Company registration in SIZ Kakheti (Georgia) represents a promising opportunity for those planning to take advantage of the region's future economic benefits. Special Economic Zone (SEZ) in Kakheti is currently under development, and according to public documents, its creation is aimed at stimulating investment and business development in this important region of Georgia. It is expected that companies that will be registered in the territory of the future FIZ, will be able to receive significant tax benefits, simplified administrative procedures and access to a number of other privileges. Below we look at the key aspects that, according to plans, will be characteristic of YOU Kakheti and will offer attractive opportunities for both international and local investors.

Basic information about PPE Kakheti

Special Economic Zone (SEZ) in Kakheti, Georgia, is still in the planning stage, but based on public statements and documents, it can be assumed that this zone will become a promising area for business development. First of all, it will be focused on the agricultural sector, winemaking, logistics and tourism. Kakheti is a historical region in eastern Georgia, known for its fertile lands and rich cultural heritage, making it attractive to domestic and international investors.

It is expected that the region's favorable location, close to the capital Tbilisi, will provide easy access to major transport routes and the international airport. This strategic position should contribute to the development of export potential companies that will be registered in FIZ Kakheti. It is planned that proximity to Azerbaijan will also facilitate access to the markets of the South Caucasus and Central Asia.

The Georgian government is considering the possibility of promoting Kakheti as an economic zone aimed at attracting investment. The project documentation indicates that in the future industrial parks, warehouses and office premises may be created here, and transport and utility infrastructure will also be developed. It is planned that FIZ Kakheti will offer comfortable conditions for registering and doing business, with simplified administrative procedures and minimal bureaucratic barriers.

Thus, in the future, FIZ Kakheti can become an important center of economic activity, providing ample opportunities for the development of various industries.

Promising areas for business registration in FIZ Kakheti

The Special Economic Zone (SEZ) of Kakheti offers diverse opportunities for business development due to its strategic location, resources and favorable investment environment. Here are some of the most promising sectors for business registration in FIZ Kakheti:

Winemaking Kakheti produces about 70% of all Georgian wine, making this region a key player in the country's wine market. In 2023, the export volume of Georgian wine amounted to more than 100 million bottles, of which more than 60% were produced in Kakheti. According to the Georgian Ministry of Agriculture, the region's wine sector is growing at 8-10% annually, making it attractive for investment. The average income from wine exports in Kakheti was more than 200 million US dollars in 2023, which confirms the high profitability of this business.

AgribusinessKakheti also has significant opportunities in agribusiness, thanks to fertile lands and favorable climatic conditions. The region produces about 50% of all fruits and vegetables in Georgia, and agricultural exports amount to more than US$150 million annually. In 2023, the volume of grain production in Kakheti increased by 12%, reaching 800 thousand tons. This growth is supported by government programs aimed at modernizing the agricultural sector and increasing exports.

Tourism and hospitality The region is famous for its historical monuments, picturesque landscapes and rich culture. In 2023, Kakheti received about 1.2 million tourists, which is 15% more than the previous year. Data from the Georgian National Tourism Administration shows that the average tourism income in Kakheti was more than US$80 million in 2023.

The region has potential for further growth, given the increase in the number of international tourists and the development of tourism infrastructure. Kakheti is actively developing agrotourism, wine tours and cultural events, which makes it attractive to various categories of tourists.

The hospitality sector in Kakheti is also showing positive dynamics. In 2023, there were more than 300 hotel properties operating in the region, including both hotels and private guest houses. The average hotel occupancy rate was about 75%, an increase of 10% compared to the previous year. The number of hotel rooms in the region is projected to increase by 25% over the next three years to meet growing demand from tourists.

These business sector in SIZ Kakheti have high potential for development and provide investors with the opportunity to take advantage of the unique advantages of the region for successful business.

Corporate structures in the special industrial zone (SIZ) Kakheti

One of the key features of Kakheti is the variety of corporate structures available to investors and entrepreneurs. These structures play an important role in determining the legal status, financial obligations and management aspects companies operating in Kakheti. Below we will look at the main types of corporate structures, their advantages and features in the context of work in FIZ Kakheti.

Inception of LLC in the SIZ Kakheti. For the establishment of an LLC within the designated special industrial zone (SIZ) Kakheti, there exist no stipulations regarding the minimal capital infusion; it may be as trifling as 1 GEL. The progenitors of the enterprise may encompass both natural persons and juridical entities of any domicile, whilst a solitary progenitor suffices, who may concurrently assume the role of director. Data pertaining to the ultimate beneficiaries is accessible to the public, thereby assuring the transparency of corporate proprietorship.

