Securing a crypto licence warrants trades to perform within the promptly amplifying E-asset field This not only drives user trust but also dispenses a gateway to transnational trading hubs. As the E-currency field continues its remarkable growth, acquiring a licence has become a prime step for organisations aiming to establish themselves as legitimate players in this premise. A crypto licence signifies adherence to licit norms, driving businesses to function transparently under statutory supervision. Also, the sequence of gaining such a permit can be intricate, often involving several stages and mandating an exhaustive comprehension of region-specific statutes.

This article delves into the phases mandated to procure a crypto warrant, the merits it offers in asserting licit abidance and functional forthrightness, and the integral thoughts for starting a E-currency trade. We will explore various territories where procuring a warrant is both time-efficient and profitable, as well as territories offering more affordable enrollment options. Additionally, the write examines the licit frames, organisational criteria, and pecuniary factors to help you pick the prime polity for generating your E-currency trade.

Understanding cryptocurrencies and tokens

Cryptocurrencies are electronic holdings secured via cryptographic tech, driving decentralised deals without intermediaries. These wherewithal, like Bitcoin (BTC) and Ethereum (ETH), play pivotal roles in the trading hub. Bitcoin, which commands approximately 48% of the total E-currency dealing hub capitalisation, facilitates deals exceeding $7 billion daily. Ethereum, with a mercantile value surpassing $220 billion, underpins smart undertakings and decentralised solutions, accounting for 18% of the crypto trading hub.

Stablecoins, including Tether (USDT) and USD Coin (USDC), are pegged to fiat currencies, offering reduced volatility. For example, USDT, valued at over $83 billion, is broadly used for deals and capital preservation in fluctuating trading hubs.

Unlike fiat currencies, E-currencies function independently of bureau establishments and pecuniary firms, forming novel openings in the electronic pecuniary premise and virtual wherewithal trading hubs.

Applications and prospects in cryptocurrencies

E-currencies are integral to the digital opulence, facilitating a broad scope of schemes. Trades utilise cryptocurrencies for remunerations, speculations (e.g., ICOs), with wherewithal handling. Of particular interest is their use in cross-border deals, which are faster and more profitable than traditional banking transfers.

For endeavours partaking in E-currency related schemes, procuring a crypto business licence is prime. This warrant asserts abidance with statutory norms, driving licit operation and fostering trust among financiers.

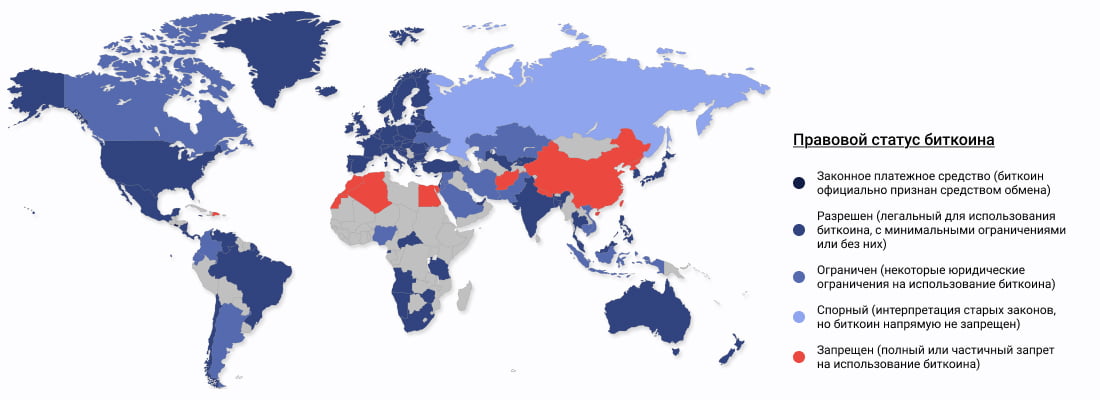

Map of cryptocurrency legality in the globe (source — Wikipedia)

"Over the past few eons, we have seen the evolution of E-monies as a full-fledged financial instrument, that necessitates a deep knowledge of their licit nature. Our team has repeatedly encountered instances where the lack of a pellucid statute qualification of tokens became an obstacle to registering a crypto company. We have helped clients structure their blueprints correctly to evade statute and assess perils."

The merits of warranting in the cryptosphere

Authorisation is vital for attempts to leverage the outlook of E-wherewithal inside a licit frame. In 2023, token transaction volumes reached an astounding $20 trillion, underscoring the merit of supervisory oversight.

A crypto warrant not only legitimises a company's schemes but also strengthens its reputation, particularly for entities like remuneration systems and exchange platforms that rely heavily on customer trust. VASP endorsing helps oversee schemes and mitigates perils for clients.

Different territories adopt unique approaches to cryptocurrency regulation. Over 60 nations have implemented approval and taxation measures, creating either promising or restrictive conditions for mercantiles. For instance, premises like the EU and the United States enforce stringent AML with KYC directives.

Conversely, territories such as Singapore offer enticing spheres for crypto trades. These territories balance moderate excise percentages with streamlined approval prerequisites, with capital thresholds ranging from €50,000 to €250,000. This accessibility appeals to serious financiers and new entrepreneurs alike.

Promising excise territories, like the Cayman Islands and Seychelles, also attract crypto trades. In 2022, these regions accounted for over 20% of new crypto enterprises due to their simplified approval sequences, making them ideal for tycoons with limited initial investment.

"Procuring a cryptolicense is not just a legal formality, but a key stage in generating a trade in the E-wherewithal industry. In practice, we have seen how ventures that neglect warranting faced account closures and fines. Our experience shows that well-structure indentures and a strategically picked purview minimize such perils."

Picking the ideal premise for a crypto licence

Picking the formal polity is an integral decision for trades seeking VASP approval. Approval prerequisites, including minimum capital thresholds, vary primely. For instance, Gibraltar mandates at least $50,000, while Switzerland requires a minimum of $250,000.

Strategic jurisdictional selection asserts rationale and abidance with global security directives. As supervisory control in the E-asset industry intensifies worldwide, choosing a supportive licit model is prime for prolonged accomplishment.

This analysis underscores the prime of comprehending the licit, functional, and pecuniary subtlelies of procuring a crypto licence. By aligning your mercantile targets with the proper premise, you can place your organisation for enhancement with legitimacy in the vibrant globe of electronic holdings.

Forms of schemes in the cryptocurrency premise

The E-currency fieldencompasses a broad spectrum of schemes, each governed by specific authorised models and approval prerequisites. Trades operating within this space must secure the suitable authorisations to assert their aids abide by licit and security statutes.

Trading and transposing E-currencies rank among the prime prevalent schemes in the crypto field. Ventures facilitating such services ought to acquire a licence for VASPs, as their schemes involve handling monetary deals and handling client funds.

Transpose portals and trading entities are also subjugated to stringent directives concerning the safekeeping and protection of client resources. This often necessitates getting a E-asset permit, particularly as these endeavours typically drive the exchange between fiat currencies and cryptocurrencies. Many regions need these ventures to undergo extensive multi-phase approval procedures, as supervisory bodies command meticulous inspections to command perils and enhance operational security. Consequently, quick enrollment is uncommon for this form of scheme.

E-currency wallets and remuneration models supply convenient tools for users to store and transfer digital tokens. Firms presenting such aids fall under the classification of E-currency service experts and are compulsory to get the prime warrants. A E-currency service licence grants these endeavours the licit model to function while asserting robust protections for clientele funds.

To reach statutory statutes for firmness and security, wallet providers and remuneration system operators ought to secure official authorisation as VASPs. This certification attests to their abidance with commands and safeguards. In some regions, a licence specific to virtual wherewithal endeavours is mandated, setting technical and licit control benchmarks for the provision of such aids.

The handling of E-assets and the deployment of DeFi portals are becoming central to E-currency speculation. Entities engaged in E-holding handling must secure E-currency permits owing to the heightened roles and perils linked with handling client funds. Possessing a licence for handling E-assets signifies a company's competence and conformance to financier safety policies. DeFi services have flourished as a transformative alternative to customary pecuniary, offering functionalities like loans, deposits, and wherewithal handling in a decentralised premise.

