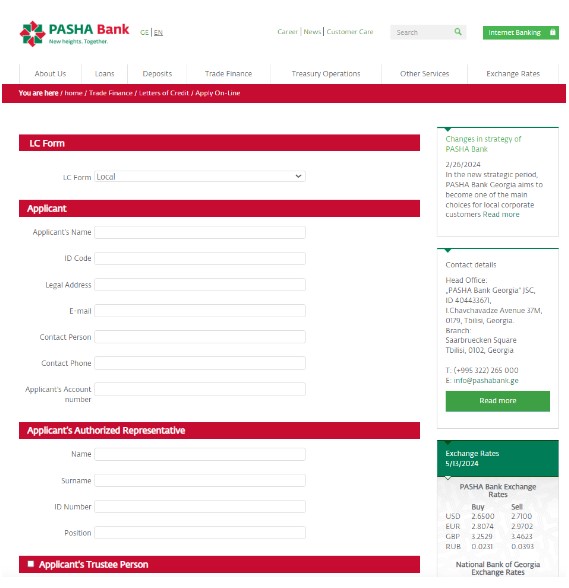

Apply online for a letter of credit on Pasha Bank's official webpage.

Furthermore, establishing a corporate account with Pasha Bank unlocks access to a suite of treasury solutions, including contract SWAP and option contract instruments, interbank connections, validation and completion functions, and automated regular payment facilities. Businesses partnering with the Georgian financial institution Pasha Bank gain access to critical operational tools, including state-of-the-art online banking capabilities.

The key features of correspondent settlement operations at PASHA Bank encompass:

- Managing cross-currency correspondent accounts.

- Direct cash transactions in lari, pounds, euros, dollars and other legal tenders.

For its business clients, both local and abroad, PASHA Bank offers lari and foreign currency clearing and settlement solutions.

Clearing and settlement services encompass:

- Multi-currency current accounts provided by Pasha Bank.

- Cash and non-cash deposits.

- Payments in domestic and international currencies to accounts in Georgia or overseas.

The participation of PASHA Bank in the SWIFT and RTGS networks, as well as its existing relationships with a select group of reputable international banks, expedite local and international financial transfers.

- Foreign exchange transactions involving either physical currency or electronic funds (dealing with domestic and international currencies) may vary.

- Checkbook services.

If you are interested in opening an account with Pasha Bank Georgia, please be advised that all banks operating in this country closely monitor the activities of non-residents, particularly in the context of tightened financial regulation. Any suspicious transactions are subject to additional scrutiny. Such measures are implemented to ensure financial security and prevent potential financial fraud or money laundering.

Let us highlight the significance of the KYC policy in the context of banking regulation and risk management. This principle plays a pivotal role in ensuring the security and reliability of banking operations. KYC constitutes an integral process applied by financial institutions for meticulous verification of clients' identity, financial, and other information before establishing any business relationships.

This process has an important impact on combating various financial crimes, including money laundering and financial fraud. In the field of corporate entities, the KYC process covers:

- A study of business characteristics, such as industry, volume and type of transactions, and the range of products or services provided by the company.

- Analysis of the ownership and management structure of a business in order to identify key participants and their roles in the organization.

- Identification of the beneficial owners of the company.

If you're curious about the feasibility of remotely initiating a non-resident account with Pasha Bank, we invite you to seek personalized advice from our team of experts to gain insights into this matter and its associated inquiries.

How to open an account in Pasha Bank?

Let's begin by stating that in 2022, legislative amendments were enacted, tightening the requirements for opening corporate bank accounts in Georgia. Prospective clients must furnish detailed documentation regarding their activities. Specifically, evidence of legal entity registration within the country, an exhaustive business plan outlining proposed activities, as well as information regarding company executives, employees, and partners are mandated. Such an approach aims to enhance transparency and ensure the security of financial transactions.

In the case of branches of foreign companies, the document package must include an authenticated copy issued by the business registry in the country of registration of the foreign company, an extract from the State Register of the Republic of Georgia confirming the registration of the branch in this country. In addition, bank managers may request additional documents during the assessment process of the application to open an account for the company at Pasha Bank.

Our company’s experts have up-to-date knowledge about the processes of bank verification and identification and can provide professional support and assistance in opening a bank account in Georgia at all stages.

Conclusion

Georgian financial institutions adhere to European and international regulations, encompassing those pertaining to banking operations. Fees associated with establishing and maintaining accounts at Georgian banks are generally more modest compared to those levied by their European counterparts. Accounts opened at Pasha Bank, a Georgian institution, come equipped with an international IBAN number.

Non-resident legal entities with a business presence in Georgia, such as local branches, staff, partnerships, or other commercial endeavors, are eligible to establish an account with Pasha Bank. Our team offers extensive assistance in opening a Pasha Bank account. We are prepared to provide not only in-depth consultations and support with gathering the requisite documentation for account establishment, but can also recommend alternative banking and payment processing solutions within this jurisdiction or throughout Europe.

How to open an account in Georgia

How to open an account in Georgia  Booming tech potential of Georgia: Register an IT company in a free economic zone

Booming tech potential of Georgia: Register an IT company in a free economic zone  Open a corporate account with a bank of Georgia in 2026

Open a corporate account with a bank of Georgia in 2026  Relocation to Georgia

Relocation to Georgia  Banks of Georgia in 2026

Banks of Georgia in 2026  Registration of an individual enterprise in Georgia

Registration of an individual enterprise in Georgia  TM registration in Georgia

TM registration in Georgia