When inaugurating a regional banking account for transactional objectives, substantive prerequisites are mandated; however, an alternative is to utilize a remittance system account. To pursue commercial endeavors, one must procure a business license. The principal of the enterprise may be either a natural person or a juridical entity of any domicile, and a minimum of one principal is requisite. There exist no statutory stipulations for the designation of a corporate scribe. The juridical domicile of the enterprise must be situated within the precincts of the industrial enclave.

Commencement of a Joint Stock Corporation in the Special Industrial Zone of Kakheti. For the establishment of a joint stock corporation (JSC) within the designated industrial enclave (SIZ) of Kakheti, specific stipulations are instituted. The minimal sanctioned capital requisite for a JSC is 5 thousand lari (1,850 US dollars or 1,600 euros), thereby facilitating the inception of an enterprise with modest investments.

Progenitors of JSC may comprise both corporeal persons and juridical entities, irrespective of their domicile. For the establishment of a company, a requisite minimum of two stakeholders is mandated, and stakeholders may assume roles in the company's governance, such as a chief executive or presiding officer of the board of directors.

Information about the ultimate beneficiaries of the JSC is public, which promotes transparency and increases trust in the company on the part of partners and clients. Payment system accounts may also be used to ensure compliance with substance requirements when opening a local bank account.

For conducting JSC activities in FIZ Kakheti required obtaining a business license. The minimum number of directors is one, and both individuals and legal entities can act as directors. The law does not provide for the mandatory appointment of a corporate secretary.

Opening of a partnership in FIZ Kakheti. In FIZ Kakheti, partnerships are a flexible form of business organization suitable for various types of commercial activities, including promising areas such as winemaking and agribusiness. Partnerships in this zone have a number of features that make them attractive to entrepreneurs.

To establish an association in FIZ Kakheti, there exists no requisite minimum capital, thereby permitting the inception of a venture with negligible pecuniary outlay. Collaborators may comprise both natural persons and juridical entities of diverse domicile. Contingent upon the nature of the partnership, it may necessitate two to four affiliates to constitute an enterprise.

Information about the ultimate beneficiaries of partnerships is also publicly available, which contributes to transparency of management and increases trust in the company. When opening a local bank account for transaction purposes, it is important to comply with substance requirements. As an alternative, you can use accounts in payment systems.

For conducting activities in FIZ Kakheti A business license is required. The law does not require the appointment of a corporate secretary for partnerships. Partners may have different roles in the management of the company, but it is important that all partners participate in management in accordance with the terms of the partnership agreement.

Opening of a branch in FIZ Kakheti. Registration of a branch in the special economic zone of Kakheti is an attractive option for companies wishing to expand their presence in the Georgian market with minimal financial outlay. The absence of a minimum authorized capital requirement, a simplified registration procedure and a number of tax incentives make this region particularly attractive for investors. The founder of a branch can be either a legal entity or an individual of any residence, however, it is necessary to provide a standard package of documents confirming the registration of the parent company.

For creation of a branch in SIZ Kakheti There is no minimum share capital requirement, making this option more accessible to companies looking to reduce start-up costs. The founder of the branch can be either an individual or a legal entity of any residence, but it is necessary to provide documents confirming the registration of the parent company.

The branch is required to comply with substance requirements, which includes having a physical office and corporate bank account in the FIZ territory. An alternative to a local bank account can be an account in a payment system, which allows you to flexibly manage financial flows.

To conduct activities, the branch requires a business license issued by the relevant authorities in the FIZ of Kakheti. The branch must appoint a local director who is responsible for operational issues and representing the interests of the branch. The law does not require the appointment of a corporate secretary.

Opening of entrepreneur in SIZ Kakheti. Individual entrepreneurs (IP) can take advantage of simplified conditions for doing business. Creation of an individual entrepreneur This zone requires minimal formalities, making it an attractive choice for start-ups and small businesses.

An individual entrepreneur can be either a citizen of Georgia or a foreign resident. For individual entrepreneur registration There is no minimum capital required, which reduces financial barriers to starting a business.

When opening an individual entrepreneur, the appointment of additional management bodies, such as a director or corporate secretary, is not required. The sole proprietor acts as the sole individual with full responsibility for the activities of the business. Information about the final beneficiaries and owners of individual entrepreneurs is public, which promotes transparency and increases trust on the part of partners and clients.

For doing business as an individual entrepreneur in FIZ Kakheti An appropriate business license is required. In addition, to conduct payments, you must open a local bank account, for which standard substance requirements apply.

The legal address of the individual entrepreneur must be located on the territory of the industrial park, which ensures a convenient location for conducting business activities and compliance with all regulatory requirements.