Although these systems function without centralised control, providers of user interfaces and those handling wherewithal flows ought to procure licences. Authorisation to function E-asset support has become a standard, asserting customer obligations are met and schemes are protected against external perils.

Mining and staking represent unique branches of the E-currency sphere. Mining involves leveraging computational resources to validate blockchain deals, while staking requires holding a set amount of cryptocurrency to support network functions and earn rewards. In certain regions, such schemes necessitate approval, particularly if performed through platforms offering pecuniary services.

For endeavours engaged in mining or staking, a licence for virtual asset schemes confirms abidance with licit statutes and regulates schemes like fund storage, transfer, and accounting. Additionally, some regions treat mining as an energy-intensive activity requiring separate permits or regulatory oversight.

Forms of cryptocurrency licences

Cryptocurrency businesses require various permits tailored to their specific schemes and trading hub schemes. These permits serve as statutory tools to assert the forthrightness of crypto support. Here are the prime forms of cryptocurrency permits and their statutory nuances across different regions:

Primary categories of cryptocurrency permits

- Cryptocurrency exchange licence. Operators of E-currency dealings, particularly those driving the conversion of fiat wherewithal to E-wherewithal, are often compulsory to procure transpose warrants. These warrants are vital for overseeing pecuniary flows, enforcing AML measures, adhering to KYC requisites, and safeguarding mercantile contributors. For instance, Estonia mandates that crypto transpose operators secure a E-holding warrant, which involves maintaining a statutory fund, submitting regular records, and implementing rigorous data protection guidelines.

- Crypto Service licence for VASP companies. VASPs must get a warrant certifying their ability to abide by transnational statutory statutes. In regions like Lithuania, such warrants oversee schemes linked to the storage and transfer of E-holdings and their interactions with pecuniary institutions.

- Wallet and custodian licence. Offering secure storage for E-assets requires a specialised licence with stringent security protocols. For instance, Luxembourg's VASP licence asserts the safety of E-currency holdings and mandates regular audits for custodial aids.

- ICO or STO licence. Undertakings raising money via Initial Coin Offerings or Security Token Offerings must acquire a dedicated permit. These permits typically demand detailed disclosures about the undertaking, asserting forthrightness and accountability for the utilise of generated monies. Switzerland, for example, has initiated tailored statutory models to back ICO and STO schemes.

By acquiring the approval prerequisites, cryptocurrency endeavours demonstrate their commitment to performing within the statute, safeguarding users, and assisting the enhancement of a safeguard electronic economy.

Trading hubs without crypto licensing

Certain regions have little or no statutory prerequisites for crypto endeavours, driving a “quick-start” approach that entices to startups eager to start promptly. For instance, in the Seychelles, organisations are not compulsory to procure a particular crypto licence, with schemes governed under standard corporate law provisions. Similarly, Belize does not mandate approval for cryptocurrency schemes, allowing endeavours to register without reaching specialised criteria. However, these territories often face scrutiny regarding forthrightness and reliability, making them better suited for firms prioritising swift service enrollment over prolonged reputability.

Alternatives to Licences: permits, certificates, and enrollment

In some territories, traditional approval for crypto services is replaced by alternative mechanisms such as enrollment or permits, offering a middle ground between regulation and operational freedom. Enrollment typically involves straightforward phases like indenture conveyance and basic corporate verification. Permits may serve as functional substitutes for licences, particularly in regions with streamlined crypto company registration systems. Some territories also offer "trust certificates," which confirm abidance with statutes without imposing stringent pecuniary conditions.

In stricter regulatory spheres, warrants stay prime for E-money support such as remuneration systems and wallets. For example, France mandates comprehensive statutory approval for all crypto venture activities. Similarly, in Switzerland, handling crypto wherewithal demands formal authorisation from supervisors, asserting protection and abidance statutes. The alternative between licence or certificates is contingent on a firm's tactical ambitions and the licit model of the territory. Startups favouring quick market entry often opt for lenient directives, while organisations seeking financier trust and reputational strength prefer territories with robust approval prerequisites.

MiCA: The EU’s pivotal crypto directive

The Markets in Crypto-Assets (MiCA) statutory, endorsed by the EU in 2023, displays a landmark in the governance of E-holdings within Europe. MiCA aims to standardise crypto commands, enhance forthrightness, and bolster financier trust. This model handles the entire crypto infrastructure within the EU, encompassing warranting protocols and clientele protection policies.

Core prerequisites: licences, wherewithal thresholds, and abidance

MiCA establishes stringent requisites for VASPs performing within the EU. The vital need is the acquisition of a specialised permit for E-money schemes, asserting adherence to safeguarding protocols, AML guidelines, and KYC sequences.

Furthermore, MiCA mandates certification for VASPs, incorporating assessments of pecuniary stability and handling systems to mitigate perils for users and financiers. Firms offering specific services, such as stablecoins or pecuniary tokenization, ought to procure additional approvals to reach asset-specific statutes. An electronic holding warrant is also mandatory, asserting abidance with transnational pecuniary directives and security criteria.

MiCA execution and adoption across the EU

Since 2024, MiCA has been a binding frame across all EU member territories, mandating the harmonisation of regional statutes with its provisions. Leading territories such as Germany, France, and the Netherlands have already incorporated MiCA into their licit systems, while others continue to align their directives. MiCA’s primal goal is to supply a uniform licit norm for crypto endeavours, abating barriers to cross-border deals and fostering growth prospects for the European crypto market.

Impact of MiCA on crypto businesses

MiCA’s implementation has primely influenced the European crypto sector, driving professionalisation and higher administrative and safety statutes. Crypto service providers must now secure the suitable licences to remain competing and licitly compliant. Adjusting to these commands often necessitates expert consultation, as endeavours ought to reassess operational models, pecuniary frames, and threat handling practices.

MiCA also allows crypto endeavours to strategically select EU territories offering more promising statutory spheres. This flexibility encourages detailed analysis of local prerequisites to optimise schemes. The regulation’s emphasis on pecuniary forthrightness and reporting has enhanced the trading hub's appeal to institutional financiers, who previously hesitated due to the industry’s statutory ambiguity.

By acquiring pecuniary service licences under MiCA, crypto companies can establish strong partnerships with European banks and pecuniary establishments, fostering prolonged stability and trust in the booming crypto sphere.

Leading territories for crypto trades in 2026

Selecting the best polity is a vital decision for E-currency firms, influencing chances for enhancement, excise responsibilities, and clientele trust. Here are some of the prime ends for crypto endeavours in 2026, assessed based on licensing prerequisites, excise policies, and legislative safeguards.

Crypto licensing in Lithuania

This polity has come up as an alluring area for cryptocurrency firms owing to its streamlined and profitable permitting sequences. Endeavours in this polity can enroll for either a currency exchange permit or an asset handling permit, rendering it a best location for both startups and initiated firms. The Bank of Lithuania oversees the permitting and statutory model, asserting abidance and monitoring schemes. Also, Lithuanian government agencies supply consistent aid throughout the authorisation phase. The polity also boasts a highly promising excise regime, further enhancing its alluring to crypto companies.

You can explore further details about the crypto permitting sequence in the polity in our dedicated article.

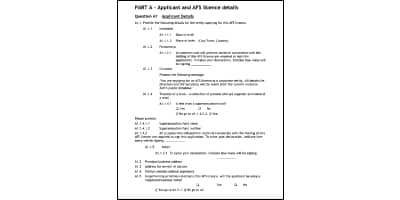

Form for procuring permission to offer or trade cryptocurrency in the EU

Crypto Licensing in Estonia

This polity continues to uphold its reputation as a premier polity for E-currency licensing, abiding to rigorous statutory statutes. In 2024, endeavours are mandated to procure a special licence to provide services such as virtual currency exchange, custody, transaction handling, and ICO schemes. The Estonian Fiscal Supervision Authority (Finantsinspektsioon) is accountable for forming an open and safeguarded statutory field. This framework asserts both operational clarity and user safeguarding, reinforcing Estonia's position as a trusted hub for crypto endeavours.

For more insights, refer to our article on crypto licensing in Estonia.

Crypto Licensing in Malta

Malta is a trailblazer in the European crypto statutory landscape, offering four distinct licence categories tailored to varying operational needs. These licences accommodate endeavours of different sizes and service offerings, facilitating seamless integration into the crypto trading hub. Malta’s pecuniary authority governs the licensing model, asserting abidance with stringent statutes. The polity’s promising excise policies and comprehensive statutory aid make it a sought-after polity for endeavours targeting the European trading hub.

Discover more about procuring a cryptocurrency licence in Malta in our detailed guide.

Crypto Licensing in Switzerland

It is renowned as a prestigious position for crypto firms, especially those looking to lure institutional financiers. The Swiss Federal Fiscal Markets Authority (FINMA) offers a scope of authorisations suited to specific schemes and aids. Among these, the E-asset pecuniary aids permit is particularly significant for companies handling E-currency assets or serving transnational corporate clients.

Switzerland’s robust pecuniary facility, strong licit protections, and stable statutory sphere stipulate a solid foundation for token firms. The polity also backs creativity via its blockchain sphere, particularly in the "Crypto Valley" territory, which is a pub for startups and major industry players. Also, membership in the Fiscal Services Standards Authority (VQF), a FINMA-recognised self-statutory organisation, can enhance a company's credibility among clientele and associates.

For an exhaustive sequence on securing a crypto licence in Switzerland, explore our in-depth article.

Crypto Licensing in Singapore

It has rooted itself as a driven Asian hub for E-currency endeavours, thanks to its transparent statutory framework and promising excise system. The MAS issues licences for schemes involving digital payment tokens. These licences enhance firms to licitly engage in E-currency dealings.

Singapore's trade-oriented sphere is underpinned by flexible licensing procedures, stringent data protection statutes, and robust AML policies. This combination creates a broad level of trust among users, overseers, and firms. Furthermore, the Singaporean controllers actively drive blockchain development through grants and educational initiatives aimed at cultivating specialists in the area.

For more comprehensive information, consult our expert analysis on crypto licensing in Singapore.

Excise directive of cryptocurrencies in different territories

Taxation of E-currencies in the transnational arena differs by region. In each state, E-currency can be categorised as a pecuniary holding, a security, or even a currency, which primarily affects impost rates and rules for their calculation. Different territories apply individual methods for regulating and taxing cryptocurrencies, forming an intricate situation for firms that seek to procure a warrant to work with cryptocurrencies and carry out licit schemes on a transnational level.

The impact of virtual asset classification on taxation

Different territories classify cryptocurrencies differently, which determines their strategy to taxation.

Pecuniary assets: In Germany, E-currency is determined by a pecuniary holding and is contingent on capital gains excise on trading and exchange. The capital gains excise rate for E-currency dealings in the polity is contingent on the length of proprietorship and can differ between 15% and 20%. If the E-currency has been overseen for less than a year, the gain from its sale is contingent on normal income excise. In the case of prolonged ownership (more than one year), dealings may not be charged.

Securities: In some territories, E-currency may be considered an analogue of securities, especially if used for speculation motives. This approach obliges companies managing cryptocurrency portfolios to pay a different excise, which is linked with profits from the sale. Privileges linked with this categorization include an exemption from capital gains levy for people if the E-currency is held for more than one year. Undertakings conducting such dealings must have a permit to perform schemes with electronic resources and abide with pecuniary reporting norms.

Taxation of E-currency dealings: excise rates

There are two main categories of levies within the excise prototype for E-currency dealings:

- Corporate excise systems: Firms incorporated in the handling and utilise of E-assets are contingent on initiated mechanisms for calculating and paying income excise.

- Capital Gains excise: The sale or exchange of E-currency that results in a capital gain is subject to capital gains excise.

- Personal Income levy: E-currency dealings in a number of territories are subject to taxation through the general personal income levy, unless otherwise provided.

Some territories offer excise breaks and rewards for E-money-related endeavours.

Territories with Minimal levy for Cryptocurrency Businesses

Selecting territories with low impost obligations is vital for E-currency businesses aiming to optimise costs and enhance profitability. This article highlights regions with minimal corporate taxes, promising dividend impost rates, and limited or no taxation on capital gains—making them lure places for companies in the crypto sector.

Territories with the lowest levy burdens for crypto businesses

For ventures progressing in the E-currency industry, opting for the proper polity is an integral first step. It involves identifying regions offering promising excise regimes and securing an E-currency authorization. A jurisdiction with a supportive licit framework, pecuniary incentives, and straightforward enrollment procedures can primely boost a crypto company’s growth potential.

To aid traders in their decision-making, here are five territories renowned for their impost merits and conducive trade spheres. These locations are suitable for both startups and initiated players seeking prolonged openings in the crypto industry.

Bermuda

Bermuda stands out with its stable licit system, which dispenses generous impost benefits. The territory imposes no corporate taxes, driving businesses to retain the majority of their profits. Crypto firms operating in Bermuda benefit from an expedited licensing phase for electronic holding dealings, typically completed within two to three months, contingent on the undertaking's complexity. This streamlined phase and impost-neutral sphere make Bermuda an alluring choice for E-currency firms.

Cayman Islands

It is a top territory for E-trades due to its zero CIT. Firms in this polity enjoy exclusions from taxes on profits, capital gains, and value-added schemes. Moreover, gaining authorizations for functioning with E-holdings is relatively straightforward, providing a flexible and trade-oriented framework. These merits make the islands one of the premier choices for cryptocurrency enterprises globally.

British Virgin Islands (BVI)

The BVI offers similar merits with its zero CIT rate, attracting crypto companies by eliminating taxes on profits, capital gains, and other earnings. This approves endeavours to maximise revenue retention. Additionally, the BVI simplifies the organisation incorporation phase, making it an efficient jurisdiction for firms dealing with crypto assets. Its statutory stability further drives its appeal to endeavours wanting a low-impost sphere.

Labuan (Malaysia)

Labuan, a federal territory of Malaysia, is a rising star for cryptocurrency companies thanks to its promising impost policies. Trading firms are levied at a competitive 3% rate, while crypto businesses can leverage levy incentives to further reduce fiscal obligations. Importantly, Labuan imposes no taxes on capital gains or income generated from crypto dealings. Coupled with a streamlined statutory model and attractive levy benefits, Labuan has been revealed as one of Asia's most alluring hubs for E-currency firms.

Madeira IBCM (Portugal)

The Madeira International Business Centre (IBCM) presents one of the lowest levy percentages in Europe for crypto companies, at just 5%. This makes it a prime area for startups and initiated crypto firms aiming to lower levy burdens while gaining a gateway to the European trading hub. Madeira IBCM also dispenses flexible fiscal incentives and a promising business sphere, positioning itself as an excellent gateway for crypto companies targeting expansion across Europe.

Territories like Bermuda, Labuan, and Madeira IBCM offer exceptional levy merits for cryptocurrency businesses. Their low or zero corporate levy rates, streamlined permitting sequences, and investor-friendly policies make them ideal locations for startups and initiated firms alike. By carefully selecting the suitable polity, electronic money traders can optimise operational costs, maximise profits, and position themselves for sustainable growth in this dynamic industry.

Territories with low dividend tax rates for crypto businesses

Territories with reduced dividend taxation are particularly appealing to E-currency enterprises, primely those with a global focus seeking virtual asset authorizations and targeting to scale their schemes transnationally.

Malta

Malta stands out as a hub for crypto enterprises, not only for its promising levy regime but also due to its unique approach to dividend taxation. Rather than directly withholding dividend tax, Malta applies a CIT rate of 35%. However, this acts as a prepayment on dividends rather than a final tax.