Steps for registering a company in FIZ Kakheti

Below is a detailed company registration process inspecial industrial zone (YOU) Kakheti:

Step 1Select a company name. First of all, you need to choose a unique name for your company. It must comply with local laws, not infringe copyright, and not be identical to the name of another registered company. You can check the availability of the name through the online system of the register of legal entities of Georgia or contact the consular center of the Kakheti FIZ.

Step 2Apply for registration. After choosing a company name, you need to prepare and submit an application for registration to the relevant authority. To do this, you will need to fill out a standard application form and provide the necessary documents, such as:

- articles of association;

- data of founders and directors;

- documents confirming the legal address of the company;

- copies of passports of founders and directors;

- financial documents, if required (for example, confirmation of the presence of authorized capital).

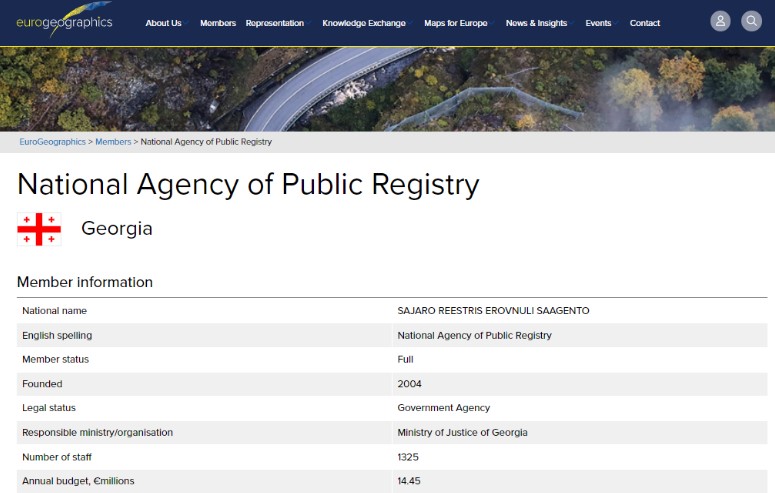

The application is submitted through the online business registration platform (National Public Registry Agency). The application process usually takes from several hours to several days depending on the complexity of the application.

Image caption: LEPL National Agency of Public Registry website.

Step 3Review of the application by the regulator. After submitting an application, the regulator usually considers it within 5-10 working days. At this time, all submitted documents are checked for compliance with legal requirements. The regulator may request additional information or documents if necessary to complete the review.

Step 4Obtain a company registration certificate. After successful review of the application and completion of all necessary procedures, you will receive a company registration certificate. This document confirms the official registration of your company in the Kakheti FIZ and allows you to begin carrying out business activities. The certificate is issued in writing and can be sent by mail or provided electronically through an online platform.

Thus, the process of registering a company in FIZ Kakheti by a non-resident includes choosing a name, submitting an application with the necessary documents, reviewing the application by the regulator and obtaining a certificate of registration.

Advantages of starting a business in FIZ Kakheti

Starting a business in the special industrial zone (SIZ) Kakheti promises significant benefits, however, it is important to consider that all benefits and preferences provided may be changed or canceled in the future. Tax incentives are currently being discussed, such as a possible reduction in corporate tax to 5%, which is lower than the standard rate of 15% for the rest of Georgia. However, this information is not final and may be subject to change, which should be taken into account when making decisions.

It is also assumed that companies in SIZ Kakheti will be able to take advantage of benefits on land tax and property taxes. In some cases, preferential terms for leasing land plots for up to 99 years are possible, but these provisions have not yet been fixed on a permanent basis and may be revised. An important aspect remains the availability of subsidies and grants for infrastructure development, but these programs are still under discussion and their final parameters have not yet been approved.

In terms of infrastructure, the Kakheti FIZ will likely provide access to modern logistics centers and transport hubs, which in turn will facilitate the export of products, especially in the wine sector, where Kakheti has a leading position. However, these plans may also change depending on the development of the region.

Programs to support start-ups and small businesses are also under development. Various support measures are currently being considered, including advice and assistance in obtaining permits and licenses, but their specific forms and amounts of assistance may still change.

Thus, company launch in SIZ Kakheti provides entrepreneurs with the prospect of tax benefits, favorable rental conditions and support from local authorities. However, it is important to remember that all these benefits are not final and may be revised, modified or eliminated depending on future government decisions and changes in legislation.

Business regulation in FIZ Kakheti

Business regulation in the Special Industrial Zone (SIZ) Kakheti includes several key aspects aimed at creating a favorable investment climate and simplifying business processes. Here's a detailed review:

In FIZ Kakheti, the main regulatory body is the National Public Registry Agency of Georgia. The National Public Registry Agency regularly monitors and controls the activities of registered companies. This includes reviewing accounts, complying with business rules, and fulfilling obligations to government agencies.

To conduct certain types of activities, companies in the Kakheti FIZ may need to obtain special permits or licenses. The regulator issues such documents and controls their use.