How does this work in practice?At the end of the pecuniary year, if dividends qualify for a lower charge rate—such as under a Double Taxation Agreement (DTA)—shareholders can apply for a partial refund of the CIT paid. For instance, if a DTA specifies a 10% dividend levy rate for a shareholder’s polity, they can request a 25% CIT refund from Malta. Effectively, this reduces dividend taxation to nearly zero, making the system highly advantageous for global crypto holdings. Such arrangements primely lower the tax burden for foreign shareholders while driving companies to secure crypto authorizations, asserting licit schemes with minimal tax perils.

Hong Kong

Hong Kong offers crypto businesses and transnational holdings the advantage of no dividend levy. Shareholders receive their income without incurring tax liabilities on profit distributions, benefitting both individual financiers and multinational corporations. Companies licensed to engage in cryptocurrency schemes in Hong Kong can distribute dividends tax-free, creating an attractive sphere for holding structures in the crypto field. This setup positions Hong Kong as a strategic pecuniary hub, ideal for profit accumulation and redistribution with minimal fiscal obligations.

Luxembourg

In Luxembourg, authorised VASPs with resident status face a 15% withholding levy on dividends. However, transnational holding companies may qualify for substantial tax relief under the participation exemption regime. If a holding entity owns at least 10% of a subsidiary's shares or their value exceeds €1,200,000, dividends from such holdings are excluded from Luxembourg’s tax base. This model incentivises crypto endeavours with substantial equity speculations to establish schemes in Luxembourg.

Cayman Islands

It is renowned as a tax haven with no levies on dividends, making it particularly alluring for crypto funds and speculation entities. Companies holding the polity’s crypto licences can distribute dividends without tax implications. This exemption excludes double taxation and approves for profit reinvestment, offering increased pecuniary flexibility. The jurisdiction’s tax-neutral framework applies to both domestic and transnational earnings, making it a preferred choice for large-scale crypto financiers.

Singapore

Its levy system exempts dividends paid to non-residents from taxation, creating a highly beneficial sphere for global holding structures. Licensed cryptocurrency companies targeting transnational trading hubs can leverage these provisions to minimise tax liabilities for foreign shareholders. This fiscal policy makes the polity a promising destination for crypto trades with high dealing volumes and significant profits, strengthening their pecuniary stability.

Territories with Preferential or No Taxation on Capital Gains in Crypto

Certain Territories exempt capital gains levies, offering considerable benefits to E-currency companies and individual financiers focused on trading or prolonged speculations in virtual assets.

Singapore

Singapore imposes no capital gains tax, making it greatly alluring for E-currency trading and digital asset speculations. Licensed organisations under the MAS benefit from tax-free capital gains, driving reinvestment without additional costs. This fosters high liquidity and drives the value of crypto assets, attracting trading firms and speculation funds.

Portugal

It exempts individual financiers from capital gains levies on prolonged E-currency holdings. This provision appeals to those seeking gradual capital growth. While crypto businesses are subject to a standard CIT rate of 21%, they can still admit excise rewards for startups, driving optimisation of earnings and reduced fiscal liabilities.

Germany

Individual capital gains from E-currency are tax-exempt if the holdings are held for over one year. This policy encourages prolonged investment strategies. Crypto businesses can also benefit from reduced tax burdens by aligning their schemes with this timeline. This approach supports strategic capital speculations and propels the enhancement of E-currency ventures.

Hong Kong

Its absence of capital gains tax dispenses significant merits for E-currency trading entities. Companies registered in Hong Kong can carry out crypto trading with minimal tax obligations, making it a preferred location for hedge funds and trading platforms.

Switzerland

It excludes individual financiers from capital gains tax, particularly benefiting prolonged E-currency holders. For corporate entities, capital gains taxation varies by canton. Territories like Zug and Lucerne offer excise rewards to licensed crypto businesses, aiding large-scale speculations and fostering a robust sphere for E-currency funds.

Selecting an optimal levy jurisdiction for crypto businesses

Opting for a polity with advantageous levy terms is a crucial strategic decision for E-currency firms targeting to prune levy liabilities while amplifying globally. By leveraging these territories' tax benefits, entrepreneurs can strengthen their trading hub position and assert sustainable growth in the evolving digital economy.

Crypto-business support initiatives in leading territories

Several territories are actively fostering the enhancement of the E-currency field by offering preferential tax schemes and aid schemes tailored for crypto enterprises. These programmes aim to ease the statutory and pecuniary hindrances linked with crypto licensing while attracting new market contributors. Below are the key territories offering specialised support for crypto trades.

Singapore: Innovation rewards and excise aid for crypto Enterprises

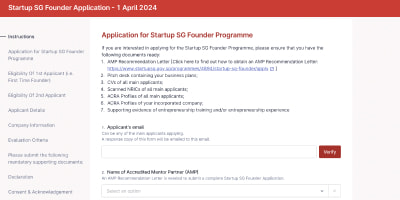

Singapore actively drives the enhancement of E-economy schemes, incorporating cryptocurrency startups, through various excise rewards and pecuniary aid schemes. The authority’s Startup SG platform acts as a central hub, consolidating initiatives from agencies such as Enterprise Singapore and the Monetary Authority of Singapore (MAS). These initiatives assist startups in funding and fiscal benefits.

Startup SG Founder ProgrammeThis initiative supports budding entrepreneurs in high-potential fields, including blockchain and cryptocurrency, driving them to establish crypto companies in Singapore.

- Grant openings: Startups can receive up to SGD 50,000 (approximately USD 37,000) to offset startup costs, covering up to 70% of qualifying expenditures.

- Eligible Costs: These include office rentals, marketing, equipment purchases, and salaries for staff directly comprised in the endeavour, incorporating crypto-related schemes.

- Application prerequisites: Applicants must submit a comprehensive endeavour scheme showcasing the innovation, viability, and commercialisation potential of their venture, including cryptocurrency solutions.

The programme is designed to encourage entrepreneurship while generating job openings and offering resources for businesses, including those focused on obtaining crypto licences in Singapore.

Startup SG tech programmeThis initiative supports tech-focused startups by supplying grants and co-funding for the enhancement of innovative products, including decentralized ledger and cryptocurrency solutions.

- Prototyping grants: Offers up to SGD 500,000 (around USD 380,000) for developing prototypes, covering up to 70% of eligible expenses.

- Co-funding mechanism: dispenses up to SGD 1,000,000 (approximately USD 750,000) for scaling undertakings, including software and tech developments for cryptocurrency ventures.

- Eligible expenses: These include R&D, tech acquisitions, and employee salaries linked to innovative undertakings.

Applicants must present a thorough project plan highlighting their tech’s trading hub potential and innovation. These programmes aim to position Singapore as a leading destination for tech-driven E-currency ventures.

In addition to these initiatives, the Virtual Asset Financial Services Licence from MAS dispenses streamlined entries to Singapore’s crypto approval framework and linked excise rewards.

Application for participation in Startup SG Founder Program in Singapore

Malta: Enterprise initiatives and tax relief for innovation

Malta is renowned for its proactive approach towards decentralised ledger and E-currency enhancement. The Business START Programme, operated by Malta Enterprise, supports early-stage startups, including those seeking crypto licences in Malta, by offering grants and expert guidance.

- Pecuniary assistance: Grants of up to €10,000 are available for startups developing innovative solutions in fields such as decentralised ledger and cryptocurrency. These funds help cover R&D, office setup, and employee costs.

- Excise optimisation: Holding a VASP Licence enables endeavours to merit reduced levy rates, improving cost handling and abidance with AML and KYC directives.

- Comprehensive support: In addition to pecuniary backing, startups receive mentorship and consultancy aid to enhance their trading hub entry and competitiveness.

Malta’s combination of fiscal incentives and straightforward approval makes it an attractive base for crypto companies looking to scale their schemes while adhering to transnational norms.

Switzerland (Canton of Zug): Grants and fiscal merits for crypto startups

The Canton of Zug, often referred to as “Crypto Valley,” is a global hub for decentralized ledger and E-currency firms. The region offers grants and excise merits to foster innovation and job creation within the crypto field.

- Grant support: Companies with a crypto licence in Switzerland can supply grants of up to CHF 500,000 to develop decentralized ledger applications, smart undertakings, and decentralised solutions.

- Cost coverage: Startups at the initial stages can receive funding for up to 70% of expenses linked to product testing, licit abidance, and trading hub entry.

- Excise merits: Firms reaching specific criteria, such as handling a physical office and operational hub in Zug, can benefit from reduced CIT percentages (as low as 11%) and exclusions from capital gains levy at the cantonal level.

These policies aim to form a robust sphere for crypto innovation while minimising pecuniary barriers for startups. Zug’s promising statutory sphere and pecuniary incentives make it a prime location for decentralized ledger-focused enterprises.

By leveraging these programmes, territories like Singapore, Malta, and Switzerland are solidifying their positions as global leaders in E-currency innovation. Their tailored support frameworks offer trades a balanced mix of pecuniary efficiency, statutory abidance, and growth openings in the promptly evolving digital economy.

Portugal: Capital gains levy exclusion and rewards for crypto innovation

Portugal is emerging as a global leader in fostering a crypto-friendly sphere for endeavours and financiers. One of its standout features is the absence of capital gains levy on E-currency deals, a policy that greatly benefits individual traders and financiers by permitting them to reserve more of their revenues.

Through the Portugal 2030 programme, the government actively drives decentralized ledger tech and E-currency innovation. Trades incorporated in R&D in these fields can channel substantial incentives, comprising impost relief, pecuniary grants, and direct funding. This initiative aims to drive tech advancements and bolster Portugal’s position as a hub for cutting-edge enhancements. Crypto-licensed companies in Portugal are eligible for R&D funding that can cover up to 75% of scheme expenditures. These funds may be used to develop new decentralized ledger applications, test crypto products, or implement other innovations that strengthen the field.

Licensed cryptocurrency service providers in Portugal also benefit from tax deductions on R&D-related expenses, which lower corporate levies. This encourages ventures to make prolonged speculations in decentralized ledger technologies, promoting sustained escalation in the field.

By minimising excise liabilities and offering strategic support, these measures position Portugal as a leading destination for crypto firms focused on tech progress and sustainable enhancement.

Estonia: Government support for startups and decentralized ledger development

Estonia has initiated itself as a prominent player in Europe’s decentralized ledger and E-currency landscape, with a strong focus on nurturing startups through its Startup Estonia initiative. This government-backed programme, managed by Enterprise Estonia (EAS), aims to foster a thriving startup sphere by attracting innovative undertakings and transnational companies to the polity. Supported by the European Regional Development Fund, Startup Estonia dispenses a suite of resources, including funding openings, mentoring, accelerator programmes, and training.

The idea presents valuable support to decentralized ledger and E-currency businesses, including entry to tailored funding programmes for innovative undertakings in these fields. Entrepreneurs can explore various grants and investment openings designed to assist crypto companies in scaling their schemes and enhancing their trading hub position. The Startup Estonia platform allows users to filter funding options based on growth stage, industry, and location, making it a crucial tool for startups seeking the best openings.

Additionally, the programme dispenses guidance on approval and abidance with AML ordinances, prime for businesses entering Estonia’s crypto trading hub. Regular workshops and seminars are organised to help startups navigate the polity’s licit and fiscal frameworks, driving them to reach the imperatives for VASPs.

It is among the prime compelling merits for crypto companies is its excise regime. Retained corporate earnings are not subject to taxation unless distributed as dividends, allowing firms to reinvest their profits into scaling schemes without incurring additional fiscal obligations. This excise benefit enables crypto firms to allocate funds towards innovative technologies, hiring competent experts, and amplifying their ventures, fostering sustainable growth.

By offering pecuniary incentives, comprehensive support, and a promising tax sphere, Estonia continues to strengthen its reputation as a destination for crypto trades and high-tech businesses seeking prolonged success.

Cost of gaining a Crypto Licence

Securing a crypto warrant entails notable pecuniary commitments, encompassing various expenses throughout the phase, from organisation enrollment to acquiring the final warrant. The overall costs vary primely across territories, covering aspects such as notary services, government fees, minimum authorised capital prerequisites, and abidance costs. Below is a detailed analysis of costs in five popular territories for gaining a warrant for crypto-related schemes.

Cyprus

- Registration costs: approximately €14,000.

- Base capital for a permit: from €125,000 to €1,000,000.

- Total costs for getting a permit: from €140,000 to €150,000.

Cyprus is a sought-after destination for VASPs, offering a well-regulated framework suitable for businesses in the crypto industry.

Malta

- Enrollment Costs: Approximately €4,750.

- Minimum Capital prerequisites: Ranging from €50,000 to €730,000, contingent on the licence class.

- Total authorising Costs: Between €180,000 and €200,000.

It is acknowledged as the "Blockchain Island," is a leading jurisdiction with a robust statutory sphere tailored for blockchain and E-currency businesses.

Estonia

- Government Fees: Approximately €5,300.

- Minimum Capital: €100,000.

- Total Costs for authorising: Between €120,000 and €130,000.

Estonia has initiated itself as a tech-friendly jurisdiction, offering streamlined procedures for companies seeking crypto licences.

Gibraltar

- Organisation enrollment Costs: Approximately €5,130.

- Pecuniary Commitments for warrants: Between €114,000 and €1,140,000.

- Total authorisation Costs: Between €171,000 and €182,400.

Gibraltar is renowned for its well-defined statutory framework, making it a preferred choice for large-scale crypto schemes and fintech companies.

Switzerland (Canton of Zug)

- Enrollment Costs: Approximately €13,800.

- Minimum Capital prerequisites: Between €230,000 and €460,000.

- Total Costs for E-money approval: Approximately €276,000.

Known as "Crypto Valley," the Canton of Zug in Switzerland is a prestigious hub for blockchain and crypto firms, presenting a firm statutory landscape.

Madeira – The most profitable crypto permitting region in Europe

Madeira emerges as among the prime affordable nations for crypto permitting, combining low operational costs with promising tax conditions. This makes it a prime choice for high-tech startups and endeavours seeking a profitable base within the EU.

- Organisation enrollment costs: Initial enrollment costs in Madeira are primely lower, amounting to approximately €3,000.

- Minimum share capital: A base stake fund of just €5,000 is compulsory, reducing pecuniary strain for novel ventures.

- Notary and administrative supports: These services cost approximately €1,000, well below the European average.

- General crypto authorisation costs: The overall cost to obtain a crypto licence ranges between €10,000 and €15,000, making Madeira one of Europe’s most affordable territories for this aim.

The polity presents a distinct combination of affordability, prime area, and a trade-oriented sphere. Its low barriers to entry allow startups to allocate more resources towards enhancement and invention in the electronic holding field.

Obtaining a crypto licence necessitates a substantial pecuniary outlay, but territories like Madeira provide profitable solutions for businesses looking to enter the cryptocurrency trading hub. By carefully assessing the cost structures and statutory benefits of each location, companies can select the jurisdiction that best aligns with their operational and pecuniary goals.

Jurisdictions with simplified licensing for crypto businesses

In the theme of quickly expanding worldwide administrative weight, a handful of locales stay curiously for crypto companies due to rearranged methods for procuring permit licenses. These locales give prospects for speedy sections into the showcase with negligible introductory conditions. Let's consider well known purviews where crypto business licensing routines, in spite of the fact that they exist, are basic and effective.

Panama

Panama is prominent for its magnanimous path to wherewithal likened executives and right now does not force needed licenses for crypto companies. Crypto businesses can work without the imperative for particular grants, that is alluring to virtual resource suppliers looking to maintain a strategic distance from tall compliance costs. In every instance, Panama is considering authoritative activities pointed at presenting directions in the virtual cash division. It is conceivable that a warrant for crypto supervisors and certification edicts for VASP administrators will be handed in the nearest future. Owing to the anticipated alterations, crypto companies in Panama will be obliged to register as virtual resource administrators and follow AML with KYC indices.

Seychelles

Seychelles offers crypto companies a generally basic strategy for procuring warrants to labor and transpose E-monies. The methods take generally small time and do not need broad documentation, making this purview appealing to crypto novel endeavours. Beneath the weight from universal monetary education, the polity has started actualizing fundamental commands that concern straightforwardness of schemes and guard benchmarks. It is arranged that unused sanctioning necessities in Seychelles for crypto companies will come into drive in the coming a long time, handling the openness and proficiency of routines.