The regulator can also act as a mediator in resolving disputes between companies and government agencies. In case of inconsistencies or conflicts, companies can contact the regulator to resolve the issues.

Basic laws regulating business in FIZ Kakheti:

- The Law of Georgia “On Special Industrial Zones”. Defines the legal basis for the creation and operation of industrial zones, establishes tax incentives and special conditions for business.

- Civil Code of Georgia. Regulates general issues relating to the creation, activities and liquidation of legal entities.

- Tax Code of Georgia. Includes provisions on tax obligations and benefits applicable to companies in the FIZ.

- Law of Georgia "On Environmental Protection". Establishes environmental requirements that must be met by companies wearing PPE.

Thus, regulation of the activities of companies in FIZ Kakheti focuses on legal compliance, monitoring company activities and ensuring compliance.

Basic banking services for companies in FIZ Kakheti

In the Special Industrial Zone (SIZ) Kakheti, a banking service system for companies plays a key role in business operations. Opening a corporate account is possible in local and international banks, such as TBC Bank and Bank of Georgia, and it is necessary to provide a package of documents, including a certificate of registration of the company in the FIZ, statutory documents, identification documents of founders and directors, as well as a business plan. Banks in Kakheti provide fast processing of applications for opening accounts, which is important for foreign investors and new companies - the process usually takes from several days to two weeks.

Banking institutions offer specialized services for companies in FIZ, such as foreign exchange services, international transfers and lending, which contribute to the efficient management of financial flows and international transactions. In addition, companies registered in FIZ can take advantage of preferential conditions, including reduced service rates and more favorable lending conditions. The banking infrastructure in Kakheti is developed, which provides convenient access to financial services through branches and ATMs in large cities in the region, such as Telavi.

Risks to consider when starting a business in FIZ Kakheti

Registration of a business in the Special Industrial Zone (SIZ) Kakheti, despite attractive conditions and benefits, is associated with a number of risks that entrepreneurs must take into account. Here is an overview of the main risks:

- Unpredictability of regulatory authorities. There may be delays in processing applications or additional regulatory requirements, which may slow down the registration process and the launch of your business.

- Difficulties in complying with norms and standards. The need to comply with both general legislation and specific PPE requirements can be challenging, especially for companies unfamiliar with local laws and regulations.

- Checks and control. Regulators conduct regular inspections, and failure to comply may result in fines, suspensions, or other sanctions.

- Instability of the economic situation. Economic instability or changes in financial conditions may affect a company's business plan and financial condition. This may include currency exchange rate fluctuations, changes in tax laws and inflation.

- High start-up costs. Despite the benefits associated with PPE registration, the initial costs of registration, licensing, and other requirements can be significant.

- Competition. Depending on the business sector, competition in the region can be high. Companies may find it difficult to attract customers and gain market share.

- Market fluctuations. Changes in demand for the products or services a company offers may affect its financial results.

- Impact on the company's image. Negative events or performance issues can affect a company's reputation, which in turn can affect business partners and customers.

Thus, despite the advantages associated with business registration in FIZ Kakheti, it is important to carefully assess and manage possible risks in order to minimize their impact on the company’s activities.

Conclusion

Registration of a company in the future Special Industrial Zone (SIZ) Kakheti in Georgia may become a strategically beneficial step for entrepreneurs when this zone is put into operation. According to public documents and statements, FIZ is planned to offer tax incentives, simplified procedures and advanced infrastructure, making it attractive to business initiatives. However, the successful implementation of business projects in the future will require careful analysis, understanding of regulatory requirements and taking into account possible risks associated with local legislation.

Competent planning and timely management registration processes in promising PPE will help entrepreneurs adapt to new conditions and minimize potential risks. Our team is ready to provide comprehensive support at all stages, from consultations on choosing a company structure to compliance with regulatory requirements.

We invite you to cooperate to prepare for the future opportunities in FIZ Kakheti. Contact us for professional help to plan in advance the successful development of your business in one of the most promising regions of Georgia. We are ready to become your reliable partner and help you unlock the full potential that this unique business center will offer in the future.

Audit and Accounting support

Audit and Accounting support How to open an account in Georgia

How to open an account in Georgia  Booming tech potential of Georgia: Register an IT company in a free economic zone

Booming tech potential of Georgia: Register an IT company in a free economic zone  Open a corporate account with a bank of Georgia in 2026

Open a corporate account with a bank of Georgia in 2026  Relocation to Georgia

Relocation to Georgia  Banks of Georgia in 2026

Banks of Georgia in 2026  Registration of an individual enterprise in Georgia

Registration of an individual enterprise in Georgia  TM registration in Georgia

TM registration in Georgia