Cayman Islands

Known for its appealing conditions for speculators, it offers a disentangled method for getting cryptocurrency licenses for businesses. This makes a promising sphere for worldwide crypto companies to work, making the archipelago a prime point for tradings in the E-cash space. Whereas crypto permitting necessities do exist in the Caymans, they are not as grave as in numerous other places, which fortifies the venture allure of the islands.

The Cayman Islands controllers are effectively laboring to advance the enactment, endeavoring to increment the degree of straightforwardness and unwavering quality of cash transposes. It is expected that extra components will before long be presented, pointing at reinforcing the jurisdiction's position as a center for universal monetary interaction.

Georgia

Georgia is an enticing showcase for E-money trades owing to its approach to permitting. It has made conditions in which getting the vital permits to labor with E-monies is less labor-intensive than in numerous other nations. This circumstance draws in numerous universal crypto companies desiring to extend their exercises to modern mercantiles.

The Georgian bureau is effectively creating the legitimate system for the crypto sect, centering on securing client rights and guaranteeing control over budgetary streams. The nation points to being more open to advancement whereas raising guard with straightforwardness guidelines. It is anticipated that in the close future, the crypto permitting strategy in Georgia will indeed be more available and reasonable, which will permit the nation to take a more steady position amongst the pioneers of the worldwide crypto sect.

Furthermore on crypto licensing in Georgia is stipulated in this article.

Salvador

El Salvador can be taken as a trailblazer in the field of E-money owing to its one of a kind approach to the lawful status of computerized resources. The purview got to be a pioneer by authoritatively recognizing Bitcoin as legitimate delicate in 2021, which cemented its picture as a driving crypto locale on the worldwide organization. Ever since, the government has been effectively creating the foundation to back crypto advertisements. In spite of El Salvador’s genuine state of mind towards the improvement of the crypto industry, the crypto permitting process in El Salvador is still in its developmental stages, with the primary arrangements as it were presently starting to be implemented.

In 2023, the nation took the to begin with steps by giving Bitfinex official consent to give crypto resource administrations. This strategy encompasses recording a task and performing an examination that analyzes abidance with all monetary data divulgence and details guard directions. Be that as it may, this handle does not incorporate stern imperatives for anticipating cash washing blueprint and discerning clients, as is common in some legitimate frames.

You can know more on the statute of crypto in El Salvador from this article.

Hence, whereas the need for needed permitting in these nations stipulates definite benefits to crypto companies, the drift towards worldwide direction of the crypto showcase is advancing, and a handful of nations are initiating to examine functions to direct labor in the cryptocurrency cycle. Forthcoming, firms wishing to keep up lawful status and the capacity to work in the worldwide field will be constrained to adjust to modern prerequisites in order to meet permitting guidelines.

Territories with a simple and fast authorisation sequence for working with digital wherewithal

In the E-currency innovation and trade, the lawful environment can change altogether from one nation to another. Whereas a few nations force complex prerequisites and make tall boundaries to getting crypto licenses, there are wards that offer streamlined permitting strategies. These nations decrease regulatory obstructions, streamline strategies and minimize money related criteria, which makes them an ideal choice for fledglings and creating crypto ventures. In this segment, we analyze five locales that are prominent for their easy and open strategy for pursuing licenses for crypto exercises, which makes them alluring for tycoon visionaries and people interested in rapidly propelling crypto-related projects.

Kyrgyzstan

Kyrgyzstan is among the appealing districts for the cryptocurrency segment in Central Asia due to its adaptable administrative guidelines and moo statutory obstructions. There are no strict administrative limitations for crypto companies, which renders it simpler to get a permit for cryptocurrency bureaus and begin laboring. The combination of an available financial environment and government bolster renders Kyrgyzstan a perfect choice for companies aiming to rapidly enter the electronic cash mercantile market.

The handle of joining a commerce in Kyrgyzstan takes as it were 3-5 trade days, and business visionaries can total it remotely, that is a particular reward for outside financial connoisseurs with new businesses who desire to dodge intricate statutory methods. The by and large edict of the route for procuring a crypto permit in Kyrgyzstan is roughly 1 to 3 months.

In Kyrgyzstan, the enactment with respect to the cryptocurrency segment remains very faithful. Much obliged to this, firms can effortlessly alter their commerce models, bypassing the complex forms and strict confinements in drive in some locales. The nonappearance of pointless administrative boundaries renders Kyrgyzstan a beneficial purview for ventures pointed at rapidly creating the advertisement.

Check out our article to learn the key points of crypto licensing in Kyrgyzstan.

Kazakhstan

Kazakhstan is a driving Asian purview for cryptocurrency organizations, much obliged to state back, disentangled consolidation imperatives, and corporate motivating forces. The nation has uncommon fiscal districts that are outlined for ventures encompassed in the bureau and utilization of E-coins, rendering the locale appealing to outside speculators and businessmen centered on this division. Disentangled enlistment methods and versatile controls encourage fast passage into the advertisement and diminish bureau costs.

Registration of a crypto company in Kazakhstan takes 1-2 weeks, which permits venture tycoons to rapidly continue the enrollment of a warrant. The add up to length of the scheming of pursuing a crypto permit in Kazakhstan is around 5-7 months, contingent on the proficiency of every arrangement and links with the pertinent specialists.

All details of crypto licensing in Kazakhstan can be acquired in our detailed publication.

Georgia

Georgia is one of the most alluring purviews for cryptocurrency mercantile in the former Soviet Union, much obliged to its quickened enrollment strategy and negligible regulatory controls. Due to the rearranged crypto authorizing handle and moo necessities for trade administration, Georgia is prevalent among trying business visionaries and organisations seeking for lengthy-duration improvement in the field of computerized wherewithal.

The company consolidation strategy takes as it were 1-2 trade days, permitting business visionaries to rapidly total the to begin with arrange on the way to permitting. The length of the method for pursuing a crypto permit in Georgia is around 2.5-3 months, counting all stages of planning, accommodation and survey of files. Enlistment can be done remotely, that rearranges the assignment for pecuniary specialists from other nations who desire to dodge extra travel bills.

You can find out more about crypto licensing in Georgia in our detailed review.

Poland

The polity is pulling in consideration as a put to enroll for the virtual benefit supplier registry, due to its effective and organized handle, which makes it an alluring goal for ventures looking to labor in the European showcase. The intervals and necessities for enrollment can legitimately be named a few of the most satisfactory in Europe, permitting new companies and ventures with constrained cash likened wherewithal to rapidly ingress the advanced pool space.

The foundation of a constrained obligation company (Sp. z oo), essential for consideration in the enlist of virtual benefit suppliers in the polity, can be done remotely and last as long as 2-3 weeks. This is helpful for outside business people who do not need to be physically displayed. The add up to the term of the enlistment preparation is roughly 2-2.5 months, contingent on the effectiveness of each organization and interaction with the significant authorities.

To apply for enrollment, a venture ought to get a Clean distinguishing proof number (PESEL) and render a trusted profile (ePUAP), which opens to Clean electronic administrations. The edict for getting these apparatuses is up to 30 days, and they are vital for submitting electronic applications, rendering the handling less complex and more straightforward. After completing all the preliminary stages, an application for incorporation in the enlist of virtual resource suppliers is handed. The controller in Poland considers the application rapidly, inside 2-4 weeks, which permits companies to begin working in the ideal time outline.

Find out all the intricacies of procuring a crypto license in Poland by reading our article.

Czech Republic

It is among the most alluring locales in Europe for companies pursuing a crypto permit. The combination of straightforward legitimate directions, adaptable statutory strategies, and accessible prerequisites renders the Czech Republic appealing to both fledglings and experienced cryptocurrency advertise players. Quick joining times and moderately moo budgetary necessities permit ventures to enter the advanced resource advertise decently quickly.

To enlist a crypto company in the Czech Republic, the prerequisites for the arrangement of the sanctioned wherewithal stay immaterial, which decreases the budgetary burden on new businesses. Trade enrollment takes 1-2 weeks, which permits you to rapidly move on to submitting reports for a crypto permit. Enrollment is conceivable both in individual and remotely - this draws in universal crypto companies that can enlist a venture without the imperative to as often as feasible come to the Czech Republic.

Offshore purviews for crypto business

Locals grouped as seaward are pursuing to be prominent among crypto companies owing to adaptable administrative criteria, favorable monetary instances, and orifices to diminish costs. Be that as it may, such goals moreover confront challenges, counting reputational issues and worldwide confinements. Let's take a glance at the five best seaward areas for getting a cryptocurrency permit and survey their focal points and disadvantages.

Cayman Islands

British Virgin Islands (BVI)

Belize

Seychelles

Flaws

Bahamas

As we can see, seaward wards offer crypto businesses critical focal points in terms of charge optimization and accessibility of permitting. Also, when opting for a purview for crypto companies, it is vital to evaluate notoriety and conformance with universal indices, as the notoriety of seaward crypto licenses can influence the prospects for prolonged participation and integration with worldwide markets.

Best jurisdictions for crypto business by region

The commerce is creating quickly, and the preference of a reasonable locale for getting a permit for cryptocurrency exercises is decided by a combination of reasons, counting assess assessment, the speed of the sanctioning strategy, conditions for the policy of the establishing back and connoisseur in the universal community. Let's consider the driving locales and the prime nations for putting up crypto commerce in every of them.

Europe: Lithuania

It has ended up among the most dynamic wards in Europe for crypto companies owing to its adaptable administrative framework and available crypto permitting conditions. Here, you can enroll in a crypto permit in a brief time - from one to three months. The preparation is directed by the Central Bank of Lithuania, which permits firms to enroll for a permit to conduct cryptocurrency exercises and gives disentangled rules for the permitting procedure.

Amount of the sanctioned wherewithal. To get the right to work with cryptocurrency in Lithuania, firms must have a base money of €50,000 to €150,000, contingent on the specifics of the operations. In cases where the organization's exercises are likened to the command or capacity of noteworthy sums of resources, the prerequisites for the estimate of the sanctioned wherewithal may be expanded to guarantee monetary reliability.

Taxation. It presents a 15% corporate salary charge, which makes appealing conditions for ventures centered on minimizing charge costs. Organizations can take advantage of particular terms for unused firms, which is particularly useful for crypto startups.

Thanks to these conditions, Lithuania pulls in both expansive organizations and start-ups interested in a steady and directed European territory.

Asia: Singapore

It is the Asian center of the cryptocurrency field, advertising a straightforward lawful frame and adaptable charge measures. It is conceivable to get a cryptocurrency permit via the MAS, which permits ventures to lawfully give administrations with advanced wherewithal and fortifies the level of client trust.

License sort: Advanced Installment Token Administrations Permit, controlled by MAS and covering the trade, capacity and administration of advanced resources. The permit is appropriate for both large-scale cryptocurrency stages and modern startup ventures working with advanced installments and exchanging operations.

Amount of authorized capital. Ventures are needed to conform with controls with respect to the sum of sanctioned capital, contingent on the scale and sort of administrations. For instance, the authorized capital for little businesses is SGD 50-1,000, whereas for organizations managing with huge sums and client assets, the authorized capital must be at least SGD 500,000.

Taxation: Singapore has a standard corporate charge rate of 17%. Be that as it may, there are imperative overhauls with respect to charge motivating forces that might be of centrality for new companies and crypto companies in Singapore. Legitimate substances can get a 50% wage charge discount, capped at S$38,000 if the company gets a S$2,000 give, or S$40,000 if the company does not get a grant.

Singapore not as it were offers fast enlistment, but moreover get to to one of the most energetic budgetary markets in Asia.

North America: Canada (Ontario Province)

In Canada, encompassing the province of Ontario, companies providing cryptocurrency-like services are needed to register as Money Services Businesses (MSBs) with the Fiscal Transactions and Reports Analysis Agency of Canada (FINTRAC ). There are no minimum foundation imperatives to establish an MSB. Seeing that as it may, organizations are needed to follow strict anti-money laundering with counter-terrorism backing directions, counting the creation and execution of substantial arrangements with routes, and the arrangement of an assigned compliance officer. Also, enlistment or authorizing with the Ontario Securities Commission (OSC) may be needed contingent on the innate of the administrations offered.

License sort: Crypto administrations permit, planning for ventures that meet strict guard criteria.

The length of the handle of getting a permit is from 3 to 5 months, which permits companies to rapidly involve their specialty in the mercantile.

Tax arrangement: Ontario has a combined salary charge rate of roughly 26.5%.

Ontario is a perfect area for businesses looking to procure a cryptocurrency permit and labor in a vigorous legitimate ambience appropriate for high-volume ventures.

Details on crypto licensing in Canada are accessible in our article.

South America: Brazil

Brazil has built up itself as the most crypto-friendly nation in South America. Much obliged to an adaptable, rising lawful system, companies can effortlessly get consent to work with advanced resources and enroll with negligible legitimate impediments. Brazil is effectively creating enactment, giving companies the opportunity to utilize advanced resources legitimately and with a wide extent of operations.

License sort: Brazil offers an official allow for cryptocurrency benefit administrators, which is issued by the Central Bank of Brazil. This permit permits companies to work with advanced resources, give trade administrations, capacity, and perform money related exchanges. Administrators who have gotten the allowance appreciate a tall degree of belief in the mercantile.

Wherewithal necessities: Brazil has direct capital necessities, which renders it a curious put to begin a startup. Crypto companies in Brazil must have at least $50,000 USD in their ledgers, which is a moderately moo requisite and diminishes the fiscal boundary to passage into the sect.

Taxation: Brazil has a dynamic corporate charge rate of up to 34%. Be that as it may, firms contributing in logical and innovative investigation can take leverage of charge motivating forces and conclusions, which decrease their charge burden. This is particularly advantageous for organizations creating modern crypto items and techs.

With such adaptable conditions and bolster for cutting-edge improvements, Brazil is pulling in novel endeavours and worldwide organizations looking to enlist a crypto permit in South America.

Africa: Mauritius

Mauritius has become a leading purview in Africa for cryptocurrency companies owing to innovative licit schemes and minimal warranting imperatives. The territory offers a simple and fast registration routine through the Fiscal Services Commission of Mauritius (FSC), which coordinates and commands the functions of projects working with electronic money. Mauritius is an enticing destination for companies seeking to quickly obtain crypto business licensing and enter the international market.

Permit sort: Mauritius gives a Virtual Resource Administrations Permit, which permits companies to execute a wide run of token schemes, counting trade schemes and E-currency administration. The permit is apt for both expansive organizations and novel ventures interested in negligible necessities and fast approval.

Capital necessities. Mauritius has direct wherewithal necessities for firms that desire to labor with virtual resources. The capital necessity for crypto companies is $25,000 USD, rendering the ward available to new ventures and modern players interested in worldwide expansion.

Tax administration. Mauritius presents among the favorable assess frameworks for worldwide enterprises. Corporate tax collection for crypto companies is as it were 3%, and capital picks up are totally forbidden from tax assessment. This is appealing for firms laboring with tall livelihoods and looking to optimize assess expenses.

Favorable tax collection conditions and negligible authorizing prerequisites for crypto businesses make Mauritius an perfect choice for crypto companies focusing on the African advertise and worldwide operations.

All the intricacies of the routine are covered in our article “How to get a crypto license in Mauritius: .”

Oceania: Australia

Australia is a leader in Oceania in rendering an apt for crypto companies, stipulating ingress to an advanced statute model and a world of mercantiles. The territory has a thorough E-currency directive carried out by the Australian Securities and Investments Commission (ASIC). This structure ensures strict control over the schemes of crypto firms, which ensures a high degree of openness and trust in licenses issued in Australia.

Sort of permit: Australia offers a virtual resource administrator permit, which controls the operation of companies that trade, store, and control electronic resources. The permit permits crypto companies to give budgetary administrations inside strict security benchmarks, which pulls in companies centered on worldwide mercantiles.

Capital prerequisites. Capital prerequisites in Australia are that an organisation may require noteworthy budgetary assets to be endorsed to work in cryptocurrencies. The least capital for such organizations can reach 500,000 Australian dollars, which makes the advertisement available basically to expansive crypto companies with a steady monetary position. This prerequisite makes a difference to fortify the assurance of the interface of clients and accomplices, making a solid working environment. In any case, it is worth clarifying that such capital prerequisites can be balanced upon ask, contingent on the particular conditions and needs of the applicant.

Excise framework: Australia applies a corporate salary charge of 30%, which is determined by the conventional rate for organisations enrolled in the territory.

Australia gives a vigorous legitimate environment that bolsters the exercises of ventures looking to get a permit for cryptocurrency benefit administrators and work with major worldwide accomplices. These conditions make Australia a promising purview for organizations with tall security benchmarks, huge speculation ventures and aspirations in the crypto division.

Find out: acquiring a crypto license in Australia from this article on the site.

Strategically prime regions to initiate a crypto business

In the worldwide cryptocurrency commerce, the choice of purview for getting a crypto permit plays a key part, deciding how the firm will create, associate with clients and abide with lawful directions. Let's consider a few nations that give uncommon conditions for propelling a crypto commerce due to their tall level of authoritative clarity and steady monetary control.

UK

The UK remains one of the driving locales for E-money ventures, much obliged to its well-structured control and notoriety as a solid budgetary center. Since 2020, the UK Fiscal Conduct Authority (FCA) has commanded the exercises of organisations giving cryptocurrency administrations with particular prerequisites for AML with KYC methods. Acquiescing to the FCA, by the conclusion of 2024, over 200 crypto companies have gotten licenses, which underlines the tall degree of administrative straightforwardness and speculation unwavering quality of the nation. In spite of the strict rules, cryptocurrency companies in the UK have got to one of the biggest worldwide pecuniary mercantiles and the chance to connect with progressed keeping cash and creative teaching, which is key to drawing in worldwide speculation and holding up tall levels of operational straightforwardness.

Full details of crypto licensing in the UK can be found in our detailed review.

Liechtenstein

Liechtenstein has demonstrated itself to be among the apt purviews for cryptocurrency ventures in Europe. The Blockchain Act, passed in 2020, puts an open and dynamic model for E-money firms, counting sanctioning necessities for computerized resource administrators in Liechtenstein. The nation moreover pulls in ventures keen in propelling imaginative budgetary items, advertising appealing imperatives for the tokenization of resources and laboring with computerized securities, much appreciated to its participation in the European Fiscal Zone, that gives ingress to the European advertise.

In our expert article you will find all the details of the crypto licensing process in Liechtenstein.

Saudi Arabia

Has as of late opened up to crypto authorizing, making it among the promising unused purviews. The nation is intensely contributing in blockchain innovation and advanced framework as a portion of its Vision 2030 program, which aims to differentiate the economy. This makes one of a kind openings for crypto trades in the polity, particularly in uncommon free zones like NEOM, which offer critical monetary motivations, streamlined strategies for outside businessmen and fiscal specialists, and solid bureau bolster for the improvement of nanotechnology. Such bolster renders Saudi Arabia a deliberately imperative locale for crypto firms looking to extend globally.

These nations not as it were to ensure clear direction and get to universal trading fields, but to give crypto companies the means to enhance and develop on a worldwide basis. They as of now stay pioneers in pulling in imaginative crypto ventures due to their administrative straightforwardness and bolster for the improvement of progressed budgetary innovations.

Full procedure for launching a crypto business with a crypto license

Propelling a crypto trade with a permit is a multi-layered arrangement that mandates cautious arrangement, assembly strict administrative necessities, and passing all fundamental checks. Planning for lawful crypto exercises incorporates numerous stages, from enrolling a company to concluding contracts with providers and planning for potential items, such as an ICO. Underneath are the primary stages for shaping a crypto commerce that will dispatch crypto exercises with a permit and will abide by all lawful imperatives.

The initial phase in making a crypto trade is to enlist an organisation in a purview that bolsters exercises with computerized resources. At this arrange, it is imperative to:

- Opt for the proper region. The choice on where to enlist a mercantile with a crypto permit contingent on the charge conditions, criteria for the aid, and the level of direction in a given nation. Each ward has its claim person characteristics, so it is worth choosing a nation with a neighborly approach to crypto wherewithal.

- Prepare a set of records for the foundation. The foundation needs a set of reports, counting the organization's statutory acts, a commercial extent, as well as data around the proprietors and last beneficiaries.

- Submitting a set of papers to the recorder. After completing all the essential papers, they ought to be handed to the enlistment center to execute the method for building up the venture.

After fruitful enrollment of the company, another organization of arrangement for cryptolicensing begins.

Once a crypto company is enlisted, it is fundamental to initiate a pecuniary account that will be utilized to store reserves and conduct monetary exchanges. Since not all banks labor with crypto companies, it is imperative to discover a bank that gives administrations for crypto companies and bolsters transposes with advanced assets.

- Choosing a bank or installment arrangement. You can select one of the crypto-friendly pecuniary, or utilize elective installment arrangements such as Revolut Business.

- Completing the due constancy method. Banks conduct checks to guarantee the unwavering quality of the client and the nonappearance of AML/KYC violations.

- Signing a benefit assention. Once the application is affirmed, the company signs an understanding with the bank and picks up vital keeping money administrations, counting the capacity to handle installments and oversee assets.

At this organization, one of the most labor-intensive forms starts - the planning of all documentation for permitting crypto exercises. Wards force distinctive criteria for documentation, but the standard set includes:

Commercial improvement arranges for the extent. Portrayal of the trade show, techniques and administrations that will be given to clients. The trade arrangement ought to incorporate data on security measures and defensive mechanisms.

AML/KYC controls. An critical viewpoint for permitting, which directs the rules of client confirmation and avoidance of cash laundering.

Corporate administration reports. Records of the administration structure of the venture, counting the arrangement of people capable of compliance with enactment and inside monitoring.

Financial archives. Confirmation of the required establishing capital, as well as detailing on the current monetary position of the company.

Before submitting archives for a crypto permit, an organization must actualize all key authoritative prerequisites for executing AML/KYC arrangements, assembly information security guidelines, adjusting inner strategies, and setting up instruments for ensuring normal detailing to the controller. All arranged archives are sent to the supervisory specialist, which checks them for compliance with the built up necessities. In the event of extra demands from the controller, the endeavor must be prepared to adjust inner strategies and organizational structure in understanding with the upgraded provisions.

After submitting the documentation, the arrangement of control for compliance with the controlled measures is propelled. This handle includes:

Due constancy. The controller analyzes the crypto company's exercises, its administration, recipients, and checks for compliance with security standards.

Risk appraisal: Organizations such as money related commissions or offices conduct an evaluation of the money related and operational dangers related with crypto businesses.

Corporate structure necessities: In a few locales, controllers survey a company's administration structure and require key workers to be certified or tried for competency to conduct crypto activities.

After satisfying all necessities, the company gets official consent for crypto-activity and can legitimately carry out exchanges with virtual assets.

To successfully dispatch a crypto trade, an vital step is to conclude contracts with benefit suppliers and accomplices who will guarantee the support of operational exercises. Incorporates facilitating administrations, information suppliers for investigation, API suppliers for the integration of installment solutions.

If a crypto company plans to conduct an ICO or other cryptocurrency operations, this arrange requires extra preparation:

- Smart contract advancement and review: Cryptocurrency companies create keen contracts that are at that point examined to guarantee security and openness.

- Marketing and speculator fascination: Organisations create a methodology to draw in speculators, counting planning showcasing materials, conducting introductions, and planning data resources.

- Token issuance and conveyance: Once the arrangements are total, the crypto company starts the arrangement of admitting and disseminating tokens to financial specialists and clients.